January 12, 2023: Conquest of the Planet of the Apes 🙈🙊

Crypto Risks Team Recommends Killing $apeUSD Gauge

Funny you should say that…

Missing from yesterday’s thread on Curve governance is a potential ape-pocalypse. The daring Risks Team is publicly laying plans for a new sort of war. The mercenary squad is executing a precision strike against the Planet of the Apes™…

The Crypto Risks team is publicly planning a raid to capture and/or kill the apes’ lifeline to the human economy: $apeUSD

This might trigger the rarest and most viral of all internet videos: the dreaded ape riot!

Post paywalled for 72 hours

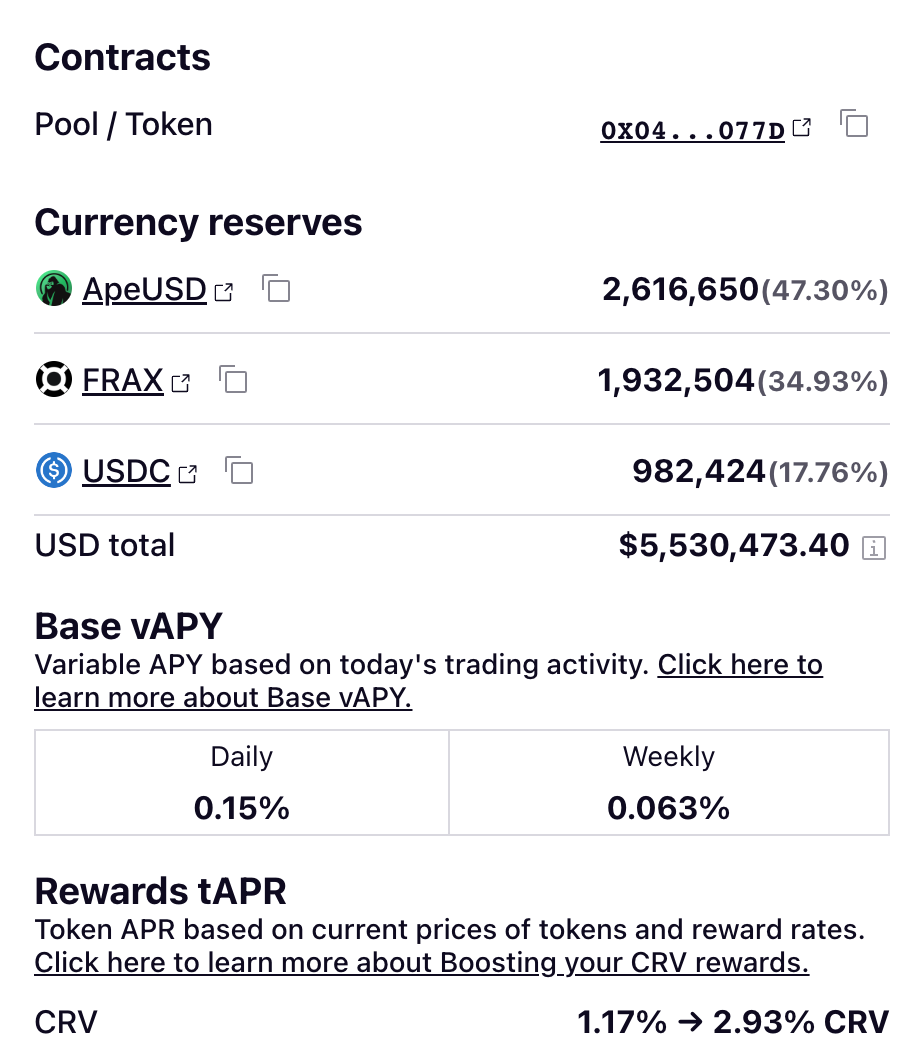

The apeUSD pool on Curve is presently yielding about 3% boosted rewards.

Not phenomenal compared to US treasuries perhaps. But elementary arithmetic is poorly understood by most apes, as it is for most humans. Sub-3% was still good enough for the apes to tally about $5MM worth of bananas amongst themselves.

The apes are also learning how to wield prehensile tools like DeFi vaults and questionable marketing hype. They’ve apparently figured out how to operate Yearn Finance’s permissionless vault. And they’ve exploited that fleeting window after a gauge launches to boast of sky-high yield, that same old monkey business.

These yields will go extinct if the ape poaching Crypto Risks team have their way.

For a bit more background, the risks team has three basic criteria to deserve if a pool deserves a gauge. The apes came up one banana short of a full bunch:

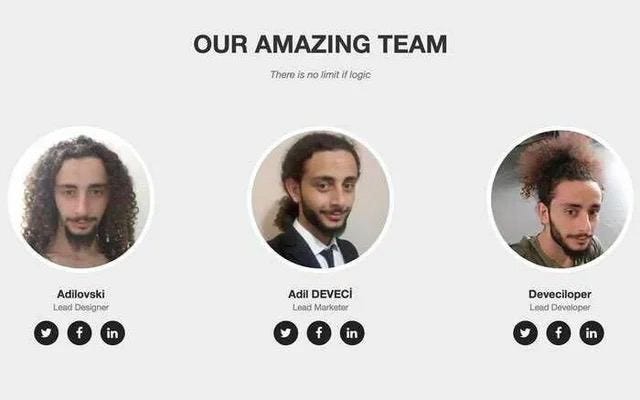

The main concerns are the composition of the team. A very small multisig with high potential to rug. Smelling a lot like one of these situations:

The Risks Team recommended solving the issue by adding some external representatives. The apes stayed silent 🙊

In case you can’t distinguish among the myriad species of primates, the $ApeUSD project has only tangential interaction with the $APE token of BAYC fame, somehow ranked 30th on CoinGecko because bripto.

The touch points are that $APE is one form of collateral used to mint $apeUSD. The $apeUSD “team” applied for a grant from ApeCoin but was rejected.

You might wonder how the gauge vote slipped past scrutiny in the first place? As the forum post points out, it was bundled along with a number of other FraxBP pairs.

The gauge vote was bundled along with gauges for sUSD, LUSD, GUSD, BUSD, alUSD, USDD, and TUSD /FraxBP pairs. We strongly urge DAO voters to vote against bundled gauge votes in the future. Bundled gauge votes make it difficult for voters to properly vet each protocol receiving a gauge and increase the likelihood that a low-quality or malicious protocol will receive a gauge. It is likely that, had ApeUSD been up for vote singly, the DAO would not have allowed it to receive CRV emissions.

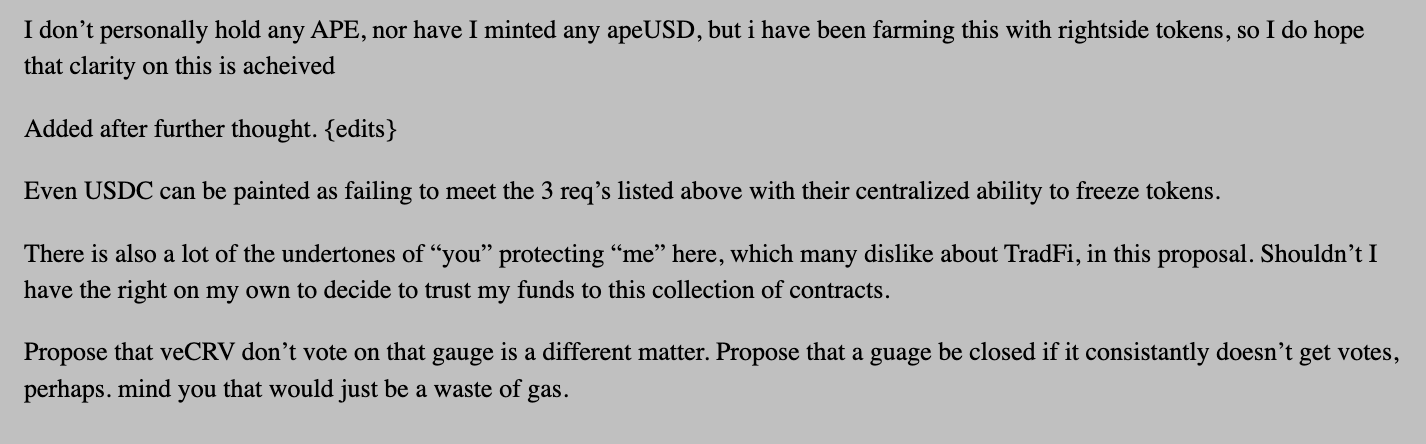

Naturally, the forum post generated controversy. One monkey at a keyboard wrote:

This was rebutted in a quote from WormholeOracle:

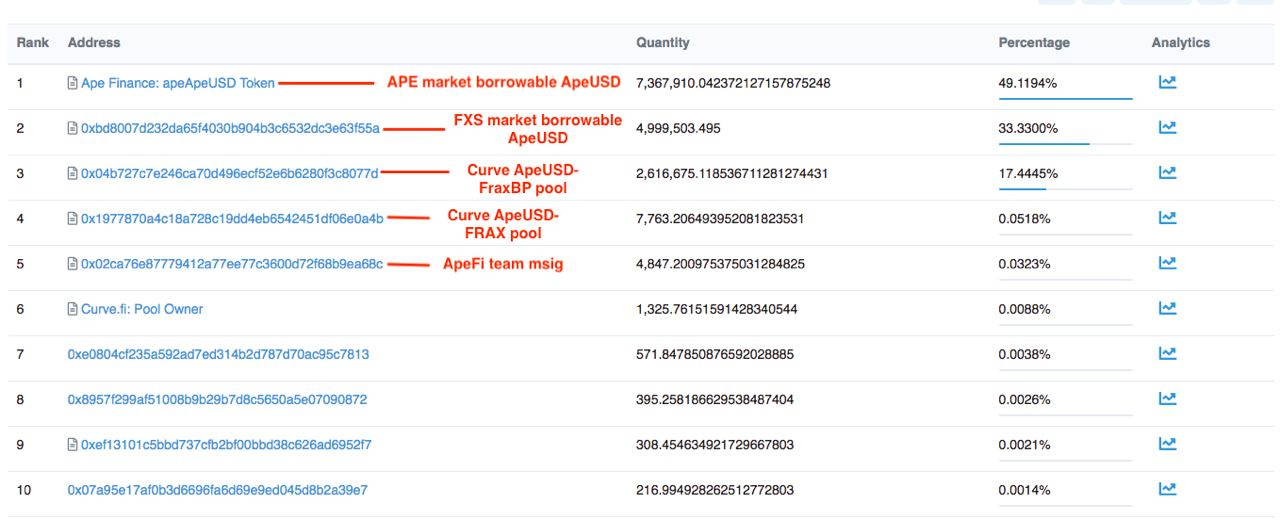

What I'm seeing is that the collateral in the ApeFi lending platform is represented by the $APE token, which had 250k $APE deposited on Dec 11. On that day, some 235k $APE were withdrawn (most by a single user). This coincides with the APE staking feature release.

Currently there are 6.5k $APE in the platform valued at $33k. At the same time, $2.6m in $ApeUSD are deposited in the ApeUSD/FraxBP pool, essentially the only holder of ApeUSD.

Other addresses making up circulating supply are insignificant. Other significant addresses are available to borrow from APE market and apparently a newly created FXS market which was seeded with borrowable ApeUSD just last week. But neither of those would constitute circulating supply.

ApeUSD shillman ApeFi Caesar has not replied to requests for comment, but we’ll certainly update you if this changes.

From our POV, the request for ApeUSD to secure their multisig is a totally reasonable common sense request given the heavy rug potential. Not even responding to such a basic request is downright suspicious. We’d not only suggest killing the gauge, but also that anybody who has funds in ApeUSD should flee.

Great detective work by the Risks Team! When it comes to cleaning up the crypto community, they definitely aren’t… monkeying around!