Think the “points” craze is going away? Guess again. The trend of bridging value back offchain into centralized databases is clearly not going anywhere.

If the “points” craze is to make their way into the bespoke Curve UI, we’re pleased to see Curve’s gone the extra mile to implement this in a more novel, decentralized, and innovative technical fashion than the median points program.

In this case, a pull request from contributor OnlyJousting shows off how anybody may permissionlessly add their points campaign to the UI by submitting a pull request to the curve-external-reward repository.

With the impending reduction in Curve supply, it may become only more common for protocols to direct liquidity from external points program as opposed to emissions. Nice to see the informational playing field is somewhat leveled here, and LPs can make more informed decisions.

Last week we briefly highlighted a laundry list of goods opportunities for yield farmers (several of which, we continue to shout, are extremely underutilized.)

June 26, 2024: Super Secret Alpha 🔍🕵️♂️

Like it or not, crypto is applied informational arbitrage. Not everybody has the time to trawl through a million Telegram and Discord groups and niche 𝕏 accounts to find the intel that doesn’t bubble up to the UI. Our responsibility is the Curve beat. Here are the best hidden stories we’ve seen of late.

Today we go into a bit more depth on one where we provided just a cursory glance.

Mezo Network

Mezo Network announced an integration with crvUSD!

Whooo! You can yeet $crvUSD to earn a Mezo Score! And a BTC score! And Curve community bonus points!

But, uh… wait a second… before you again YOLO your surviving net worth into another protocol, maybe it would be prudent if you first ask what exactly is a Mezo? (not financial advice, of course)

Mezo self-identifies as the “Bitcoin economic layer,” which appears at the surface level to be an upcoming EVM-compatible chain powered by $BTC (and using $tBTC to bridge).

The Bitcoin powered chain will be powered by what they refer to as a “Proof of HODL” mechanism.

The documentation is a bit scarce on the subject, with just a sentence describing:

Users secure the network by locking BTC and MEZO tokens and validating transactions via CometBFT consensus

“Proof of HODL” at this stage appears to mostly be backgrounded, amidst a bootstrapping phase / points program. Deposit funds in the form of BTC or BTC-backed stablecoins, and earn 1000 points per day with multipliers for longer lockups.

For this program they announced they are accepting up to $200MM, currently having received $128MM. In addition to $crvUSD, they also accept stablecoins in the form of Threshold’s $thUSD and Ethena’s $USDe, as well as several forms of Bitcoin.

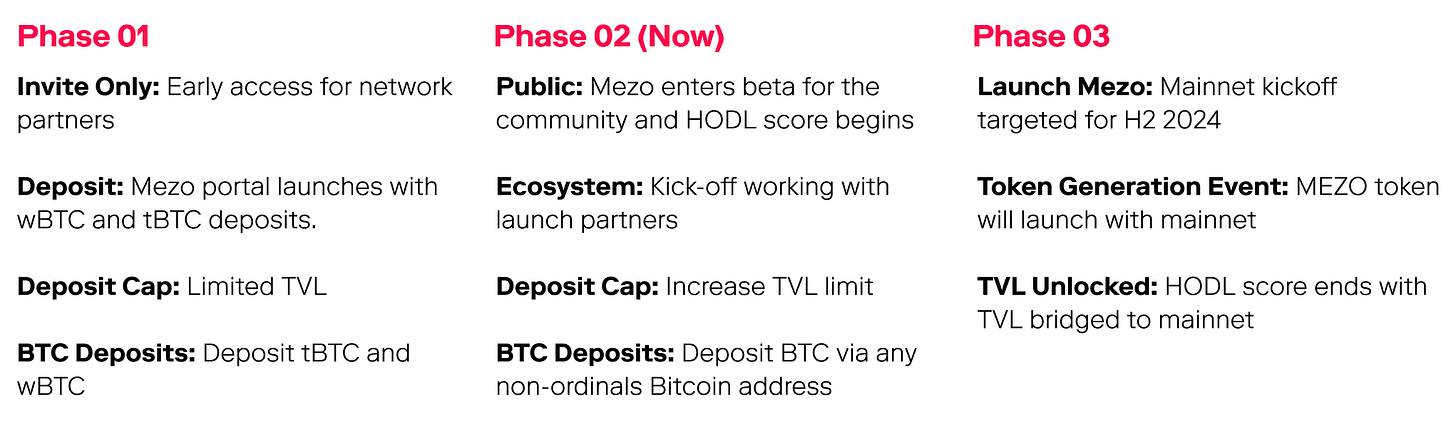

It’s the second step on their roadmap, with Phase 3 constituting the launch of their mainnet.

How do they make money? Stablecoin deposits are free (exclusive of gas costs). In turn, the protocol uses the stablecoins for yield farming, though it doesn’t touch the Bitcoin desposits — probably a wise move given the paranoia among hardcore Bitcoiners about losing a single satoshi.

Instead, they profit from Bitcoin deposits by taking a fixed .001 BTC fee on all transactions, and requiring a minimum deposit of .01 BTC.

What of risks? Numerous, as with everything in DeFi! Most notably, the portal contract is an upgradable proxy contract, which always increase rug risks (even upstanding teams may be coerced to rug users of upgradable contracts). There’s also the assortment of various DeFi risks for the stablecoin deposits.

We couldn’t find a Github account to give the codebase a glance (which may be irrelevant as the code is upgradable.) You may instead read their audit reports by Quantstamp and Thesis Defense. Note that the latter is affiliated with Thesis, which built Mezo, so there’s a potential conflict of interest (though the audit appears quite thorough and good).

Finally, there’s a laundry list of crypto-aligned VCs backing them.

Some users consider VC backing to be a good thing (social proof, potential bailout from hacks), whereas others (including ourselves) find it more portentious (VCs need somebody to dump on, so it’s usually retail.)

For what its worth, tops of their points leaderboard is an address NoVCsToBeFound.mezo, so that may be some limited reassurance.

In total, certainly some red flags to be aware of, as we generally expect with most DeFi projects. Yet even with all this foreknowledge of all these risk factors, we nonetheless plan to ape, (though we have yet to do so.)

Why? As often… facts are free… opinions for those who can afford it…