Did you catch this space this morning, featuring all the alfa from Mich?

The event was to celebrate the listing of $CRV on HashKey, a leading Digital Asset Exchange licensed in Hong Kong. If you missed it you can catch the recap.

Or settle for this lesser event coming up in a few hours…

Dock Or No?

It’s been so long since we saw a green candle…

Nobody knows what it means, but it’s provocative… it got the people going…

Blessed are those who could just enjoy the pump. For the rest of us, we tried to flip on our brains. Here’s the full explosion detailed in slow motion….

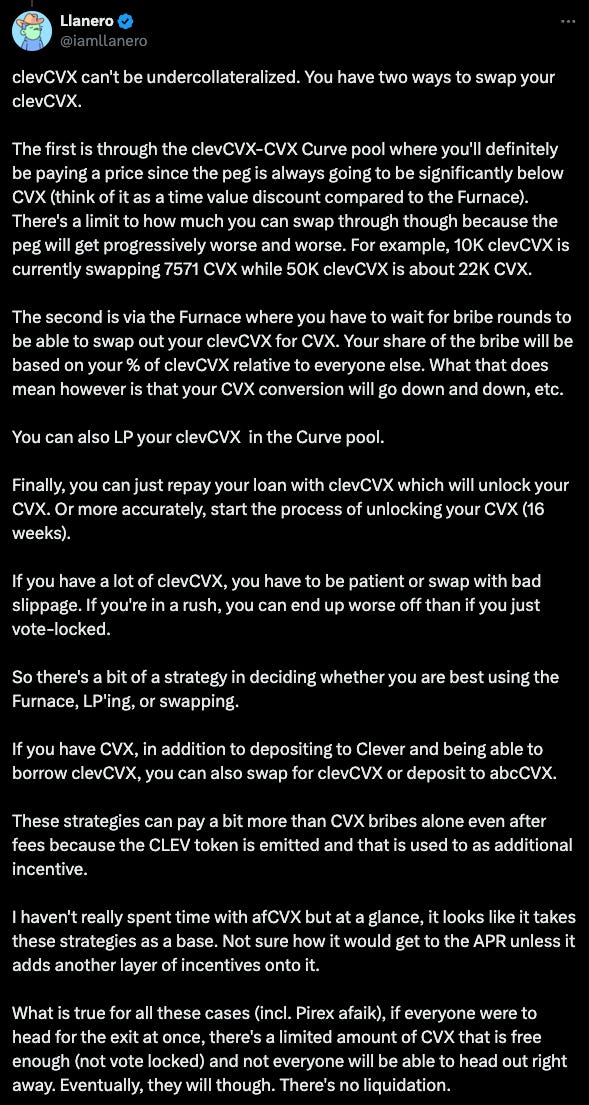

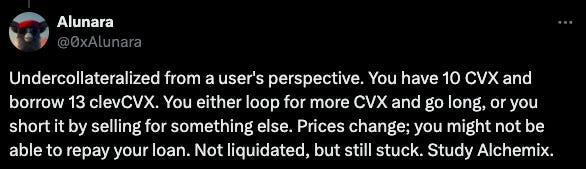

Of course this would inspire a full conversation on the subject.

So there is some accord reached, but the cat is already out of the bag. The legendary DCF God described his experience…

Which inspired yet more conversation

The rest of the world shared good thoughts…

Read through the above posts, what do you notice?

As with so many things in crypto, any apparent conflict mostly reduces to differing time preferences. It always comes back to Reserve Protocol’s ReGov event at ETH Denver:

March 13, 2024: Regov Recap ⚖️🏛️

Congrats to Reserve Protocol, which just saw the market cap for their RTokens sail past the $50MM mark…

This debate is the latest flare up of the suddenly hot $CVX wars.

This past week, CLever’s $clevCVX officially flippened Pirex’s $pxCVX as the largest holder of vlCVX, driven heavily by adoption of Asymmetry’s products.

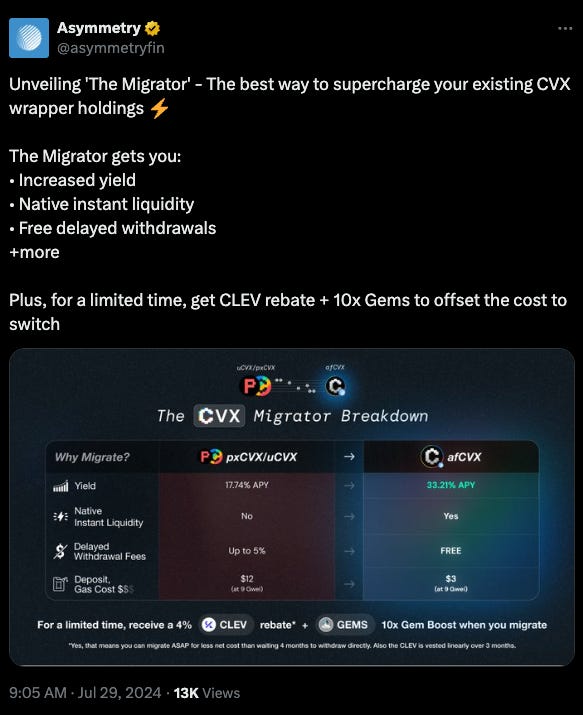

In other circumstances, yesterday’s timeline might have been dominated by Asymmetry’s revelation of The Migrator.

But looks like the post did numbers anyway? Maybe CVX Wars are good for the attention economy…

Asymmetry wasn’t the only one taking advantage of all eyeballs on CVX.

Convergence took the opportunity to plug $cvgCVX

Don’t forget about the CVX lending market on FiRM

Of course, the rise in $CVX price was even better for anybody who adopted f(x) Protocol’s leveraged $xCVX

And even though the original post scarcely took the chance to self-promote the Union (built on $pxCVX), satisfied users would offer a testimonial.

So we hope that by chronicling the whole debate has served to make you all more educated on the whole subject.

However, this is web3. At the end of the day marketing is marketing is marketing…

For every person who bothers to read to the end of the article, there’s a hundred of illiterates who will never bother to read the fine print, and simply yeet their net worth to whomever offers the dankest meme.

And maybe that’s OK.

Perhaps the killer use case of DeFi is to allow people whose innermost desire is to get rekt a more efficient offramp to part them from their money. Let’s turn off our brains and embrace the memecoins…

You read all the way through! Your prize at the bottom of the cereal box is… some bonus disclaimers! They can’t all be winners, eh?