First, a Moment of Zen

This response was perfectly acceptable, and we’d fight anybody who says otherwise…

Asymmetric Returns

A miniature case study about our friends at Asymmetry Finance, who recently completed a token generation event for their $ASF token. They worked with Arrakis Finance, a liquidity management well known for managing JIT liquidity on Uniswap v3.

The launch was a success by standard metrics. The token actually enjoyed 17% more buy pressure than sell pressure in the wake of its launch. Yet the community was aghast to see that the token was collapsing in value.

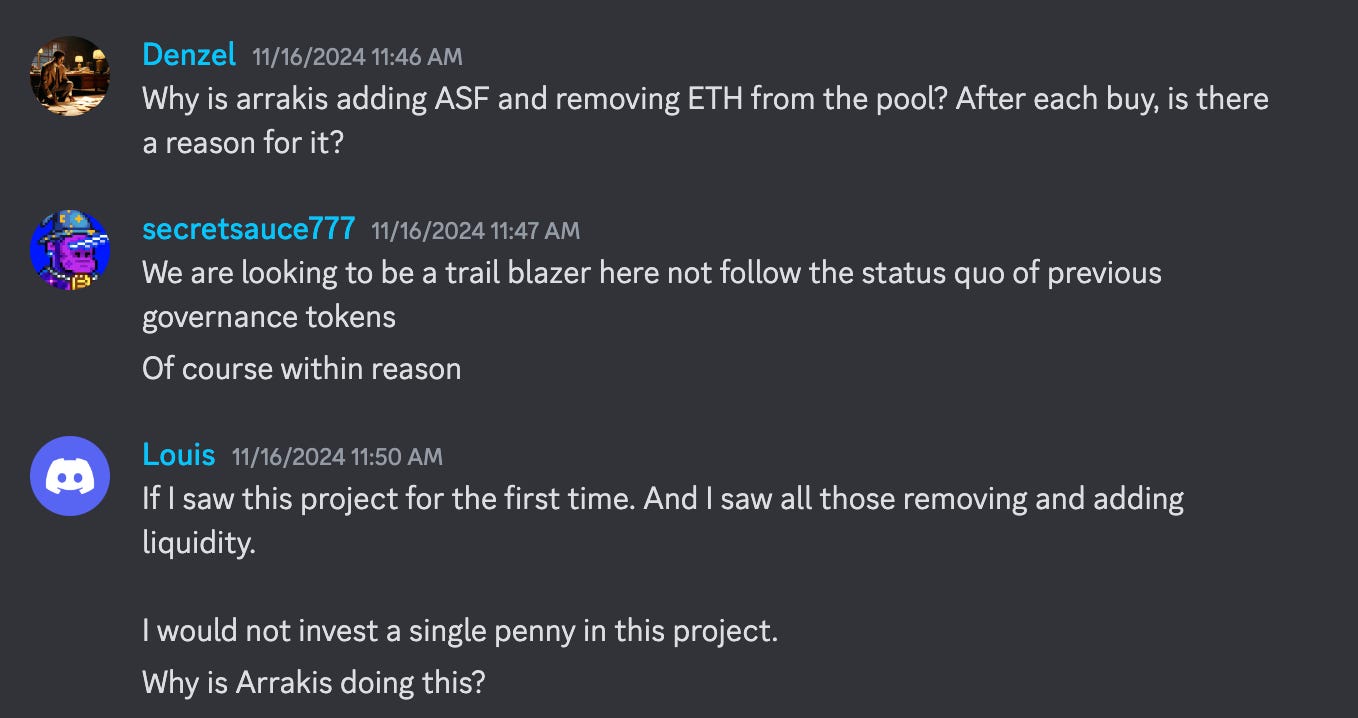

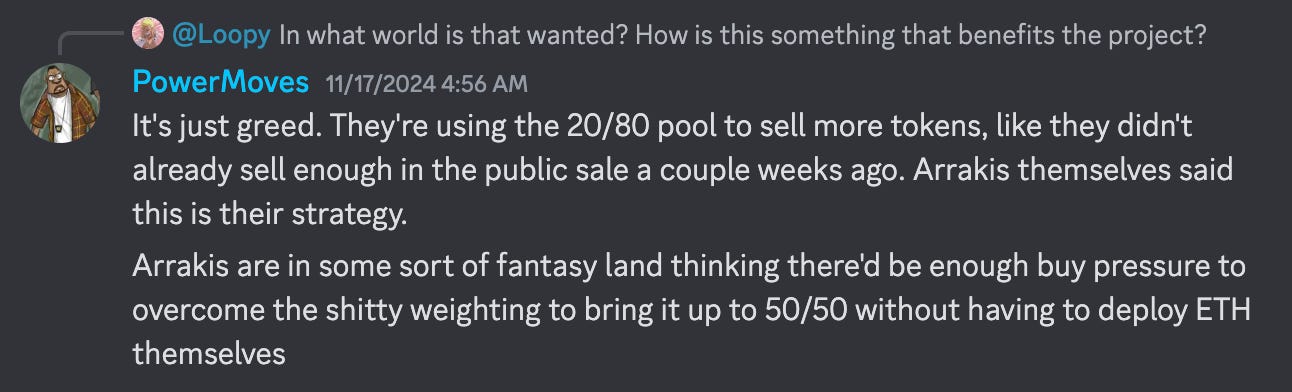

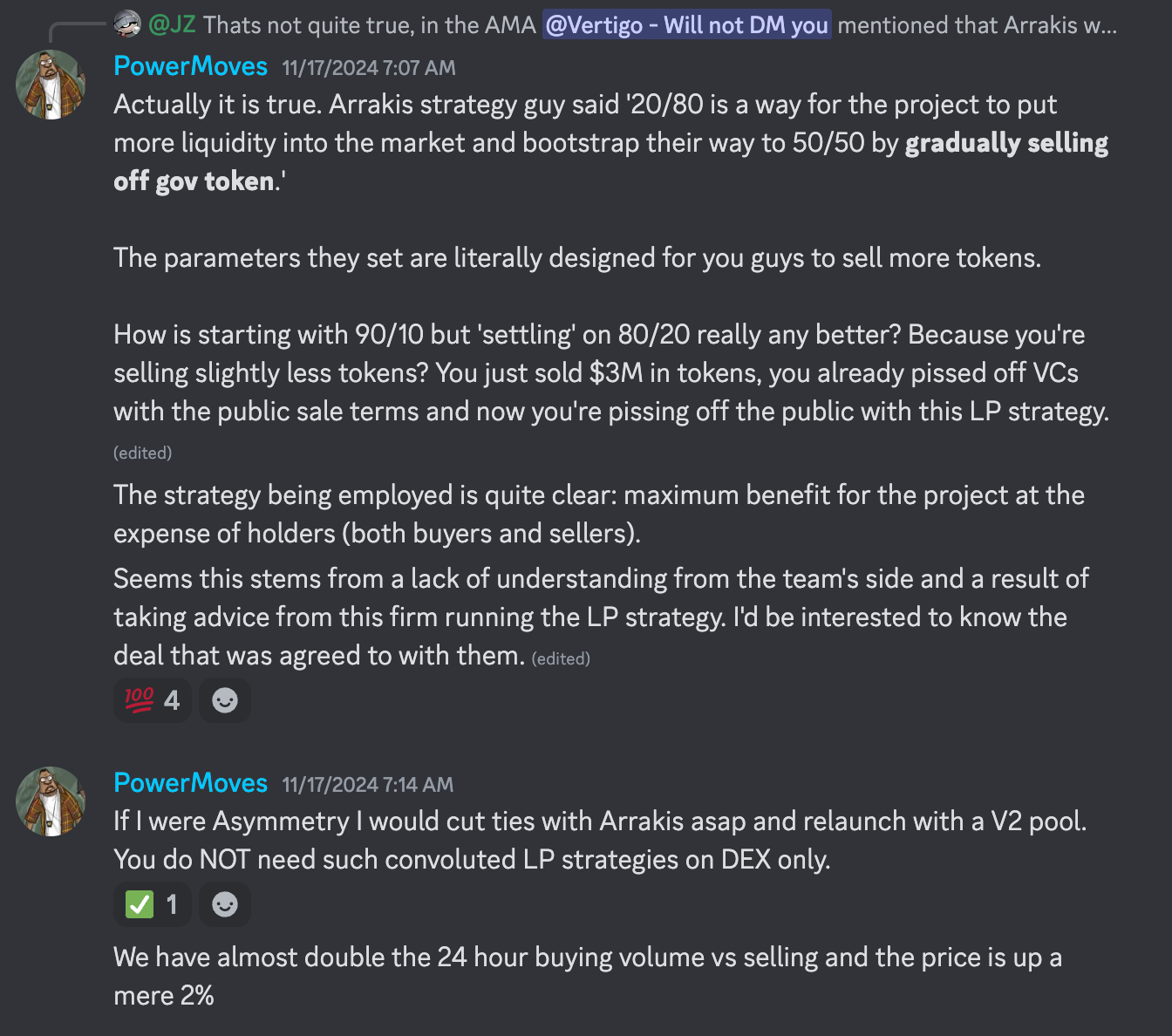

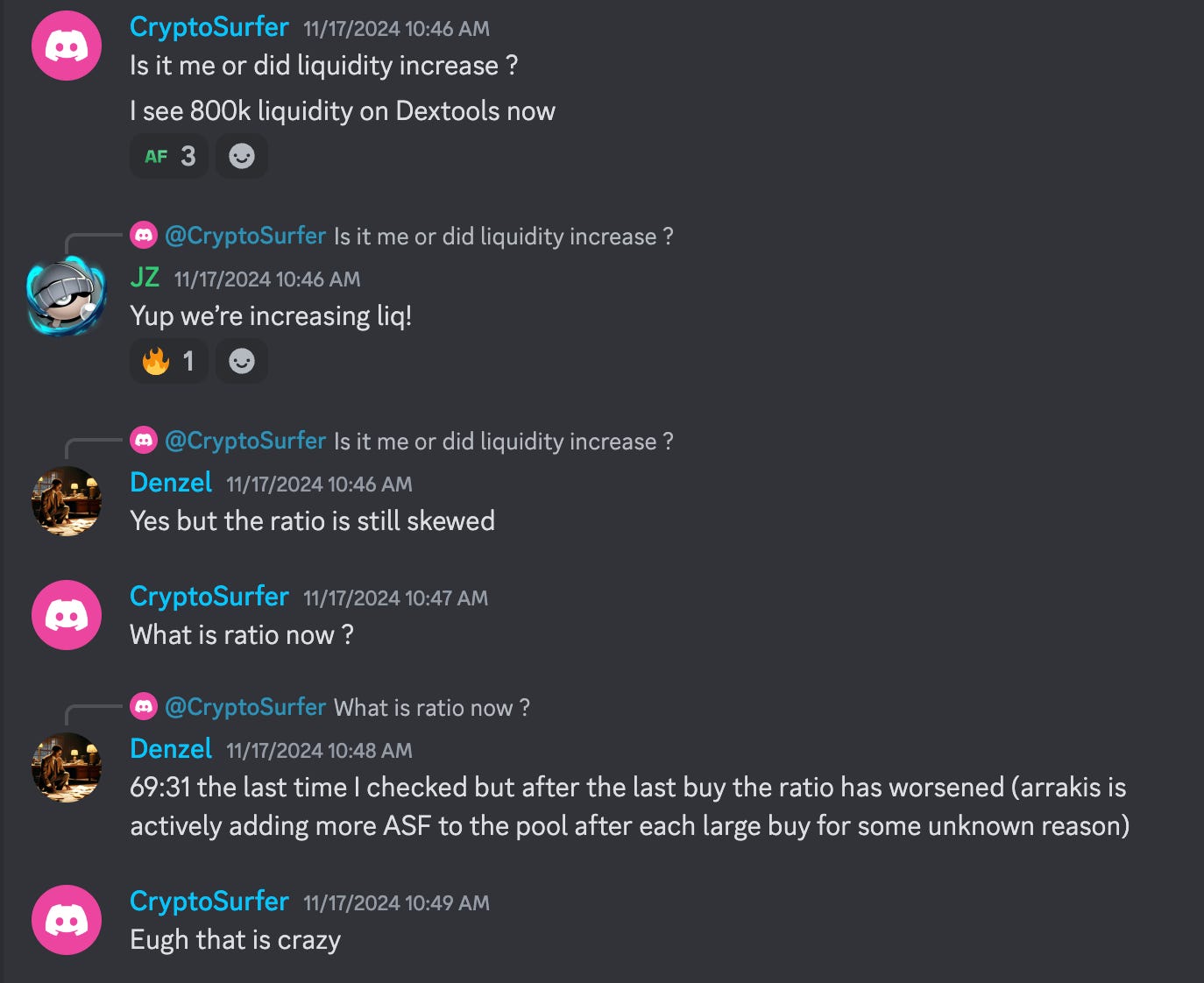

They noticed that Arrakis Finance was adding $ASF into the pool following every major buy, because their liquidity was structured as a 20/80 pool.

The calls quickly came in to jettison Arrakis, and the team responded quickly.

The debate also spilled over into public on 𝕏

Arrakis stepped in to defend themselves

Ultimately, the team gave up and moved liquidity to a Curve CryptoSwap pool.

The token would enjoy rising fortunes in its new Curve pool from this point forward.

The community rejoiced and celebrated internally.

The celebration would pour over into the public square.

The team would open up the new pool, already a success in many respects, to a governance vote to receive $CRV emissions.

Lessons

Liquidity management is a difficult game, particularly during the sensitive launch period.

In this case the managed 20:80 strategy proved less palatable than a Curve CryptoSwap pool that did not place its thumb on the scale.

In defense of Arrakis, perhaps the 20:80 strategy would have been seen as preferable under different buy/sell circumstances. In the past we’ve seen cases where tokens opted to launch primarily using a Curve CryptoSwap pool and suffered extraordinary sell pressure, and the community would direct blame at the nature of the CryptoSwap pool instead of the project’s garbage tokenomics.

Ultimately, our view is that trying to artificially compel the free market in an unnatural direction is a bit like pushing on a rope instead of pulling.

Figue from Paladin described his recommended strategy at Stable Summit, which is one primary pool on Curve and an additional pool with concentrated liquidity. Watch this short clip for all the alfa:

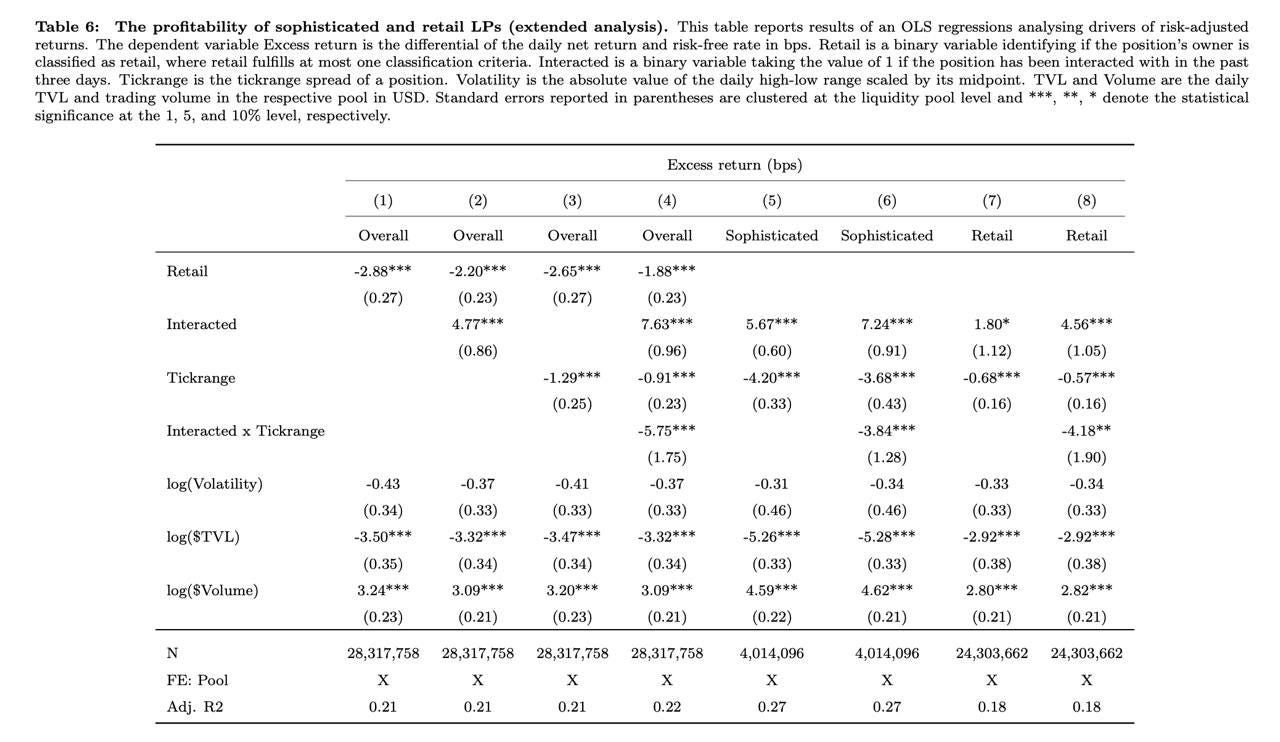

This is not simply of interest to degens, but institutions are also beginning to study how best to optimize liquidity management. Recently the Bank for International Settlements released a study on Uniswap v3, finding it was a small group of skilled participants disproportionately profiting.

When in doubt, always good to reach out to experienced veterans. For the sake of Curve, pool creation is permissionless and may be accomplished directly within the UI, but with a variety of complex parameters it can be easier to reach out to the team who can run simulations to help optimize these parameters.

For prior coverage of $ASF’s public sale and stablecoin, check out this article.

October 25, 2024: Wealthy AF 💎💰

Congrats to Asymmetry Finance, which opened its public sale for $ASF and saw quite a response.

Disclaimers! Author is long $ASF, $CRV