July 10, 2023: Stablecoin Capital Efficiency 🪙🧮

Quantifying the concept of stablecoin capital efficiency

“Stablecoin capital efficiency” sounds way more advanced than it actually is. It’s just how many dollars does it take to mint one dollar worth of stablecoins.

If you’re minting stablecoins, you naturally prefer this to be as close to $1 as possible. If you have $1MM that could be earning ~5% interest in banks, a stablecoin that is only 50% capital efficient would have to provide over 10% yield to be competitive. So this really matters.

A stablecoin provider might prefer a less capital efficient solution. If users must deposit more money, this means that a stablecoin provider gets more dollars into the bank. If that money is, say, earning yield, it means greater profits. The general principle is that the greater the backing, the less risky the stablecoin.

Of course, the most capital efficient protocols are redeemable stablecoins, which usually offer 1:1 direct dollar to dollar parity. Of the highly centralized stablecoins, $USDD is the most notably overcollateralized. All the other big ones just take your dollar and put it into treasury bills, which lately means major profits. Tether is more profitable than Blackrock!

Very few stablecoins have tried to be more capital efficient than 1:1, and the ones that did usually didn’t hold onto the moniker of “stablecoins” for very long. Do Kwon’s ill-fated UST was estimated to be only about 80%-90% backed by LUNA at the time of its collapse.

USDN was even worse, as low as 16%.

It would go on to rebrand as “Neutrino Index Token,” which trades at around $0.05 today. Ouch.

Nowadays, very few people dare to try an undercollateralized stablecoin. Most that did have not survived. However, it’s worth pointing out that Frax’s AMO was able to support a slightly undercollateralized model for several years, although they moved to 100% backing after public opinion turned against the model.

Presently, there are no stablecoins we’re aware of that try an undercollateralized model. Maybe in a future bull run some degens will try it out, but presently it’s either 100% collateralized or overcollateralized.

It’s easy enough to pull data on the collateralization ratio for every major stablecoin. Or, at least, what they claim. Tether naysayers have spent years complaining that the protocol is dishonest in their monthly attestation reports.

At the moment it’s TrueUSD’s turn in the barrel.

June 28, 2023: $TUSDepeg? 🌇💥

Tomorrow we’ll likely zoom out to look at the late breaking news that BIS is looking to build a CBDC platform using Curve’s v2 pools, so drop your reply guy takes over the next 24 hours if you want to be included in the newsletter… For now though, it’s $TUSD’s turn in the barrel!

Based on what they all claim, here are the current capital efficiency metrics for every major stablecoin:

For those interested in sourcing this yourself, the sauces are all presented at the bottom.

You can see most of the major centralized stablecoin providers sit at near 1:1 — but once you look at the more decentralized stablecoins you see that they are almost all overcollateralized to some degree.

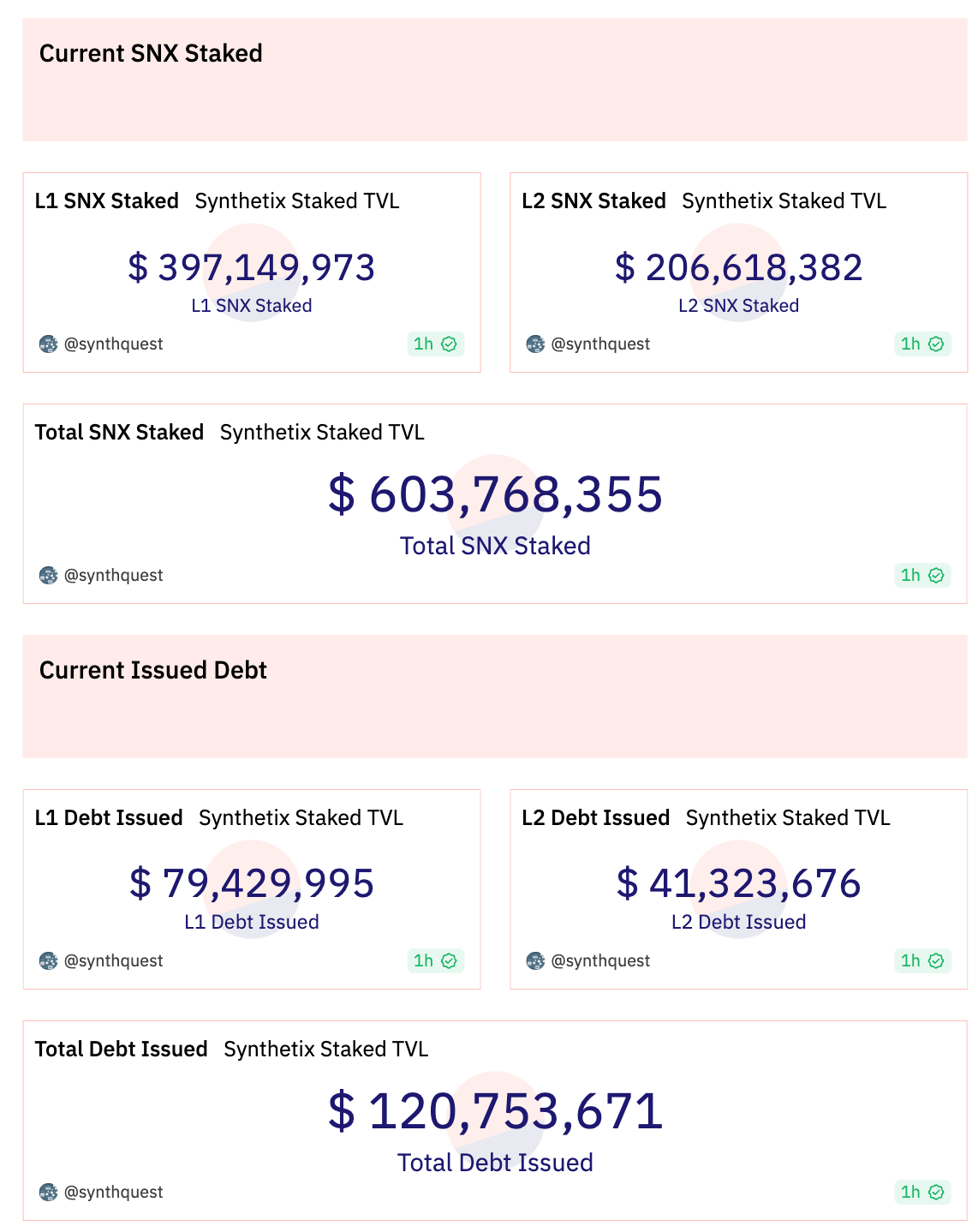

Synthetix’s $SUSD is the most flagrantly conservative here. The protocol has a target ratio, formerly 6:1 but presently updated to 5:1, that keeps SNX lending extremely safe.

It’s also one of the most profitable protocols, so don’t necessarily jump to the conclusion that “capital inefficiency” is necessarily a bad thing — it’s a design choice.

Liquity’s $LUSD is another extremely such protocol that is very conservative on this front. They keep their highly decentralized stablecoin backed 2.5x, and they’ve weathered everything that’s been thrown at them.

With extremely decentralized stablecoins like these two possessing such low capital efficiency ratios, it’s easy to see why the concept of the “stablecoin trilemma” became popularized. This concept states you can have two of the three: “capital efficiency”, “peg,” and “decentralization.” We won’t cover this concept in this article, but we feel it lacks nuance.

Suffice to say that several of the more decentralized stablecoins show higher capital efficiency. As mentioned above, the Frax AMO has supported periods where it was undercollateralized. For Frax’s case, it’s seemingly a switch the protocol can flip as it likes.

Frax also has the most gorgeous dashboard showing, block-by-block the current balance sheet. Eat your heart out, accountants.

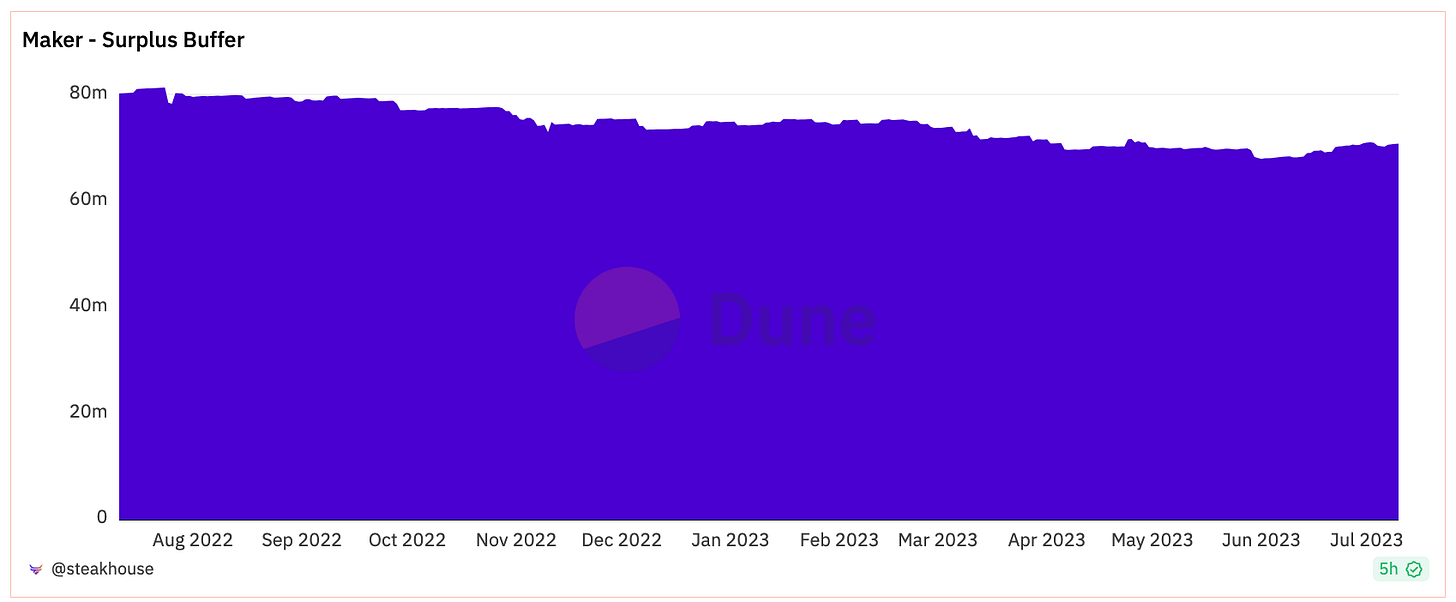

DAI is in a bit of a weird state, but they keep quite a buffer in reserve although they are mostly backed by dollars.

For $crvUSD, it is among the most capital efficient of the decentralized stablecoins, with a ratio of 82%. It could be theoretically higher, but users can select their leverage and some don’t go right up the bleeding edge. One could imagine the $crvUSD user-friendly liquidation mechanism could support even higher capital efficiencies, but there’s no particular reason to risk it at this nascent .

Since we’ve pulled some of the other key stablecoin stats, like peg and decentralization, how does it all stack up?

One might expect that stablecoins sacrifice capital efficiency in order to promote a stronger peg. Curiously, we see the exact opposite. It’s one of the stronger correlations that the most over-collateralized stablecoins have the worst peg.

Decentralization is more of a mixed bag. Most of the centralized stablecoin issuers are operating 1:1, although it’s a design choice. USDD chooses a higher backing ratio, (and also has a poor peg). The decentralized stablecoins run the gamut between about 20% to 90% efficiency.

We do see that there’s a pretty reasonable correlation between efficiency and market cap. 90% efficiency to achieve 9 figures, 80% efficiency or below in the eight figures.

Stablecoin Efficiency Sources:

usdt: https://tether.to/en/transparency/#usdt

usdc: https://www.circle.com/en/transparency

dai: https://dune.com/SebVentures/maker---accounting_1

tusd: https://www.tusd.io/

frax: https://facts.frax.finance/frax/balance-sheet

usdp: https://paxos.com/wp-content/uploads/2023/06/USDP-Monthly-Stablecoin-Reporting-May-2023.pdf

usdd: https://usdd.io/#/

gusd: https://www.gemini.com/dollar

lusd: https://dune.com/liquity/liquity

eusd: https://dune.com/defimochi/lybra-finance

mim: https://analytics.abracadabra.money/overview

susd: https://dune.com/synthetix_community/synthetix-stats

crvusd: https://crvusd.curve.fi/#/ethereum/markets

mai: https://mai.watch/

alusd: https://alchemix-stats.com/