May 24, 2021: The Dreaded Depeg 💸💸💸

Amidst market nukes, $UST + $USDN dropped 5% below the dollar

Curve is among the safest shelters amidst a broader market nuke. In fact, during the tactical impacts over the past week, Curve enjoyed two days of billion dollar volumes.

If you were mostly swimming in the dollar or euro pools, you may not have noticed the market turbulence, just enjoying great sales on crypto.

While Curve is a relatively safe space amidst turbulence, it’s not riskless. Over the weekend we observed one of Curve’s most notable risk factors play out in realtime: the depeg.

At the moment, Egorov’s Invariant works so brilliantly because all assets are presumed to hold the same value. If any asset depegs, then anybody stuck in the pool ends up with the less valuable asset.

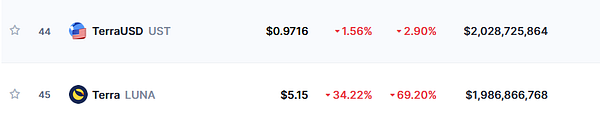

This past weekend for stretches of time, both $UST and $USDN both traded at about $0.95 on the dollar. $UST has since seemingly repegged, with $USDN pushing towards a repeg.

Terra

Terra has an ambitious ecosystem and it may be approaching the upper bounds of these ambitions. Their Anchor protocol made quite a splash when it announced a whopping 20% interest on UST. In this case, this anchor may be weighing them down.

Given that $UST is supposedly backed by $LUNA, you can see where traders may be afraid when their stablecoin flippens its reserves.

Believers argued UST’s backing is more complicated.

At any rate, traders were understandably concerned.

Thankfully, as of this morning UST appears to have regained its peg.

Neutrino

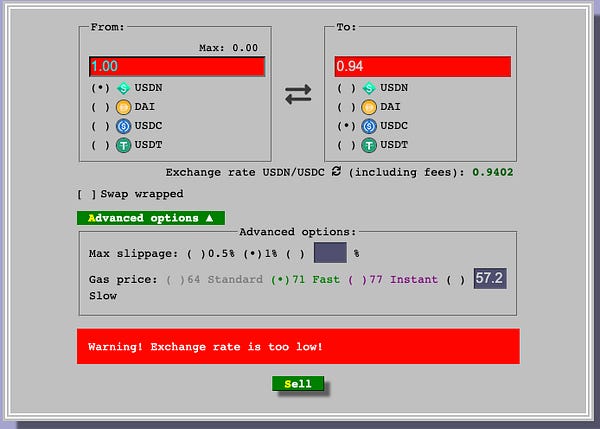

Meanwhile Neutrino had also promised aggressive yield, and was also backed by a non-pegged crypto asset. Seeing a pattern?

You can guess what happened to $USDN amidst the chaos.

Again though, proponents argued its backing is more complicated.

USDN is also recovering somewhat, back to $0.98 on the dollar as of publication. Since sitting in USDN pool also earns you interest rates above 7.5%, it may be the case that on balance you still come out ahead. Next time you may not be so lucky though.

The Downside

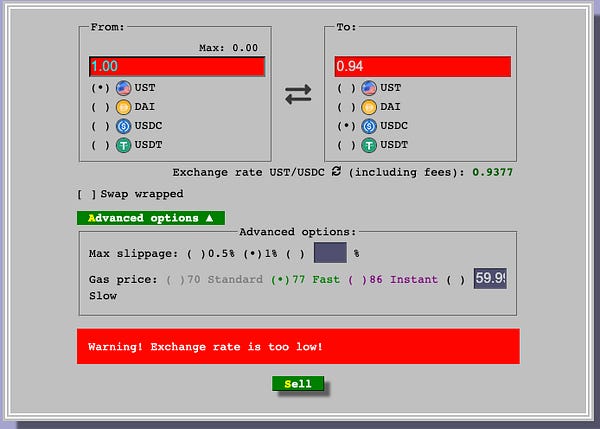

If you were in either $UST or $USDN, Curve’s phenomenal architecture priced these assets efficiently, meaning no ability to escape. If you had tried to withdraw for any dollar assets, you had to accept a discount.

If you tried to withdraw $UST or $USDN you can get a “bonus” in the form of a less valuable asset.

If you expected these assets would regain its peg, then you might have withdrawn just to claim the bonus and come out ahead. Or just waited it out in the pool and hoped it smoothed out.

Some users indeed were betting that the peg would recover and buying up the disounted assets.

If you feared the death spiral to zero, then you may have rushed to get out before it dropped further.

We’ve seen in the past other failed stablecoins don’t generally go to zero, but can drop to very low values.

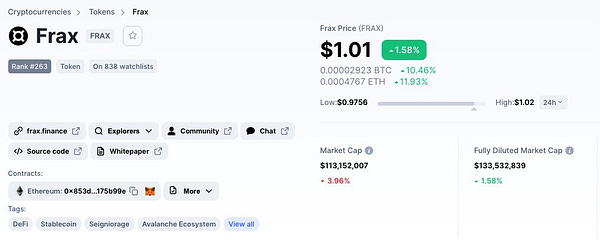

Thankfully, this potential depeg has only hit two Curve pools so far. Other Curve pools are taking the opportunity to call out competitors.

It’s a great lesson that if something in DeFi appears too good to be true, it may in fact be too good to be true.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a Curve maximalist, and has a small stake in the $USDN pool.