May 21, 2024: Hyper Bulla 🐂📈

New Secondary Monetary Policy proposes to smooth overlapping Llama Lend and crvUSD markets

Woosh… everybody’s bull.

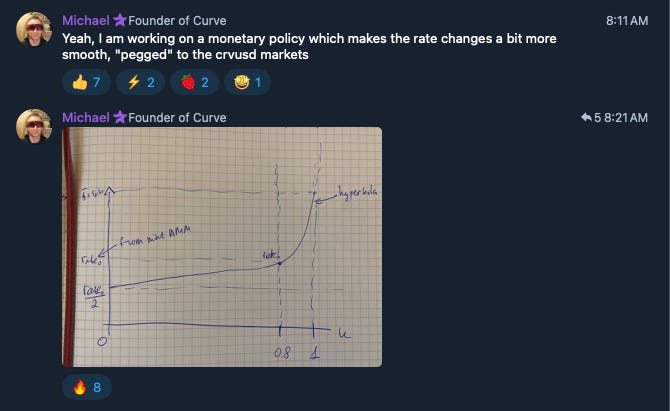

A lot of people are excited because of ETH ETF stuff, but we know there’s only change in monetary policy that’s got chads’ hearts aflutter…

Come to think of it… it sort of looks like Mich forecasted yesterday’s Ethereum chart…

What did Mich know and when did he know it...

Better question: What’s the story with Curve’s newest curve?

It starts with a summary of all the current lending markets Curve has

At the moment, Curve hosts three different lending market platforms, crvUSD, Llama Lend on mainnet, and Llama Lend on Arbitrum.

The important one for Curve is $crvUSD, because this one delivers revenues for veCRV. Llama Lend markets exist simply to provide a liquidity sink for $crvUSD.

You may notice some overlap among the various markets offered though. Most of the Curve lending markets have a duplicate lending market somewhere else. Is Curve undercutting itself?

Fortunately for greedy veCRV hodlers, $crvUSD markets hold the highest rates. This is mostly due to demand for leverage, which doesn’t exist in the Llama Lend UI (yet!). This allows for interesting spreads where you can get 18.1% rates on $wstETH in the $crvUSD market but just 7.07% on Llama Lend.

There’s also often differences between Arbitrum and Ethereum mainnet — such as WBTC loans for 3.17% on the former but 7.76% on the latter. In fact, a lot of arbitrage opportunities can exist between the two chains — mostly because of the time it takes to bridge, but that’s a completely different story.

Often times $crvUSD prices are different on the L2 by a meaningful enough amount to provide an arbitrage opportunity. The $FXN market provided a textbook example when the price of the token depegged on the sidechain.

April 15, 2024: Game of Drones 🕹️🚁

There are days where decades happen… Over the weekend, a performative, slow-motion drone swarm in the Middle East mercifully caused little real world carnage. The real collateral damage was to the prices of cryptocurrency tokens (excluding resilient memecoins).

Perhaps a faster bridge may be useful?

But we digress…

The question at hand is why duplicate markets between $crvUSD and Llama Lend?

In fact, it’s not an error. In theory, it’s fine to have both markets — the invisible hand of the free market should simply nudge both markets to equilibrium.

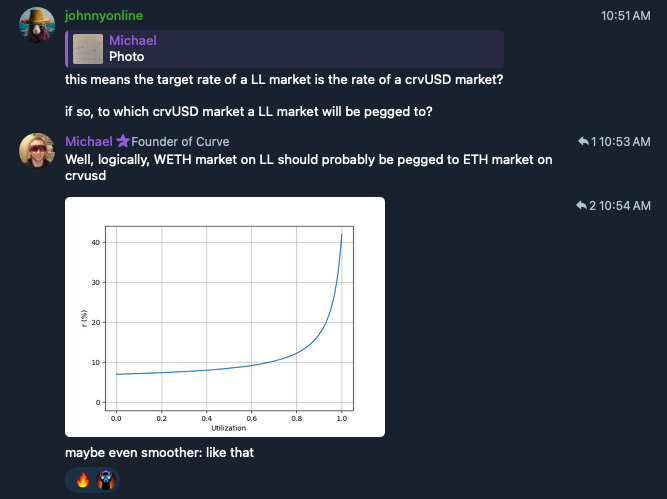

The goal with this new monetary policy is in fact to better coordinate the overlapping markets so they can be pegged to each other while still growing efficiently.

It’s accomplished using this slightly smoother hyperbolic curve, which happened to precede the hyper bulla market by just a few hours…

Impressively, this went from napkin sketch to Github commit in about an hour.

In fact, you can play with the math quite easily yourself. Here’s a chunk of Python

import numpy as np

import matplotlib.pyplot as plt

# Parameters

u0 = 0.8

alpha = 0.5

beta = 2.0

r0 = 0.05

# Calculating coefficients

u_inf = (beta - 1) * u0 / ((beta - 1) * u0 - (1 - u0) * (1 - alpha))

A = (1 - alpha) * (u_inf - u0) * u_inf / u0

r_minf = alpha - A / u_inf

# Utilization values

u_values = np.linspace(0, 1, 500)

# Borrow rates

rates = r0 * (r_minf + A / (u_inf - u_values))

# Plot

plt.figure(figsize=(10, 6))

plt.plot(u_values, rates, label='Borrow Rate')

plt.axvline(x=u0, color='r', linestyle='--', label='Target Utilization')

plt.xlabel('Utilization')

plt.ylabel('Borrow Rate')

plt.title('Borrow Rate vs Utilization')

plt.legend()

plt.grid(True)

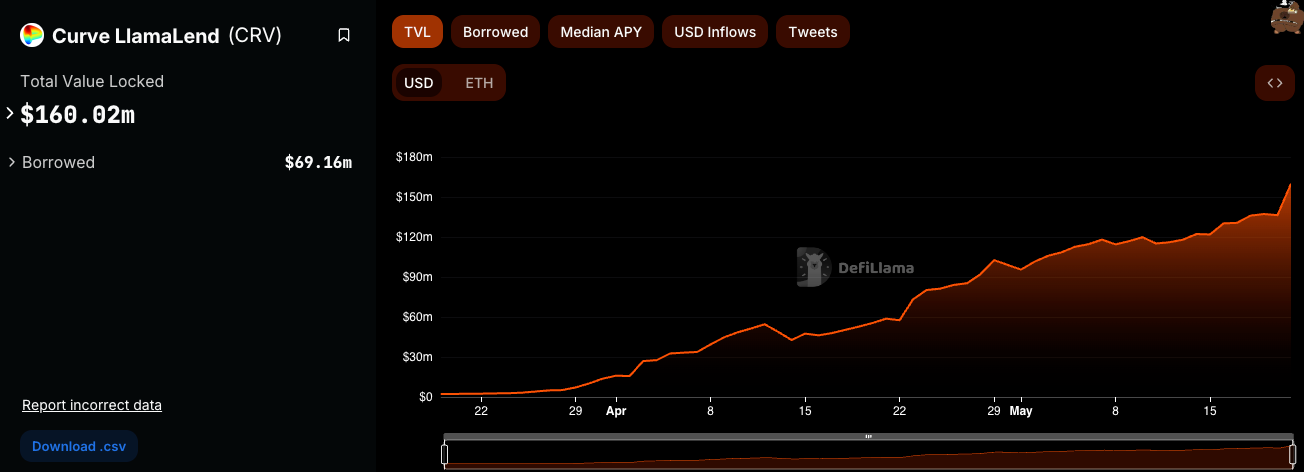

plt.show()If you keep attuned to the Curve social channels, you’ll note that the biggest question on Mich’s mind is how to most efficiently manage growth of Llama Lend. It’s been impressively “hockey stick” shaped to this date.

However, Llama Lend doesn’t do anything for Curve revenue, except to indirectly promote the use (and healthy peg) of $crvUSD. The steady growth has been great, but as of yet too insignificant to have any effects on $crvUSD. Llama Lend would need to do about a 3x before we see it start to affect $crvUSD supply.

We have a bit of time before this new Secondary Monetary Policy may even be put into effect. Dreaming up the code is easy, the tough part is testing it severely so that Curve code can maintain its good track record

A 3x is tough, but not impossible. Llama Lend’s soft liquidations are popular...

And Curve can safely open a variety of markets on popular tokens using Llama Lend’s isolated markets.

Lots of opportunity for growth…

Getting to a half billion is a tough fight, like everything in crypto. Of course we’re betting on the big-brained Curve team to pull it off.

Disclaimers! As always, author is long $CRV, $ETH

Please help us grow by sharing this thread on 𝕏!