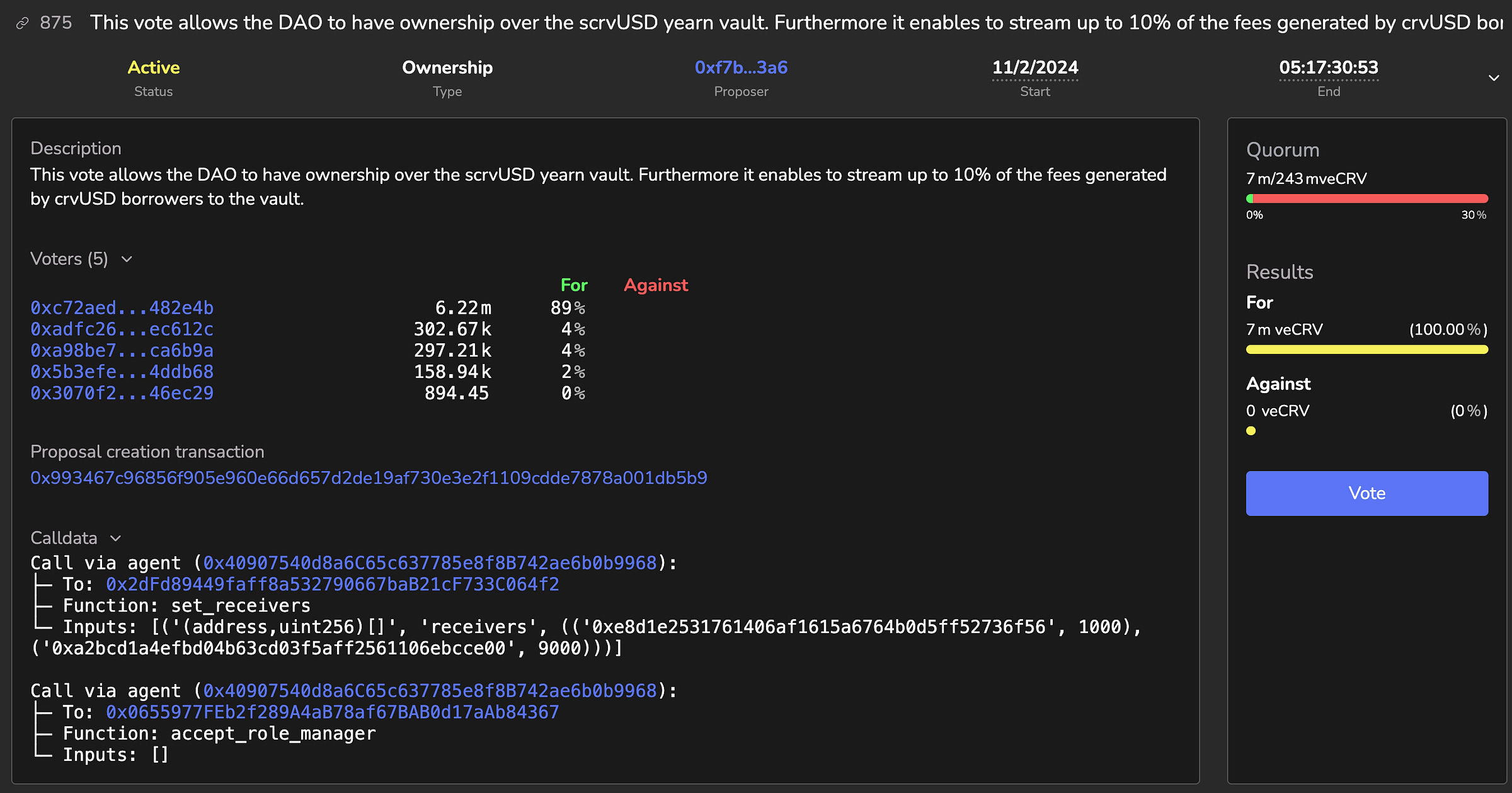

The vote is up! Vote for $scrvUSD like the fate of the free world depends on it!

If you already voted early, find 5 friends and get them to the polling booth!

Now that you’ve voted, here are some frequently asked question about what you just voted for…

What is $crvUSD?

$crvUSD is a novel decentralized stablecoin with an innovative that provides automated protection against liquidations, and arguably holds the strongest peg mechanism among decentralized stablecoins.

What does $scrvUSD stand for?

$scrvUSD appears to stand for “savings” $crvUSD, a system that allows users to deposit $crvUSD to earn native yields from the lending protocol.

How does $scrvUSD differ from $st-crvUSD?

It doesn’t! Dropping the “t” is just cleaner…

Why is $scrvUSD good?

The “s” in $scrvUSD might also have stood for “scale,” because it is intended to scale $crvUSD supply. $crvUSD is useful for Curve because every dollarcoin in existence pays interest back to veCRV holders.

A 10x in $crvUSD supply means a 10x in revenues, all else being equal. But if $crvUSD is not scaling, then there’s no revenue growth.

$scrvUSD is intended to scale $crvUSD per the not-so-secret plan laid out in public:

Why doesn’t the current system scale?

In short, $crvUSD needs more liquidity sinks.

We’ve seen the violent whipsawing of $crvUSD borrow rates as the stablecoin pushes above or below peg. More liquidity sinks have a stabilizing effect.

The occasions where $crvUSD is above peg and borrow rates plummet are generally short-lived, often in response to sudden market downturns where borrowers rush to repay loans. When this happens, Peg Keepers print $crvUSD to flood the markets with supply. Borrow rates push to near zero.

Most of the time, $crvUSD sits near the peg, generally a couple basis points under an even dollar. Many borrowers like to take out a loan, then trade the $crvUSD for another stablecoin, which pushes the peg downward slightly. The dumping continues until the system’s borrow rate naturally pushes upward to the point where no more new borrowers are incentivized to enter the system. In other words, it stops scaling.

How does $scrvUSD fix this?

One might describe $scrvUSD as lending $crvUSD to a vault in exchange for yield.

Per the prior post from Mich, $crvUSD is at a point where the borrow rate (~15%) is higher than the HODL rate (~8%) where users would be willing to simply “HODL” their $crvUSD instead of selling it.

In other words, the borrow rates are too high! However, if these high borrow rates get redistributed to $scrvUSD holders, then it creates an incentive for stakers to deposit $crvUSD for $scrvUSD. This takes $crvUSD off the market, causing borrow rates to drop. A virtuous cycle…

Would $scrvUSD replace crvUSD as a fee token?

It’s a good suggestions and certainly interesting to think through the ramifications. That said, we wouldn’t support this shift (though of course it could be voted on by the DAO and pushed through if there was enough demand)

We know from Curve’s years of paying out 3CRV that a lot of fee tokens are not collected for various reasons (gas costs, taxes, idleness, et al). For the case of naked $crvUSD, this is a good thing for the system, because it serves as a natural supply sink — a growing pot of $crvUSD is not sold, therefore pushing the price upwards.

However, for every $scrvUSD in existence a fee must be taken from veCRV and redirected to $scrvUSD. Therefore it makes sense to be strategic about how these funds are redirected. A subsidy of this type is good if it changes behavior of users who otherwise would have dumped $crvUSD.

This clearly does not apply to the case of veCRV fees. A lot of $crvUSD is presently sitting idle and unclaimed. Switching to $scrvUSD would mean subsidizing the users who are already keeping it idle. This is an expensive subsidy to incentivize behavior that’s currently happening anyway without needing any such subsidy.

It’s possible, but unlikely, that a substantially greater amount of users would stop claiming $crvUSD rewards if they were $scrvUSD, but it seems unlikely, and anyway there is lower hanging fruit. Far better to entice existing borrowers to hold their $crvUSD as $scrvUSD. Or to encourage new borrowing for the purpose of accessing the $scrvUSD rate.

Who wins with $scrvUSD?

Potentially, $scrvUSD stakers, if they are seeking a stable source of yield. So too could borrowers benefit if $scrvUSD does stabilize borrow rates.

Another potential winner is other yield bearing stablecoins might also see interest in pairing with scrvUSD. We’ve seen lately the rise of high native trading APYs for yield-bearing stablecoins on Curve… perhaps the ability to earn a native savings rate plus additional trading APYs might become an attractive opportunity for yield farmers.

Our piece on the landscape of yield-bearing stablecoins:

October 9, 2024: StablecoinWifYield 💵🌱

st-crvUSD is around the corner! When it launches, it will join a busy field of stablecoins programmed to earn a native yield. Is a new narrative taking shape?

Finally, the hope for Curve as a protocol is that $crvUSD supply grows significantly, such that revenues to veCRV increase over the long run. If $crvUSD successfully scaled over 10x and got to a billion dollar market cap, then even if borrow rates fell somewhat, overall revenues would be almost certainly be higher in the long run.

Who loses?

The clear losers are veCRV holders, at least in the short term, who must give up some revenues to pay for this savings rate.

Wait, so why exactly should I vote for this?

The presumptive reason to vote for this would be the calculus of any investor… spend money today in the hopes of greater returns tomorrow.

$crvUSD revenue at present scale is great incremental cash flow, but hardly “life-changing” money for most readers. Doing some back of the envelope math, veCRV holders are getting ~15% APRs on ~$67MM supply of crvUSD means about $10MM per year.

Now imagine if borrow rates fell to 10% $crvUSD scaled to $1B. In this scenario, veCRV holders are earning $100MM per year, about 10x. A good investment! You are quite happy to shave a bit of fees in favor of growth.

Aha… was that Investment advice?

Cool it, Gary! The above scenarios are entirely fictitious and imaginary. We offer no financial advice of any kind on this blog. We urge all of you to consult with a registered financial advisor, and avoid cryptocurrency investments, which may be volatile.

It’s entirely possible $crvUSD doesn’t scale as a result of $scrvUSD. If so, then veCRV holders simply lose. Or, DeFi being an ourobouros, perhaps $crvUSD supply simply scales exactly to some equilibrium point, where veCRV holders break even on the deal and no further.

Or maybe it gets and you lose it all! Speaking of which, here is the related audit:

Oct. 7, 2024: Audit Trail - Fee Splitter 🕵️👣

It’s audit season! Audits for the Curve Fee Splitter and permissionless lending markets (“Llama Lend”) have been made public in the past week.

Is $scrvUSD the magic bullet that solves everything?

Quite probably no. The most likely outcome is:

$scrvUSD launches

$crvUSD TVL shows signs of scaling

Some unforeseen new obstacles emerge

Growth stalls

The community rallies to find the next solution

$scrvUSD is the next step in the process, but likely not the final step. Valhallama is much more about the journey that the destination.

All the same, $scrvUSD appears to be a clever and clear step in the correct direction. It has a clear and compelling use case, and fits well with one of DeFi’s best narratives.

We therefore urge all veCRV holders to vote yes and support the long term success of Curve!