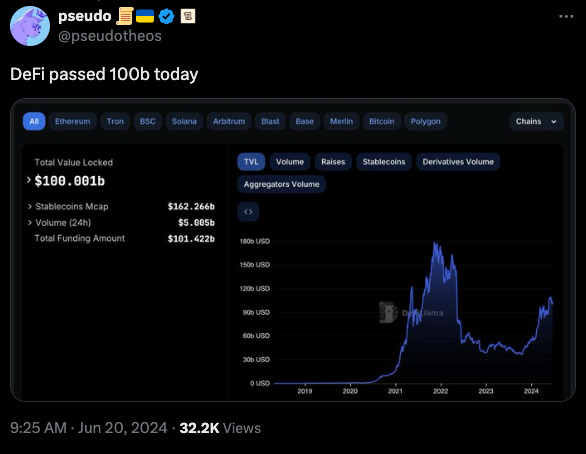

June 27, 2024: DeFi Renaissance 🎨🏛️

Rumors of the death of DeFi were always greatly exaggerated

Old enough to remember a few weeks ago, when DeFi was dead, slain by memecoins.

The subtle resurgence of respect for DeFi as a narrative is as welcome as it is overdue. After the embarrassments that were Luna, FTX, et al, ETH maxis had tried to distance DeFi. But wherever a new chain launches, DeFi inevitably follows. DeFi is an undeniable killer use case of crypto.

While gambling on memecoins briefly took the limelight, we always felt this particular narrative was liable to fizzle out. The handful of people in this space with a long-term mindset tend to find their way into yield farming, and prove quite resilient against transitory narratives.

Read nagaking’s piece in Reserve’s Yield Farmer’s Almanac for more on the DeFi revolution:

It’s wonderful to see the first signs that DeFi is no longer a dirty word!

Stablecoin market cap is approaching an all time high

As goes stablecoins, so goes TVL

Some DeFi tokens are already out of the doldrums. Aave skated through the bear market without much drama, and is seeing a nice revival.

Curve perhaps suffered a lot more public trauma during the bear, between the Vyper hack and liquidation flak. All the same, the bloodied protocol emerges with an annualized revenue of $37MM, putting it at least in a similar weight class with Aave.

We can’t guess where investor sentiment will shake out. Any revival of sentiment towards DeFi remains more subtle than we enjoyed during the most exuberant throes of DeFi Summer. But around the flywheel, we’re at least seeing hints of a DeFi Renaissance manifesting in various ways.

For one, the landscape of Curve’s DEX architecture has completely readjusted itself to latest trends.

A nail in the coffin of the FUD that Curve TVL was overly dependent on $CRV emissions? Or the birth of a new FUD?

The elegant phasing out 3CRV in favor of $crvUSD is a market of the evolution to a new phase of DeFi.

Note: We’re working on a longer article on the technical mechanics of this fee switch, but the smooth execution masks a lot of complexities under the hood.

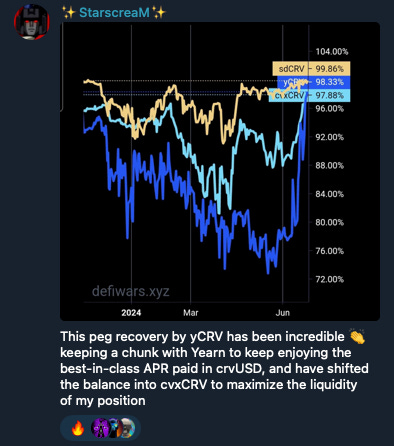

In another wonderful sign of a DeFi resurgence, we’ve seen the peg of various $CRV wrappers heal dramatically over the past week.

Yearn devs again showing off why they’re the best execut000rs in the biz

Buying the $yCRV dip may have been one of the most profitable trades anybody could have made in recent weeks (you’re welcome, readers!)

The influx of $CRV locks is a clear indicator to us of the resurgence of DeFi.

It’s one of the benefits of "cash flow” tokens. Drive down the price of a memecoin, and speculators simply lose interest. Drive down the price of a real yield token, and you just drive up yields. Sure… nobody likes token prices going down… but at least the community members and supporters get to enjoy a few nice big numbers…

See also, $PRISMA die-hards enjoying generational bottoms…

June 25, 2024: Over the Rainbow? 🌈☔

It’s been a tough day…week…month…quarter… shoot, it’s been a tough existence for the ETH-derivative stablecoin protocol. A short upwards correction in the past 24 hours notwithstanding, what’s been going on with the protocol lately that might justify the continued sadism of investors?

Slow and steady “real yield” is not as eye-catching to retail as the threat of a quick 100000000x, but it has a lot more potential for staying power. Investors punishing real yields during memecoin mania was always silly, so we’re glad to see quality protocols reasserting themselves.