July 6, 2021: $EPS Didn't Kill Itself 🪢🚨

Why are fewer users claiming their Ellipsis airdrop?

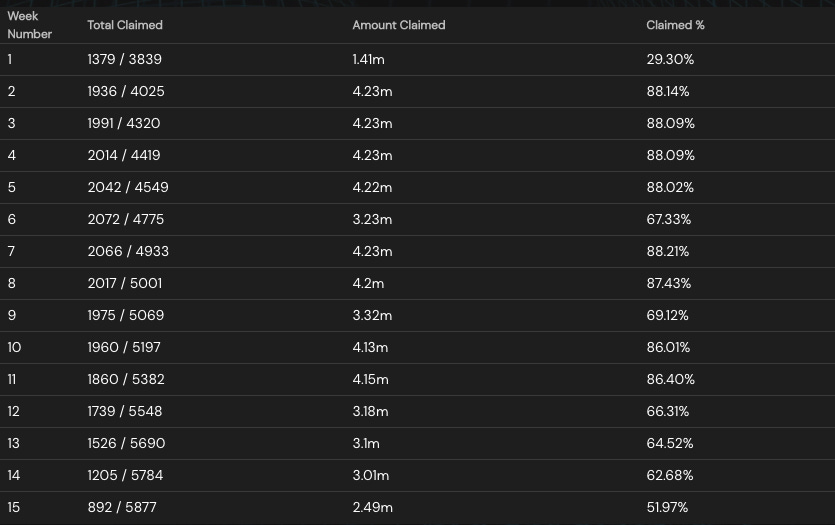

Just a few months ago, the Ellipsis Airdrop was the big event in DeFi. Today numbers are dwindling. From nearly 90% to just about 50%. What happened?

One explanation is simply a drop in the $EPS price has knocked it off people’s radar. The claim % almost perfectly tracks the drop in Ellipsis price from nearly $5 in April to around $0.50 today.

Ellipsis price was always destined to drop from its buzzy highs at the outset. As a DeFi token, it also has a something of a built-in floor. That is to say, assuming trading behavior persists as it and no other catastrophic event, you can do a discounted cash flow analysis to derive a fair market value.

By way of example, here’s some back of the envelope math — staking 1 $EPS token appears to net roughly $0.10 per year in BUSD in trading fees based on current activity. Presuming you expect this activity to continue for a year or so, if the price of $EPS dropped to, say, $0.05, it would be a no-brainer to buy. Every $EPS purchased for a nickel would give you a dime worth of BUSD back by the end of the year. At this price, the BUSD return would be 200%, a better deal than anything in DeFi at this low price.

All this also completely ignores the far more generous EPS rewards being generated. Running assumptions on cash flow valuation of EPS has a lot more moving parts — variable emissions rate, price movement, etc. For sake of simplicity, we’ll simply assume each $EPS token generates one additional $EPS token per year.

Here where the risk of price sensitivity has a major effect. If you buy at the price of $1 and it drops to a price of $0.10 then it’s a bad deal and you lose a lot of money. Your purchase of 1 EPS after one year gives you $0.10 BUSD + 2 EPS, so you have $.30 on your $1 purchase, a 70% loss. If you buy at $0.10 and it stays at $0.10, then at year end the $0.30 in pocketable value is a 300% return.

Lately EPS hasn’t fallen below $0.35 and generally stays around $0.40. I loosely interpret this as a return of $.10 BUSD per token (+25% on a $0.40 price) plus the value of another EPS. If EPS drops to $.10, this would be a loss of 25% at end of year. If EPS went toward $1.00, this would be >400% gain. As the price approaches an absolute floor, the downside risk tends to lessen. I’d guess more sophisticated arbitrageurs are running a more complex version of this math and projecting that at $0.40 the price is worth the risk and something of a natural floor.

So if you’re new, you should know that I’m an idiot and you probably want to ignore everything I ever wrote. That said, my read is that we’re basically reduced to cash flow analysis like this because whoever or whatever is continually nuking crypto markets to smithereens is removing anything like a “market premium.” That is to say, wholesome government-approved ponzis like the stock market take expected cash flows but then multiply by some premium because of “expected growth” or whatever. This results in $TSLA trading at a 100x premium, because it may not make much money but there’s a robust system in place to support a higher price.

The sustained nuking of crypto means we aren’t allowed nice multiples, they simply get eradicated by the turbo-selloff pressure. Hence, we’re forced to value against absolute floors, not ceilings. At least DeFi tokens throw off cash so they have floors, pity the person calculating the floor on $SHIB.

The scary thing? If a DeFi token goes below the implied floor price, the market interpretation is not necessarily that it’s an arbitrage opportunity. If they’re selling a dime for a nickel, the implication is that there’s a half a chance the protocol will simply die or disappear and you never even get your dime.

When I see $EPS at $0.40, it strikes me as a low value in terms of cash flows, so therefore I assume the price may reflect existential concerns about Binance Smart Chain.

This is a fair concern. Around the time $EPS cost $5, Binance Smart Chain was looking like a credible challenger to Ethereum. Lately, BSC looks like it may not survive.

Decentralization doesn’t matter… until it does…

You be the judge… is the writing on the wall?

Or is this just nerves?

So back to our initial question, why aren’t people claiming their airdrops?

Nowadays it’s probably most attractive to simply wait the three months and take the full amount. Claim and you lose half the tokens. Stake it and you earn back ~25% in three months time. Even if you are aggressively compounding, you’ll still probably have more net tokens if you just wait the three months. Can anybody check my math on this?

On this level, you may be able to read the tea leaves that this bodes well for Ellipsis and BSC more generally. If users suspected BSC was going belly up, they would be claiming their tokens at a 50% loss and heading for the nearest bridge. Instead, users are thinking BSC might survive another three months. Or at least they’re keeping keeping their options open and getting ready to make a beeline for the exit.

Should BSC indeed survive, we think Ellipsis looks like a better bet than most projects on the chain. Just like Curve has climbed to the top amidst a wild DeFi landscape, Ellipsis is also proving relatively stable in the wild west that is BSC. It’s starting to add some new pools that are starting to see activity and juice other pools with rewards.

Notably, on a chain adorned by multiple rugs, it’s proving itself not the target of hacks, but the part of the hackers getaway strategies. A vehicle to capitalize on BSC rugs? That deserves a multiple.

EDIT: Corrections to my faulty math:

Want some bonus Curve yield? How about some NFT airdrops!

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist and stakes $EPS