May 5, 2021: Cross Examination 🐳🦐

Curve's record cross-asset volume saw whales dumping ETH for USD

Much like every month, it’s been a wild month in the crypto markets. Ethereum ran up heavily against Bitcoin. Dogecoin became the fourth largest coin as it flirts with the all-important $0.69 benchmark.

As you might expect, turbulent crypto markets are increasingly washing up onto the Curve + Synthetix cross-asset transactions.

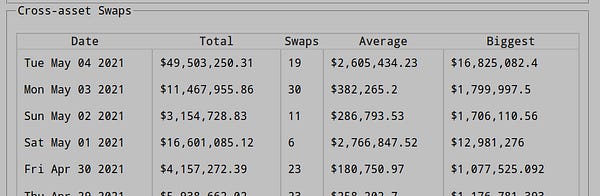

After a bit of a dip last month, transactions ticked up throughout April. Yesterday’s wild $50MM day pushed activity to record heights.

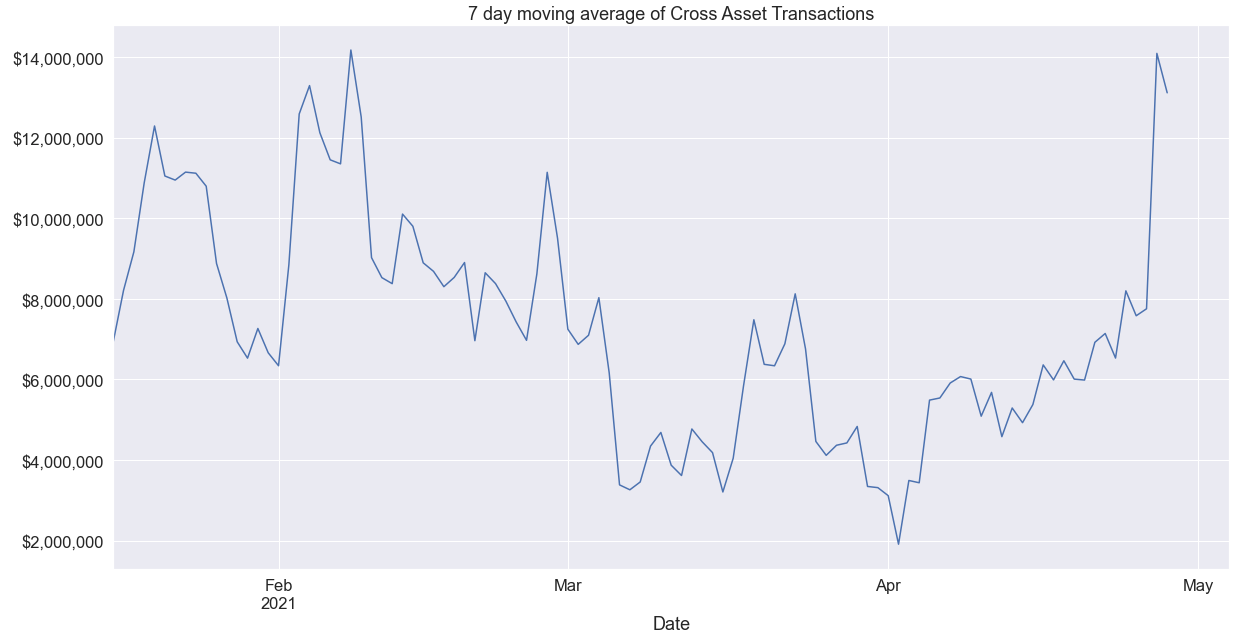

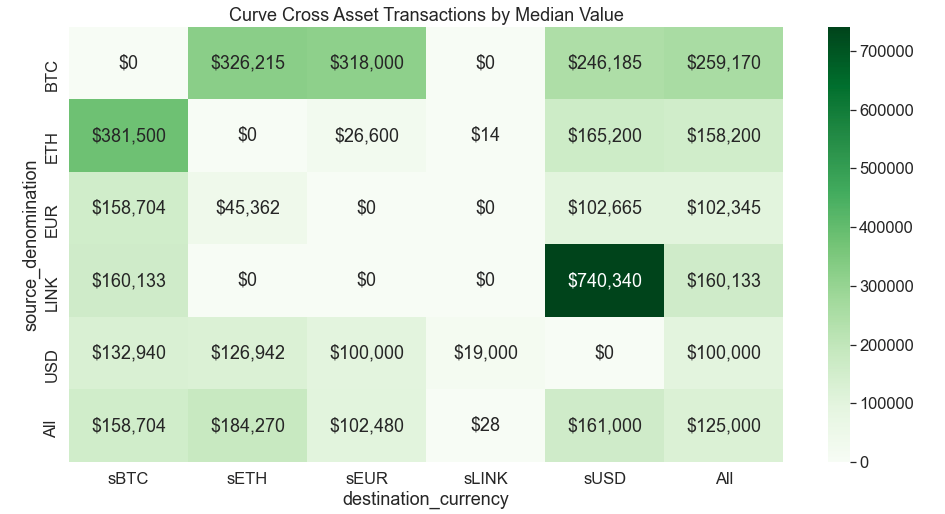

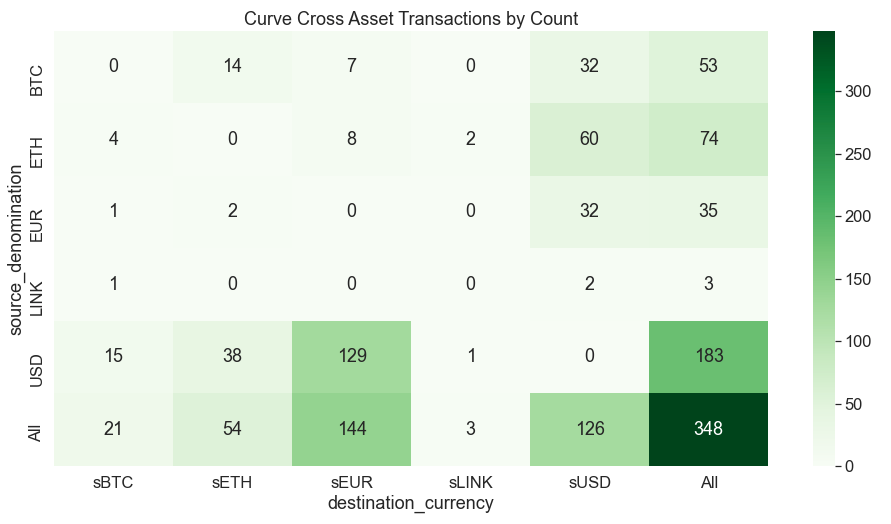

Every month we try to take a look at the activity to better understand the action. In March users moved out of BTC and into ETH + USD. Before that we saw heavy USD sales. This month, here’s what we saw:

ETH to USD (whales 🐳)

Over the past month, the bulk of the value transacted was users selling Ethereum into sweet greenbacks. Of nearly $200MM we tallied, $118MM ended up in dollars, a 60% majority.

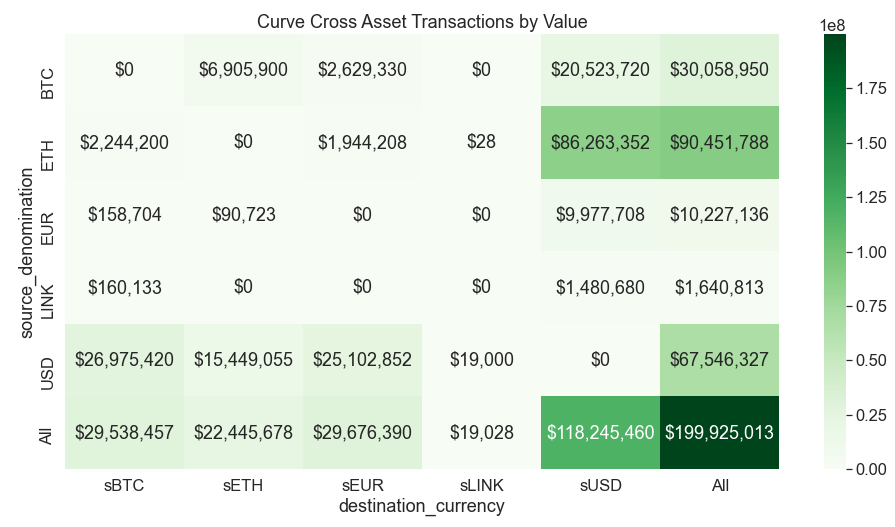

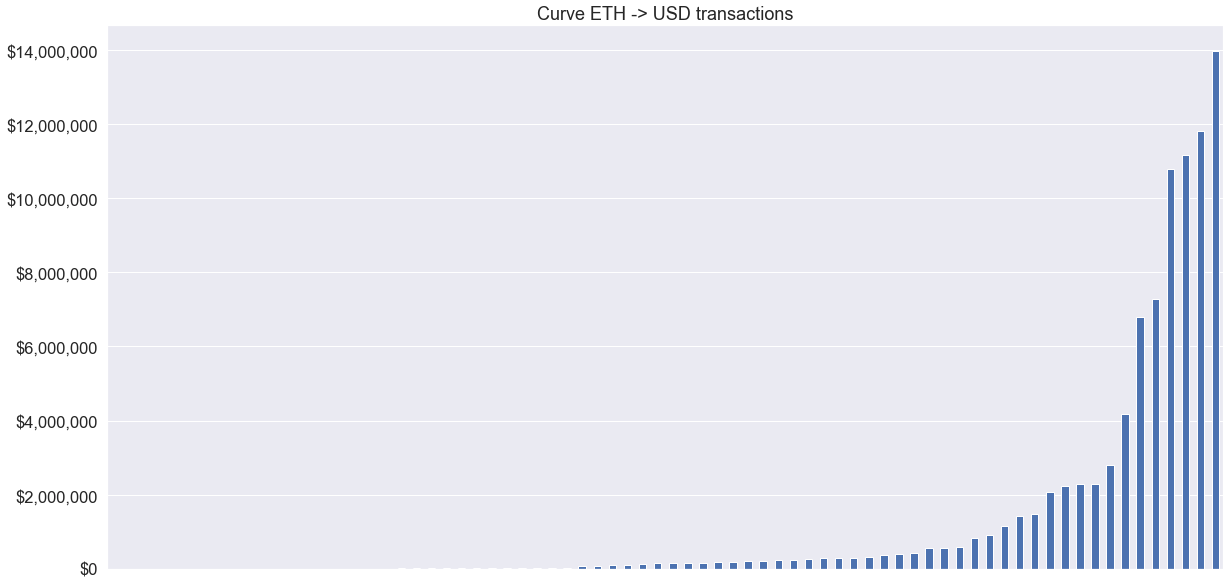

Now to be clear, this is absolutely the effect of a handful of large whale moves. Consider the distribution of these specific transactions by amount.

A few whale transactions of over $10MM apiece weighted this pretty heavily. In fact, if you look at the median transaction size, ETH to USD hardly shows up.

Physically and figuratively speaking, we can’t just throw whales out with the bathwater. Whales are people too… or mammals at very least. If any blockchain detectives want to go whale watching, here are some of the big ones to keep an eye on:

A biggie from three days ago

Possibly they’re trying to sell high on Ethereum’s massive price run. Or perhaps they need cash so they can buy the next big coins.

SELL USD (shrimp 🦐)

Although USD was the destination of choice for whales, the bulk of the activity among the peasant underclass was to sell off USD. $67MM in value left USD for BTC, Euros, and ETH (in order of total value). These tended to be relatively small transactions. The median sale was $100K, hardly enough to buy a roll of toilet paper these days.

As you might expect, this meant a large number of moves by raw number of transactions. Indeed, over half of all transactions involved selling off USD.

Which brings up the next notable trend.

BUY EUROS

We often see a large subset of people moving relatively smaller sized sums between USD and Euros, and in this case the balance was heavily towards buying Euros. Almost nobody sold off Euros over the past month (35 transactions), while 144 transactions involved purchasing Euros.

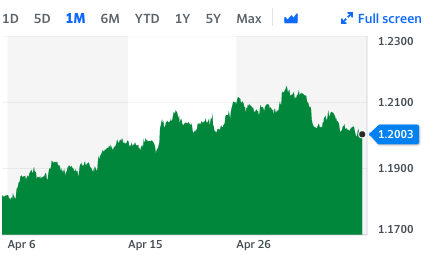

It’s possible this is simply due to macro trends. Over the past month the Euro has been rising steadily as the United States embarrasses itself on the global stage.

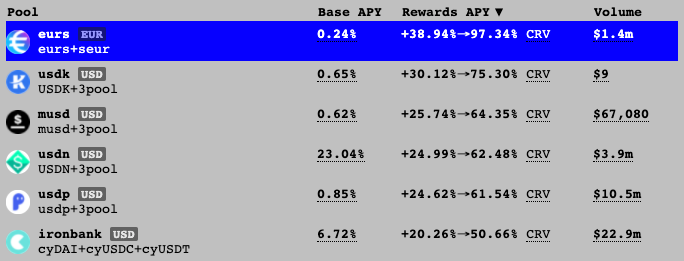

Another plausible explanation is simply that users want that juicy $CRV, the token that keeps on giving. The Euro pool is by far the best place to stake your money if you want to max out rewards.

Did you catch any trends we missed? Share your analyses in the comments!

Do you have any long-form features about the crypto space you’d like us to feature? We have some scheduled off-days coming up and want to use the opportunity to feature intelligent analyses of the cryptocurrency space and/or the Curve ecosystem.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist, owns some BTC, ETH, USD.