Perhaps it’s just everybody timing their updates to drop during ETH Belgrade, but there’s been a ton of amazing news dropping this past week.

Ape

Ape Framework released a major release this past week in version 0.8!

The thread linked above and release notes include a bunch of important notes to smooth over migration. Key changes:

Massive Project Refactor: Simplified paths, improved dependency management, and new project configurations.

Enhanced Trace API: More efficient and customizable transaction tracing.

Bug Fixes: Resolved plugin config issues, compiler selection bugs, and datetime bugs

New Features: Added Holešky to EthereumConfig, auto_mine property in TestProviderAPI, and new contract creation metadata (!)

We use ape framework probably weekly, maybe even daily. Astute observers may have noticed it featured just yesterday in our scripts to pull stats for LLAMMA

Check it out, and you yourself may well find yourself going ape

Peg Keeper

Ahh…. I’m pegging… We told you the regulators were coming!

May 28, 2024: The Regulator

$crvUSD is soon to be controlled by Regulators! They told you FIT21 would shake things up, amirite…

And now they’ve arrived!

To better visualize the changes, check out the interactive tool created by the great Llama Risk team

Speaking of Llama Risk… they’re also hard at work updating the Sturdy Finance crvUSD aggregators

And next up will be updating their Morpho vaults

The savvy team are proving more than just adept number-crunchers, but sophisticated operators playing the game…

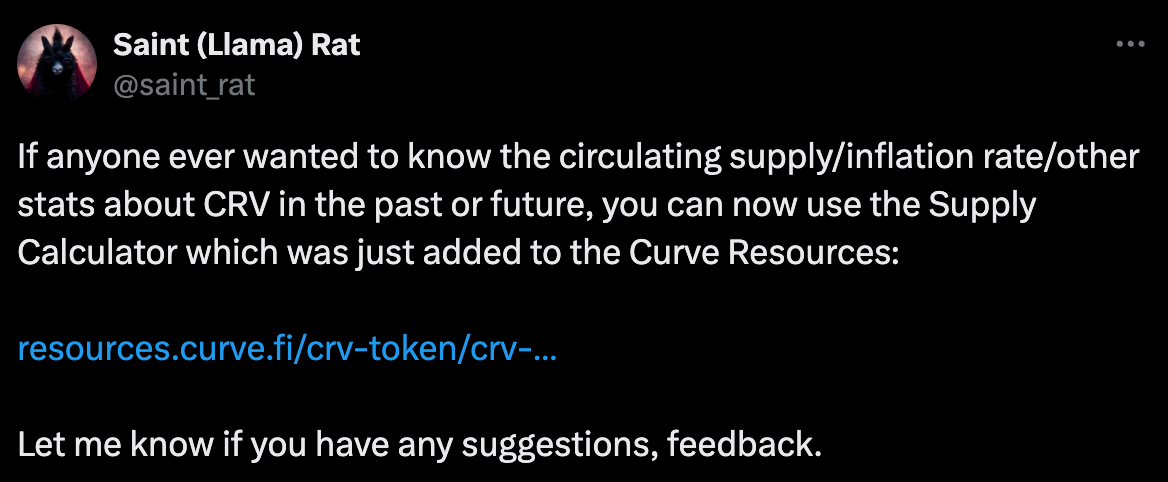

Stats Paradise

It’s a golden age for left-brained Curve observers. The resources page received a gorgeous update with an interactive supply calculator.

Plus new updates to the Curve Monitor

Stablecoin Maximalism

You’ve probably already seen it, but we wanted to highlight this outstanding thread from Reserve Protocol on stablecoins…

Spectra

Topping the list of things we’ll likely write about in more depth next week but mention in passing now in case we forget due to a million other updates is the new Spectra Finance launch

Why should you take interest in the new permissionless yield derivatives? Among other things, it utilizes Curve’s v2 pools in its architecture. Curve’s cryptoswap contracts are over-powered and under-utilized as a dev tool, so bullish on teams that recognize its potential.

They feature a variety of touchpoints across the flywheel, worth a look!

Speaking of…

$cvgCVX

Convergence released details on $cvgCVX. Lessons in this…

Maybe you haven’t been paying full attention to Convergence, but the smart money has already acted…

And speaking of Stake DAO…

Stake DAO

We’ve already tipped you off on OnlyBoost, and please, no more reminders, for the good of your bags! Everybody deserves the mythical 2.5x boost

Asymmetry

Continuing our series of things we’ll likely write about in more depth next week but mention in passing now in case we forget due to a million other updates, Asymmetry Finance has their $ASF token set to launch next week.

Expect more on this next week, unless we get distracted…

Conic

Finally, a series of updates we’ll theme hacked projects you may have presumed dead but still grinding hard… the status of Conic Finance was discussed some in Curve socials, and it is confirmed v2.1 is in the pipeline…

Subscribe to the Conelink Substack for all the latest updates

Prisma

Concluding our series, worth keeping an eye on the resurgence of activity at Prisma. Having dealt with the immediatee fallout from the hack, we’re starting to see the team get back to “business as usual,” like onboarding new collateral…