Help us share this thread on 𝕏

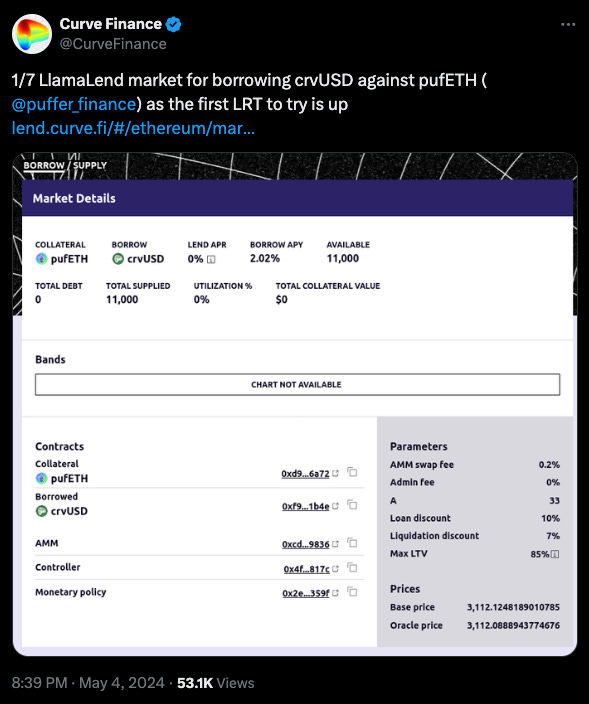

Welcome to the new $pufETH market on Curve Llama Lend.

Launching new markets onto Curve Llama Lend is fully permissionless, (we provided a tutorial immediately after the launch), but just because anybody can release their own market doesn’t make it a good idea to.

At minimum, it requires a liquidity pool with a modern price oracle that can be utilized. The pool should also be sufficiently large for better performance.

For cases where this might break down, check out this article recapping what happened when the $FXN pool on Arbitrum had <$100K in liquidity, relative to $4.5MM on mainnet:

April 15, 2024: Game of Drones 🕹️🚁

There are days where decades happen… Over the weekend, a performative, slow-motion drone swarm in the Middle East mercifully caused little real world carnage. The real collateral damage was to the prices of cryptocurrency tokens (excluding resilient memecoins).

We don’t strongly follow the LRT wars, because our article on the subject didn’t do numbers, which we interpret as a relative lack of reader interest in the subject. This is pretty much the last time we looked into it:

February 7, 2024: Double the Stakes 🃏🎰

Perhaps you noticed that the newest narrative is no longer just ETH staking, but now ETH restaking. With Eigenlayer cracking $4 billion in deposits, a variety of services are scrambling to dominate liquid Eigenlayer staking in the same manner that Lido dominated ETH staking. The only thing growing faster than the entire Liquid Restaking market is the …

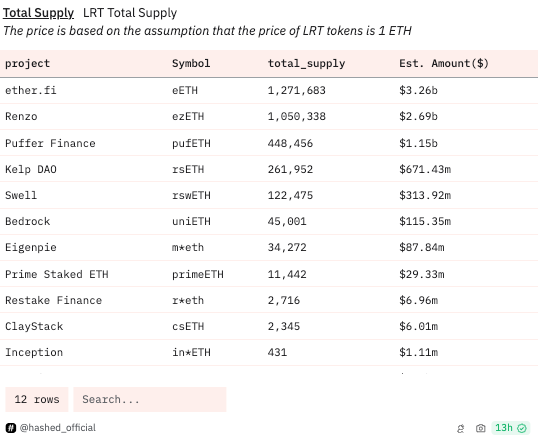

Since February, it seems the market has generally cooled towards LRTs. The overall chart is showing a bit less of the “hockey stick” and more of a levelling off. Perhaps crypto is onto the next narrative?

Among the LSTs, Puffer continues to rank strongly, 3rd place with $1.15B.

A healthy percentage of this sits in the Curve pool, making it a good candidate for Llama Lend.

The pool has been a major success for Curve. Among the top pools by TVL, pufETH is third!

Incidentally, Curve’s top five pools by TVL have just 0%-2% rewards tAPR. In a sane world, this would refute and mute the most banal concerns of the “death spiral” army. Yes, incentives can drive liquidity, but other properties make it sticky.

$pufETH stands out as the only pool here not earning Curve rewards, (although a gauge vote was approved to a different pool back in February.) The craze here is being driven by points. We’ll see what happens this week when they launch mainnet…

As for the Llama Lend $pufETH market, it’s definitely too early to say how it will perform.

The market was created based on simulations from the $ezETH depeg a few weeks ago.

April 24, 2024: $ezETH Come, $ezETH Go... 💥📉

We’ve historically been a bit wary of LRTs and generally stayed away from discussing them often. Mostly for the very petty reason that our only article on the subject failed to do numbers and we’re still salty… We chalked it up to the fact that we assume most of our readers intuitively seemed to grok that a photocopy of a photocopy might tend to lose fi…

This turned into some simulations that showed off how it lossy an LRT might be given a range of values for the “A” parameter.

You can observe losses are at their lowest with A around 33, which is exactly where the market ended up. In total, the market sports a max LTV of 85%, not too bad for degenerate gamblers…

It also inspired a governance vote for a tweak to the exponential half life.

However, we won’t know for a bit. In Llama Lend, TVL is still chasing incentives. The pools with emissions hooked up have six to eight figures. The WBTC and pufETH pool have only $10k apiece.

Another gauge vote will probably go through, maybe next week if it passes.

So, you’ll have to wait until then… in the meantime, here’s a great read on Llama Lend and what it’s done to the Curve ecosystem: