May 4, 2021: FROYO YOLO 🍦🍨

Curve Fork Stablecoin AMM launching on Fantom

You can almost feel alt-season around the corner. And what better way to celebrate the changing seasons than a cold refreshing treat.

The announcement of FROYO Finance, an unauthorized Curve fork, had absolutely nothing to do with Curve, but it redounds to the benefit of veCRV holders so what the heck. Let’s roll with it!

Of course, Curve famously launched on Fantom already, where it generates healthy activity in the range of $5-$10MM daily volume. Additionally, the two Fantom Curve pools provide an effective base APY of about 4.5% at the moment, which is only incentive because Curve’s Fantom branch does not offer rewards at the moment.

Enter FROYO. Per their launch announcement, FROYO exists to resolve “community’s plea for incentivized liquidity for Curve pools.” This will come with a new token, $FROYO, designed to function with liquidity provider fees and a locking mechanism much like $CRV.

Similar to the Ellipsis $EPS rollout, they will also be taking a snapshot of veCRV holders and distributing the token weekly in an airdrop over the course of a year. Like the $EPS airdrop, the $FROYO airdrop will include a 3 month vesting period with a 50% early exit penalty. In total, 25% of the 1,000,000 supply is earmarked for vCRV holders.

It’s clearly too early to say exactly how this $FROYO airdrop will play out. In the early days of the $EPS airdrop the hype was insane, but the frenzy died down as the absurd 2000%+ published APYs calmed down to a humdrum 600% APY. In hindsight, the dominant strategy would have been to claim the airdrop and sell immediately, then buy back into $EPS if you like after their price dropped to the $2 range.

Pleasantly, Ellipsis has also beefed up some of its fundamentals since launch. They’re up to 5 pools and have held their value despite BSC suffering some growing pains.

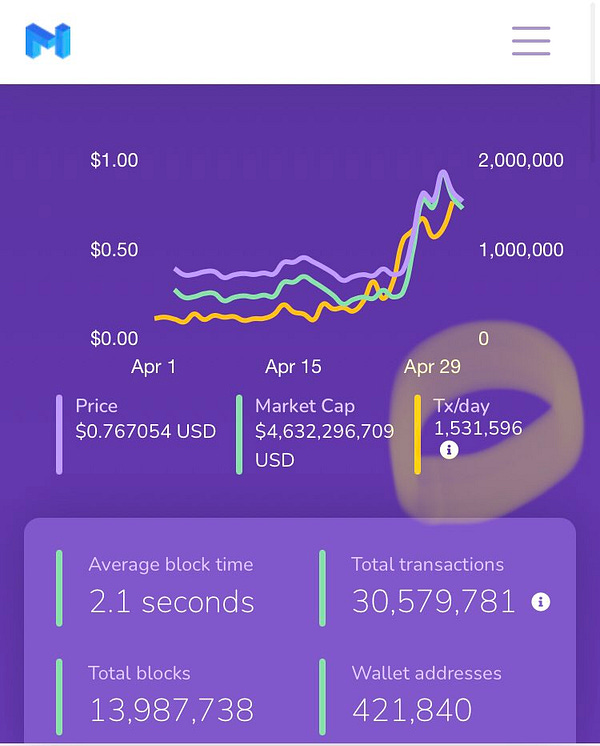

Whatever your expectations for this airdrop, you may temper them somewhat by noting that Fantom is quite a bit smaller than BSC at the moment. Fantom has about half a billion in total value locked on their entire chain at the moment per Defi Llama, while Ellipsis alone has over 5 times that, to say nothing of BSC more generally.

An additional factor that could temper the effects of $FROYO relative to $EPS is the effect of airdrops on taxes for US users. If the opportunity is judged to be smaller, US users may prefer waiting this one out to avoid constructive receipt.

That said, we’ve seen smaller sidechains have major growth potential if they can attract users. We’ve seen incredible activity on Polygon over the past few weeks, as an explosion of blue chip DeFi protocols has driven intense demand for $MATIC.

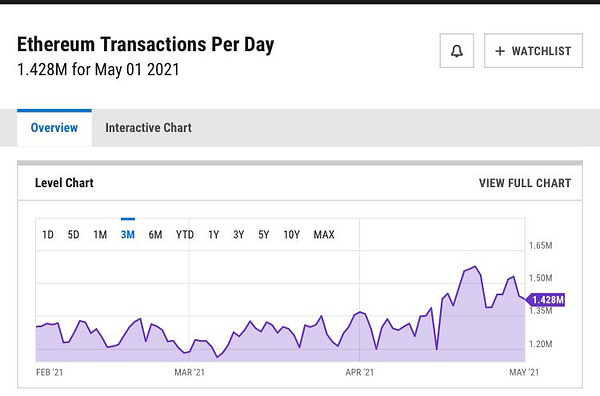

With Ethereum gas prices again skyrocketing (in terms of USD, not gwei) and additional building on Fantom, perhaps we’ll see a similar explosion of interest. At any rate, $CRV holders are clearly excited about the upcoming launch of $FROYO.

Do you have any long-form features about the crypto space you’d like us to feature? We have some scheduled off-days coming up and want to use the opportunity to feature intelligent analyses of the cryptocurrency space and/or the Curve ecosystem.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist, owns no $FROYO or $FTM.