What a long strange trip it’s been! Following cryptocurrency for a few years, we feel we’ve ascended our consciousness into ethereal planes in the most holistic possible way.

For the everyone else, there’s LSD.

Amidst bear markets and bank crashes, staking into Ethereum Liquid Staking Derivatives has been the sole “up-only” market of the past few years. DefiLlama recently noted that Liquid Staking surpassed DEXes by total volume locked.

Accordingly, the innovation is flowing to LSDs. Hitting the market in time for summer are a spate of new variants. New entrants this month include Binance’s $BETH, Origin Protocol’s $OETH, and Yearn’s $yETH, the first two of which are already pursuing a gauge vote for their Curve pool.

BETH

Exactly one week ago, Binance announced “Wrapped Beacon ETH” ($wBETH). In the Binance model $ETH can be staked for $BETH, whichcan only be used within the Binance casino. They are also introducing a wrapped version ($wBETH) which can be sent off-platform, with wrappers present on both Ethereum and Binance Smart Chain.

$wBETH works under the cToken model, accruing staking rewards daily and adjusting the exchange rate accordingly. This means holding a constant amount of $wBETH can be redeemed back to $BETH at a different conversion rate every 24 hours.

Accordingly, the new Curve pool has already been created, and it’s one for the history books. It’s the new pool launched in the cutting edge next generation era, with capabilities like oracles, lower gas fees, and all that pizzazz. For reference, check last week’s article on the improvements:

April 25, 2023: Tricrypto: The Next Generation 🚀🖖

Keep an eye on the Leviathan News YouTube channel this morning for a possible livestream with Tricrypto NG author Fiddy. Finally, a “big week” that doesn’t involve a sense of existential terror. crv.mktcap.eth is a reader-supported publication. To receive new posts and support my work, conside…

It’s a bit interesting they got this pool out so quickly. The Next Generation factory is still in testing and hasn’t been hooked up to the new UI yet. You can only access it from the classic interface.

This hasn’t stopped them from tossing up a gauge vote already. Their forum post quotes:

“By offering CRV rewards to users for staking wBETH/ETH LP tokens, Curve will continue to incentivize user participation in the platform and maintain its role as a leading liquidity provider in the DeFi space.”

This wording is a bit ambiguous, as it seems to imply Curve itself would be responsible for the incentives (which is extremely unlikely). Whencesoever the potential incentives flow, the speed with which they’re pushing the gauge vote suggests they have aggressive plans for the pool.

Is it wise to ape into such a pool when Binance’s founder is under strict action by US regulators? Tough to say — the regulators have also been fiercely attacking Coinbase, but this hasn’t thwarted the success of Coinbase’s $cbETH.

As a US citizen, we’d personally be reluctant to utilize Binance’s wrapped Ethereum when the exit strategy required going through an exchange prohibited to US users. Needless to say, the US market is driving itself towards obsolescence, so the ability to exit through Binance may rather be seen as a feature in other parts of the world. We don’t really have the global perspective to say.

Remember, this is not financial advice, and you should contact your registered financial advisor when considering aping into degenerate internet ponzicoins.

More Info:

OETH

Origin Protocol has been making big moves lately. You may recall their dollarcoin $OUSD recently became the base layer of Archimedes Finance launch product:

Origin is now moving into the LSD game. Their full solution, $OETH, has yet to officially launch, so you can sign up for announcements at https://www.oeth.com/ in the interim.

While we wait, the team is clearly building out the infrastructure for $OETH. They’ve seeded their Curve pool with over 500 $ETH worth of tokens. Unlike Binance’s $BETH’s cTokens model (exchange rate changes), Origin’s $OETH works under the aTokens model, where the exchange rate is meant to stay constant and yield gets airdropped periodically to wallets. Curve has supported such pools for some time, so the Origin pool exists as a classic v1 pool.

$OETH has an interesting design mechanism in that it is minted using other LSDs as collateral, Lido’s $stETH, Rocket Pool’s $rETH, and Frax’s $frxETH.

Per this description, the yield is dependent on the $OETH pool receiving Curve rewards, hence the push for the gauge vote.

The $OETH design therefore utilizes price oracles to confirm the price of the collateral tokens. For $stETH and $rETH this involves using Chainlink price feeds, but with no feed for Frax’s $frxETH they are turning to Curve’s time-weighted price oracle function.

The specifics of the yield generation strategies are guided by $OGV stakers, representing the governance for the project.

More Info:

yETH

A third model entirely, $yETH is an Ethereum token backed by a basket of LSDs. The specific basket will be subject to other governance votes, but with baskets set to include 5 total LSDs, none of which will comprise >45% of the pool, you should expect to see many of your favorite LSDs make the cut.

$yETH by itself does not earn yield, and is intended to maintain a 1:1 peg with $ETH. In order to receive yield, users must stake $yETH as Staked yETH ($st-yETH) to earn compounded yETH from LSD earnings and other protocol rewards.

Of the three LSDs we profiled today, $yETH will likely be the last to roll out. The snapshot vote passing just last week. If they adhere to the timeline they outlined in their governance forum vote, then we should expect the launch phase to play out over the next two weeks.

The good news for Curve maxis is that the launch phase includes plans to launch a Curve pool and pursue a gauge. Thanks to Yearn’s accumulation of governance tokens, it could be straightforward for them to incentivize liquidity to the pool.

More Info:

Three new LSDs, three hot trips for your summer adventures!

To see how these compare, check out some of our previous articles on other ETH LSDs:

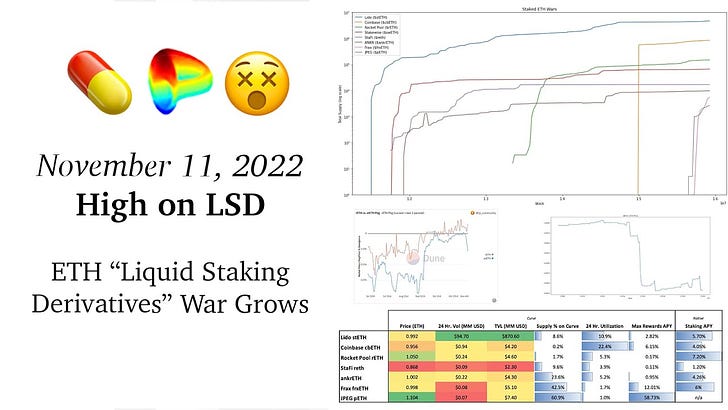

November 11, 2022: High on LSD 💊😵

Llama Party at 9 AM PT! Guest of honor this week is you 🫵 — Join in the Discord! The battle of ETH Liquid Staking Derivatives (LSD) has gotten more interesting in recent weeks with the launch of new entrants since the merge. Here’s the history of the LSD wars. We had to plot on a log scale, otherwise Lido’s intense lead would dwarf all others.

Sept. 12, 2022: Wrapped ETH One-Pager

Download PNG | PDF Notes on Data Sources All Data Pulled September 11 between 6:30 - 7:30 PM PT. Author does not vouch for the veracity of this data — all readers are encouraged to do their own research and consult with their registered financial advisor as opposed to psychos on the internet.