Earlier this month we highlighted how Frax was killing the staked ETH wars, along with everything else they touch. 8.4% is pretty tough to beat, right?

But before we get into sfrxETH… what’s this? A new challenger?!

Synthetix ETH is not a participant in the staked ETH wars, as they are a synthetic token and not an LSD. Yet if you’re just looking for ETH yield, you probably don’t care. So who or what is driving this yield?

Crypto boomers may recall as far back as two months ago, when Synthetix requested a parameter change for their pools..

Surprise! Everything worked out exactly as intended. In late December, the team released Perps v2. Synthetix has been on cruise control ever since.

Naturally, as users wise up to tools like aggregators, we’re seeing trading volume flowing to the best source. Increasingly, this is Synthetix.

In a good thread, Curve highlighted the effect of rising prices on the sETH pool utilization. Lately, Synthetix’s “atomic swaps” have become a highly efficient option for on-chain trading.

The result of the market’s recent frenzy is that, at times over the past week, Synthetix has often ranked among the highest fee generating protocols for users.

Make sure to read through the replies on the last tweet for some important context on how Synthetix works ^^

Unsurprisingly, spiking volumes has also led to skyrocketing user numbers.

Although, from a starting point of 10 to 23 users, it’s easy to juke the numbers…

What’s really wild is Synthetix is just getting going. The Synthetix roadmap is extremely ambitious, and they have a tendency of executing. Here are some of the items in store for the year:

As well as several new markets on the horizon

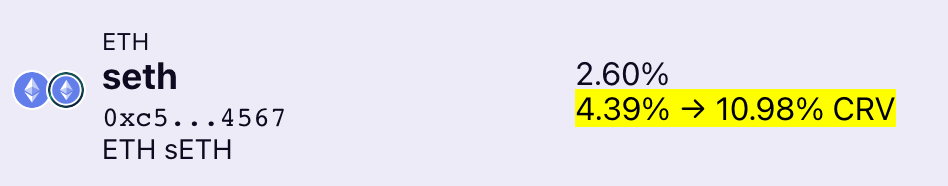

How might you capitalize on Synthetix? One way would be to look for Curve pools where you might consider serving as LP. Transactions routed through Synthetix are routed automatically through Synthetix’s various Curve pools:

One way to profit off this uptick is to heed Curve’s call and be a liquidity provider.

However, these fees tend to be rather low, so it may not be compelling outside of rewards emissions, which Synthetix is heavily incentivizing.

Therefore, you may instead prefer to stake $SNX directly on Synthetix, where 100% of Synthetix fees go directly to stakers.

Should you speculate on the $SNX token? We don’t offer financial advice and we’re not active traders, so use your own judgements.

But, perhaps it’s the last to move on exposure to flywheel assets? Over the past few weeks, we’ve seen a number of distressed DeFi assets pumping hard relative to $ETH, including big moves by $FXS, $CVX, $CRV, $CLEV, $CTR.

The latter for instance, jumped hard:

Given the surge in flywheel assets, we’re a bit surprised the move by $SNX has been relatively tepid by comparison.

Is $SNX due for a pump as well? We couldn’t possibly say. Perhaps people aren’t aware of Synthetix’s role in the Curve ecosystem? Or maybe something different is behind all this? Not sure!

Some more background, our June article on Synthetix: