The Curve Wars are shifting to new and unexpected fronts

The initial Curve Wars focused on the veCRV discrepancy between Convex and Yearn, but this has continued to be a rout, with Convex over 3x Yearn. In total 75% of circulating Curve is now locked.

Convex and Curve are so deeply intertwined at this point, they are functionally two sides of the same coin. As goes one, so goes the other. Curve makes sense for smaller bags, but for large whales, Convex ends up being the only practical option. The 10% fee Convex takes on a ~1.8x boost doesn’t particularly matter if your other choice is boosting natively on Curve from 1x to 1.02x rewards.

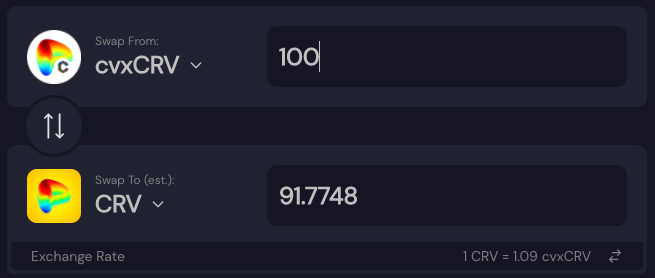

Lately though, things have gotten crazy. Several of the mechanics hinge on the relation between the $CRV token and the Convex equivalent $cvxCRV. For most of the past few months these two tokens have traded in a relatively narrow band. Yet for the past day or so, the discrepancy is growing unusually lopsided.

Historically the peg has been intentionally loose, more of a “price ceiling” given the codependent incentives offered by the two platforms.

It’s unclear whether the discount is a temporary fluctuation, a coordinated attack, or a permanent loss of confidence. It is clear that the broader crypto market is in an unusual state. If you believe markets are rational, then the interpretation is that runaway inflation is causing the dollar to strengthen against crypto 🤡🤡🤡

The most notable trend is shifting behavior from turbo-selling. Both Curve and Convex are perpetually impacted by large sell pressure in the form of automatic dumping. In the case of Curve, dumping is mostly linked to Yearn strategies

Curve itself has weighed in on the subject of auto-dumping, citing this strategy as “fair game”. Plenty of $CRV on the markets available for buyers with a lower time preference. We’ve seen evidence that the existence of Convex is already shifting the contours of these debates.

About a month ago the Curve community floated a proposal to restrict double dipping into $CRV rewards, which could have constricted the supply of $CRV available for dumping strategies. Although this particular proposal didn’t go anywhere, Convex finds itself increasingly capable of bullying competitors through its governance powers. At the micro level the fundamental $CRV value comes from its trading fees, while at the macro level its governance value is taking on greater importance.

Meanwhile, on the Convex side, they have been reckoning with dump pressure, primarily from Alameda Research:

The turbo-sell pressure has revived the classic “Vampire Squid” moniker.

For the younger set, the “Vampire Squid” slur was first used by the great Matt Taibbi, who classically described Goldman Sachs as "the great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money."

To bring it all full circle, Sam Bankman-Fried, the waifish muppet running Alameda, recently threatened to buy Goldman Sachs.

In the latest turn, it seems as though Alameda dumping has declined considerably over the past week, although it may be a case of misdirection.

If you are worried about dumping, you might consider a farming strategy that takes this into account:

Despite the effects from short-term greedy players, the long-term greedy are still making plenty of money.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist, and therefore long $CVX.