We know there’s intense interest in $CRV token price chatter, but we don’t follow price action closely nor do we proffer anything like financial advice… check the unofficial Curve Social Channel on Telegram if you want updates on number go up or down.

And while you’re beefing up your Telegram presence, join over 10K subscribers to Leviathan News… providing the finest decentralized crypto news crowdsourced from an army of degens!

Final plug for the voracious readers in the midst… Reserve Protocol has a cool new blog series launching on Medium…

$yCRV

We tried to warn you about $yCRV… (tho it wasn’t financial advice of course)

Looks like people are willing to ape in for promises of nothing but rainbows? 80% of $yCRV has been staked!

Now it’s repegging…

We don’t know yet how the yield will shake out, but the torrential FUD-storm hitting the crypto markets (particularly $CRV) will mean yet again some elevated yields in the form of healthy $CRV trading fees. Brace yourself for some gorgeous numbers…

Binance

Binance is integrating direct $CRV deposits and withdrawals on Arbitrum and Optimism

Interesting news for a lot of reasons… but in particular we’ll be looking at what effect this has, if any, on CEX<>DEX arb trading of $CRV between Llama Lend markets on Mainnet and Arbitrum.

The difference in borrow rate and overall supply is stark…

Mainnet

Arbitrum

We’re a burger, so we’re not allowed to enjoy the future of finance, but we hope this means good news for all of you.

Wen Llama Lend on Optimism? No idea, but we hope soon

Bullish $ASF

Today marks the launch of Asymmetry Finance’s IDO, being conducted on PAID Network.

The team dropped more details on tokenomics recently, including facets like a 3-year vesting window and a significant allocation to the DAO:

This $1.5MM community round supplements a $4MM angel round

And while the team may be too embarrassed to admit it, we’ll reveal in the interest of full disclosure that author was a participant in said angel round.

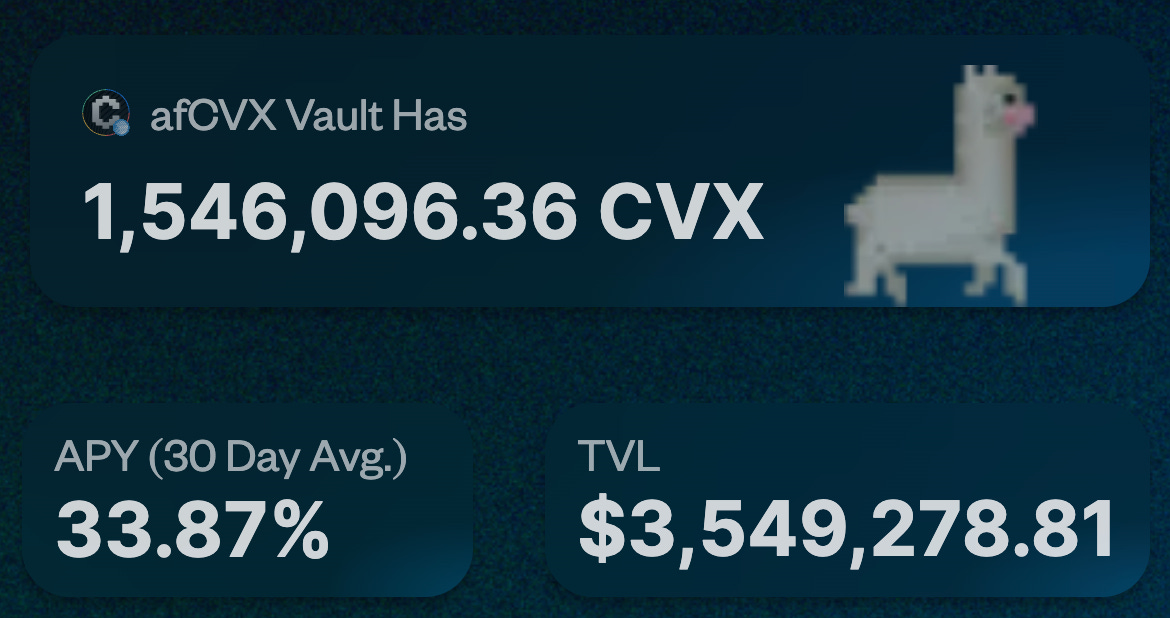

The team is choosing to fundraise with strong tailwinds, having locked up over 1.5MM CVX via $afCVX.

Now… one point that’s been a bit forgotten amidst the DeFi doldrums is CVX is among the class of tokens that is fun for retail, but extremely useful for builders. Owning a stash of CVX gives users tremendous power to direct liquidity at will.

When DeFi is sleepy, this use case gets overlooked. Recently there have been too few projects building in DeFi, so there’s been too little competition to steer liquidity.

Asymmetry DOES have plans to launch new products in DeFi. They have ambitious plans across the Curve ecosystem and beyond. For Asymmetry, directing liquidity could prove strategically important, so this CVX war chest could be a valuable weapon.

They dropped some of this alfa in a recent spot on Leviathan News, as well as a dozen other spaces.

We promise, we keep trying to warn you…

Author is also in the new $yCRV rainbow percent vault, so a lot of bag pumping in today’s newsletter. But lest you fear we’re too scuzzy, yesterday we pumped $GEAR, and we happen to hold no bags.

June 11, 2024: Get Your Rear in $GEAR ⚙️🧰

We know the UwU hack looms large in everybody’s consciousness, but it’s quite literally yesterday’s news! That is to say, we’ve updated the tail end of our post from yesterday with the remaining developments in the UwU hack and urge you to check there if you want the final updates on the subject.

Hmm…

…looks too cheap…

…we should get some $GEAR bags…