July 10, 2024: Good to be Kingmaker 👑🏰

Convex Finance's Strategic Position in the Resurgence of DeFi

In the past few weeks, the energy feels to have shifted. Specifically, $CRV bulls reasserted themselves on the timeline, and more broadly, DeFi / revenue-generating tokens became less of a taboo.

Perhaps it’s time to draw more attention to the fact that there’s only one group of people who have made money in crypto lately (well, two, if you count muggers in Brussels.)

While high time preference “traders” have mostly gotten poor, wealth has flowed to the minority of crypto users with a lower time preference, disproportionately still holding stablecoins, who have been enjoying steady yields.

As we all know, a bullish “sentiment” towards DeFi may not necessarily translate into “token number go up.” But if the ever-transient narrative does in fact return towards long-term bullishness on DeFi, it’s a reminder to pay your proper respect to the protocol that best took advantage of the bear market to steadily position itself as kingmaker over what then looked like a wasteland…

With big moves around $cvxCRV, Napier, Asymmetry Finance, and Protocol f(x)… the chessboard has never looked better for the kingmaker Convex Finance.

$cvxCRV

We’ve talked a lot about the repeggening of late, as all three $CRV wrappers have seen an influx of activity.

July 8, 2024: Locked & Loaded 🔒🗝️

It never fails… newsletter takes a few days off… and metric tonne of activity hits $CRV. Recommend everybody to study everything that happened at Stable Summit:crv.mktcap.eth is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

We may still be puzzling about the precise reason…

Thanks to the great wavey0x, we finally have more tools to understand that all three wrappers are delivering strong and consistent yield.

It’s clear that for all the success Yearn and Stake DAO have seen in pushing their wrappers, Convex will continue to claim their piece in the form of $cvxCRV.

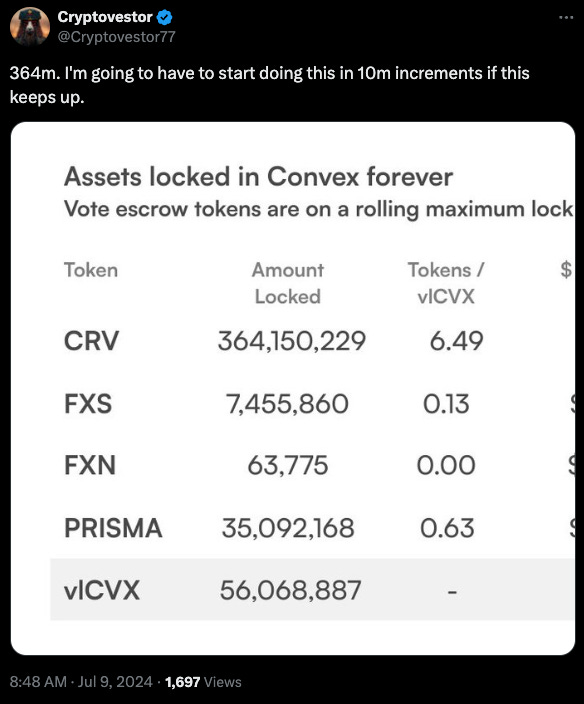

A rising tide lifts all boats. For the sake of Convex, it’s resulting in such an influx of $CRV that Cryptovestor is having trouble keeping up.

The lockathon has directly impacted the veCRV:CVX ratio

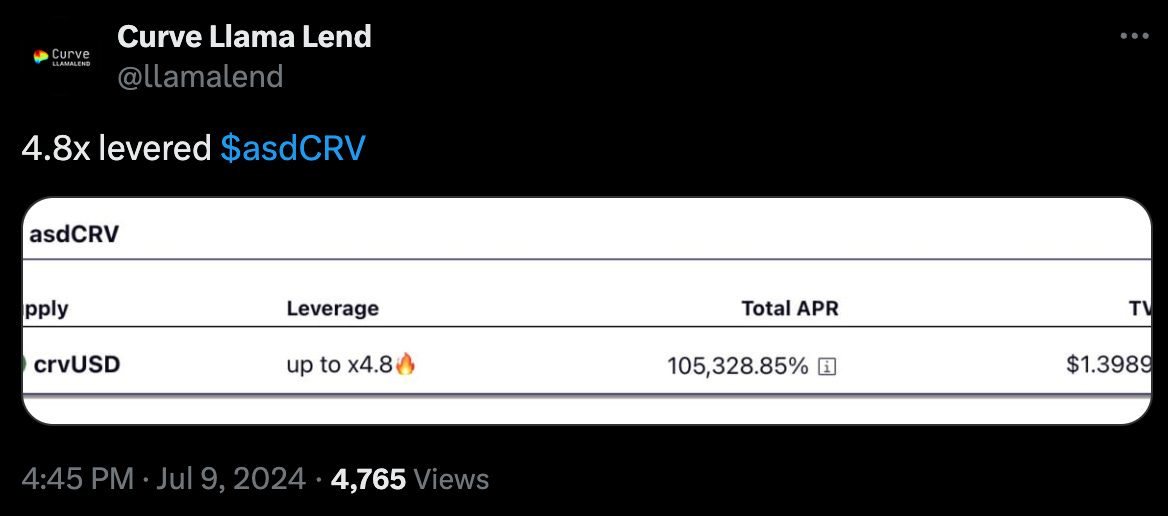

Meanwhile, lending markets are reopening to $CRV. Llama Lend on Arbitrum is testing out an $asdCRV market on Arbitrum with 4.8x leverage.

Yet this market is very much in test mode, with just $12K TVL at the moment.

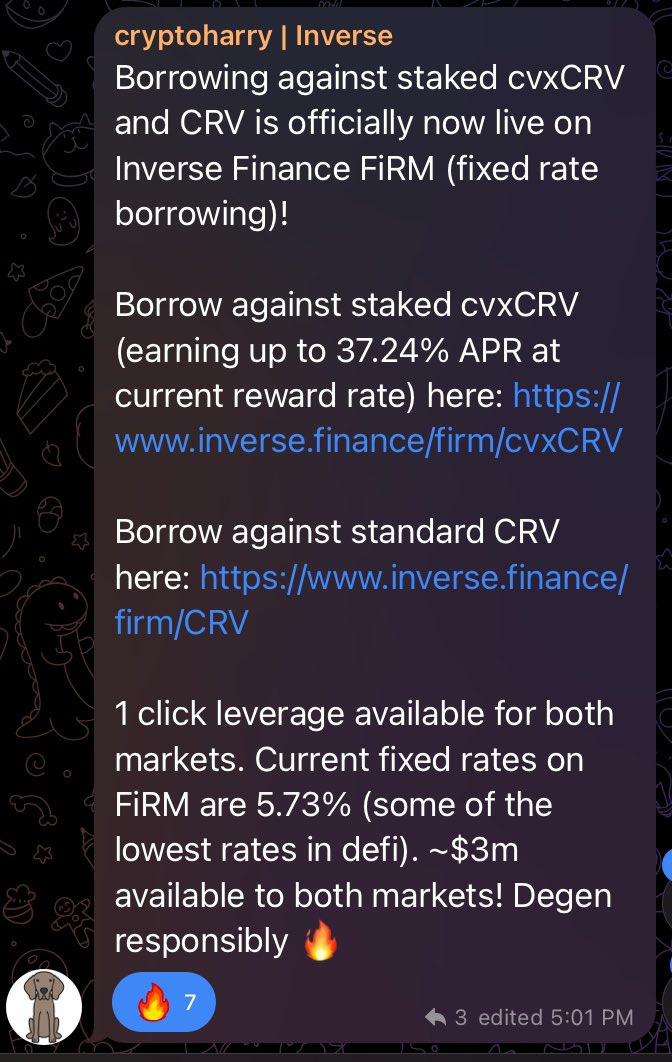

Meanwhile, Inverse reopens to both $CRV and $cvxCRV alike, with several millions worth of liquidity.

Buckle up, it’s about to get composable up in this piece…

Napier

Yield trading for the flywheel is officially launched, and off to quite a start.

The project has sailed past $7MM toward its $10MM cap.

Much of this is no doubt chasing points, as their Llama Race is underway and earning 5x Napier points for early depositors.

Details on this chapter of the points program:

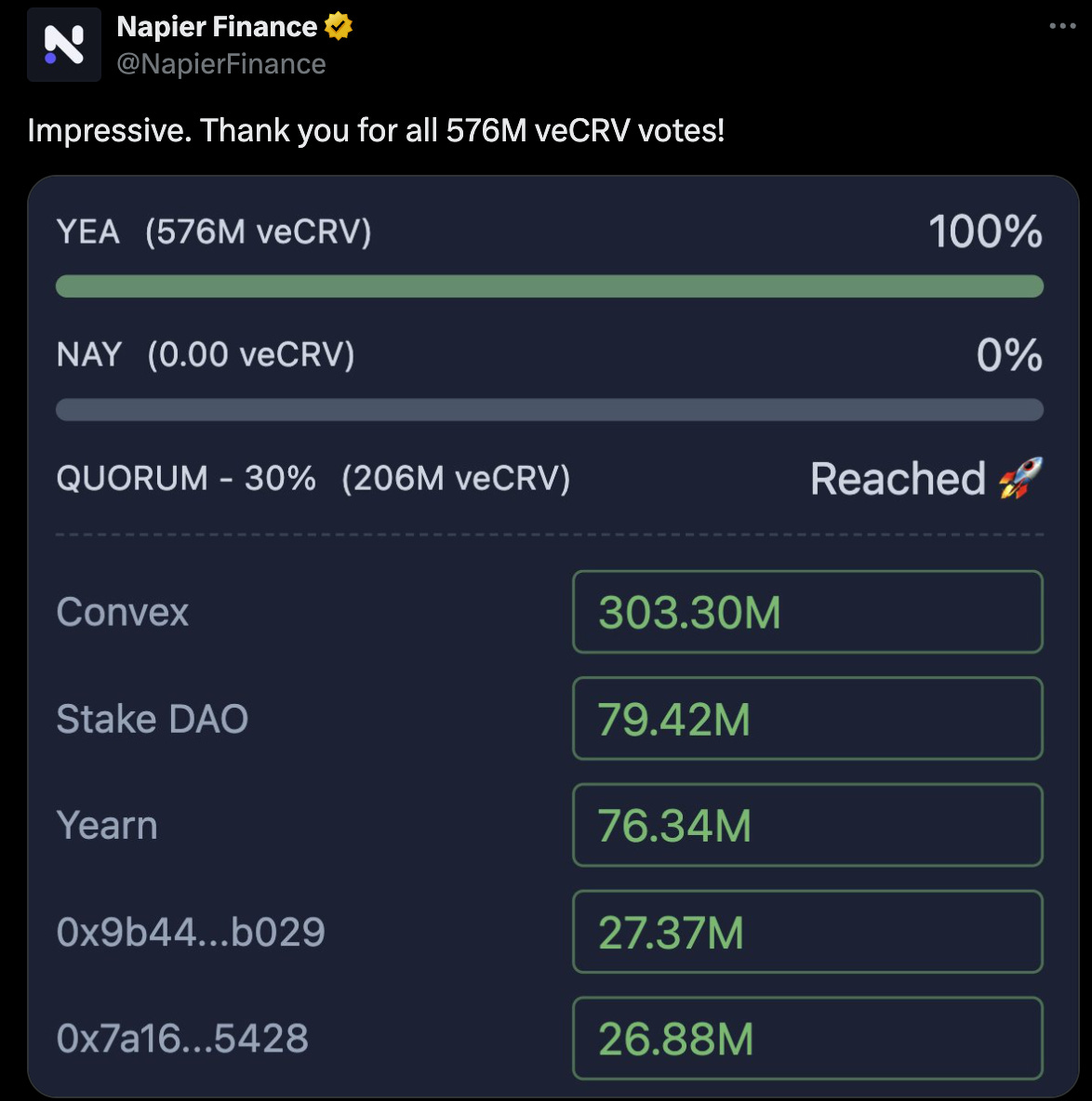

Their first pool officially passed gauge vote with nearly 3x quorum, thanks also to the promise of points.

Should Napier Finance prove successful, the downstream beneficiary will be, as in all things, Convex. Over the long weekend, $cvxNPR was officially announced, which could mark the fifth protocol annexed into Convex’s fiefdom.

We’ll of course need to wait and see where Napier goes, as its still in the early stages, but it’s certainly caught our eye amongst the most promising projects to launch in the past year…

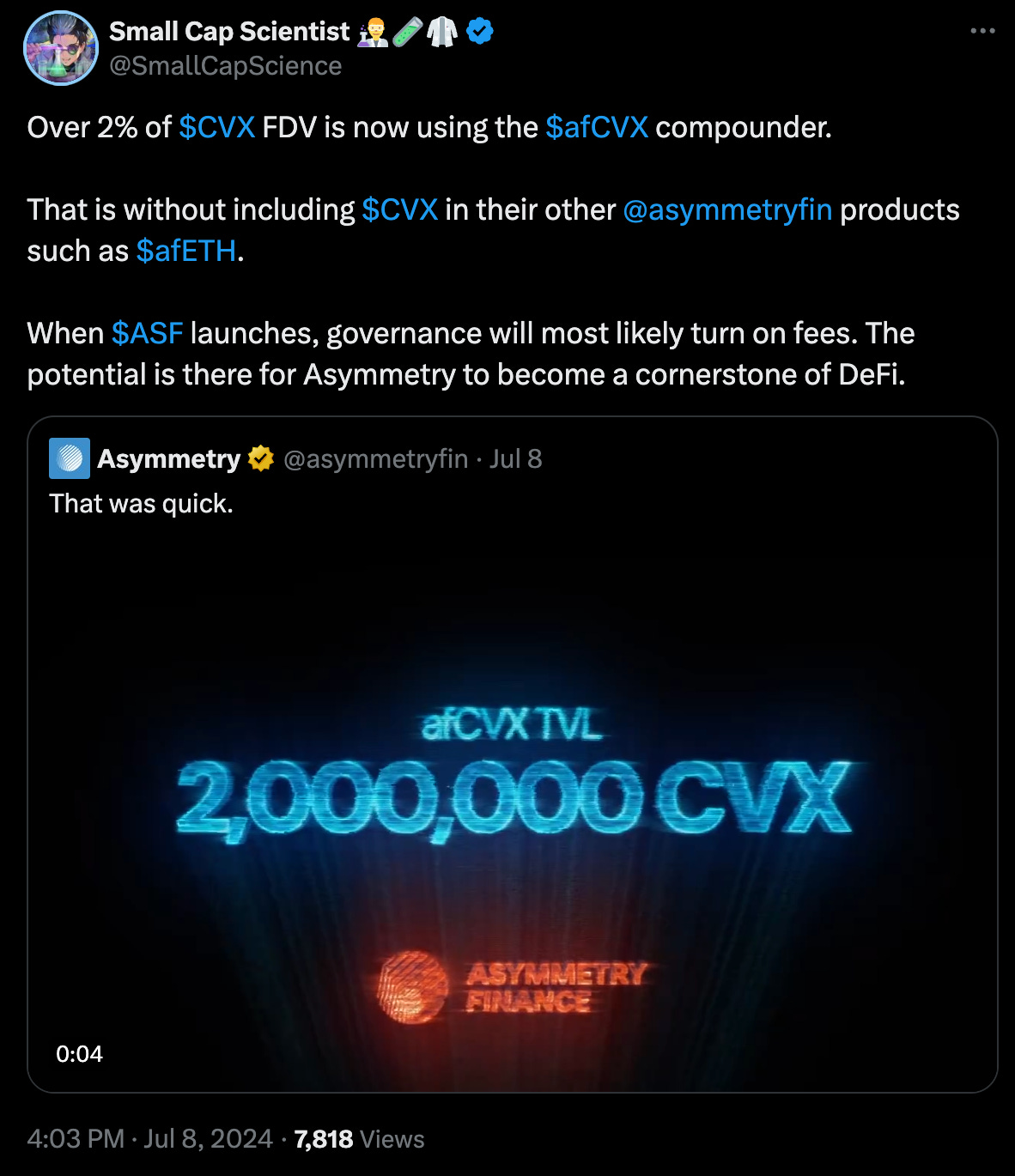

Asymmetry

Congrats to Asymmetry on collecting 2MM CVX.

Locked into the $afCVX compounder, this gives the nascent protocol a major footprint in the world of DeFi.

It has turned the CVX wars asymmetric. With a portion of Asymmetry’s products built atop Aladdin DAO’s $CLEV, this has reshaped the battlefield.

With the CVX wars turning hot, keep an eye on Convergence, which is releasing its own $cvgCVX wrapper.

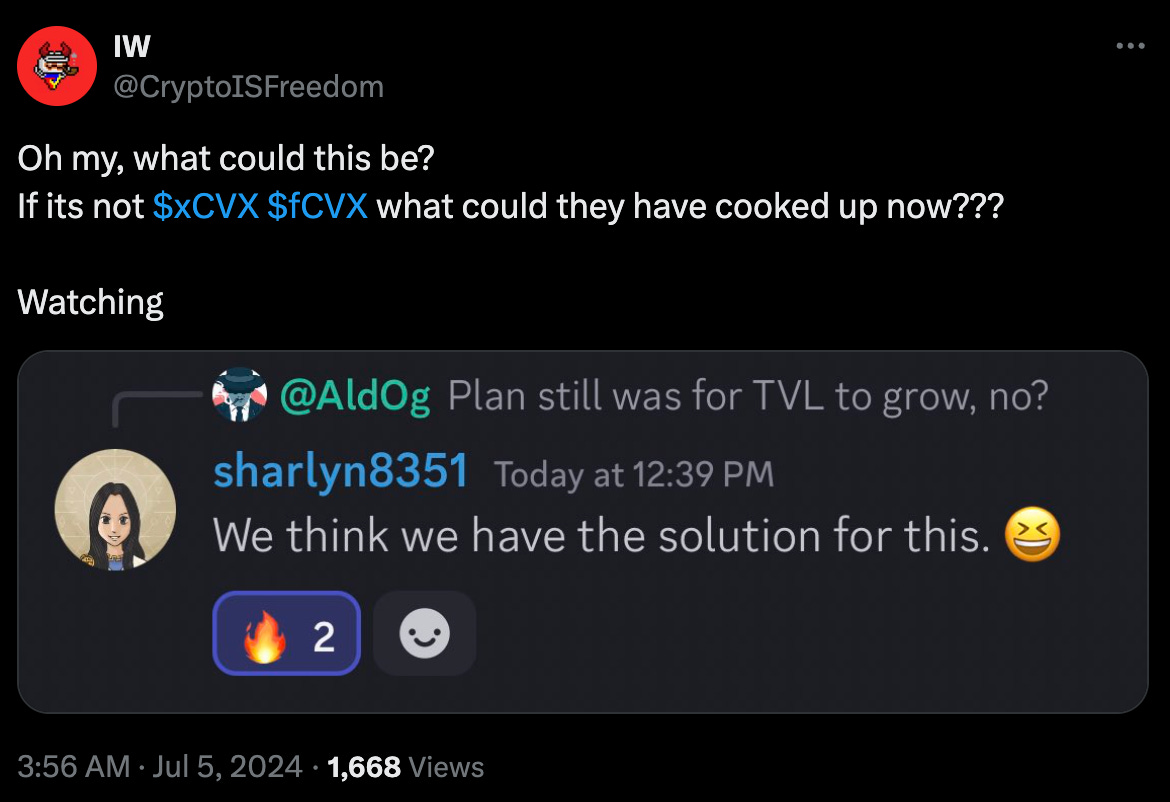

And if you thought people would stop wrapping $CVX, guess again…

Protocol f(x)

Aladdin DAO has always had giga-brained plans to exploit synergies among their three protocols, Concentrator, Clever, and Protocol f(x)

Eagle-eyed readers will note we already subtly cited Concentrator (new $asdCRV lending market) and Clever (via Asymmetry Finance.)

Rounding out the trio is the newest celebrity pairing: $cvxUSD / $xCVX

Like the alchemists of yore, Protocol f(x) has shown tremendous success at splitting basic elements into their constituent parts. They’ve successfully cleaved Bitcoin and forms of Ethereum into stable and volatile pairings, and then smelted the inert isotopes into a single ultra-stable TrifxUSD pool.

The newly announced CVX pair is next, with a CVX-backed dollarcoin ($cvxUSD) and leveraged pair ($xCVX) soon to appear. The prophecy has been fulfilled!

This will open up all variety of strategies…

It all takes us back full circle to where this newsletter started.

The vast majority of crypto is building “flash-in-the-pan” products for short-term focused traders grab all the attention, while the power steadily accrues to those who have maintained a “slow-and-steady” focus on building cash flows over a longer term.

Convex and these new Protocol f(x) wrappers are providing the latest such tool to do so.

For more on Protocol f(x), check out Cyrille Briere’s A-list European tour.

Disclaimers! Author is exposed to basically every token/protocol in this article (excluding Napier, where we have no interest except perhaps whatever points might have come from voting in favor of their resolution).