Nov. 4, 2024: Vote for $scrvUSD! 💵🗳️

The vote is up! Vote for $scrvUSD like the fate of the free world depends on it! crv.mktcap.eth is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

It’s been a week since Curve launched $scrvUSD, and it seems that the market has flipped from fear to greed in this time.

We won’t pretend the market euphoria is entirely due to $scrvUSD, but we’re pleased to see Curve happening to ship a product into a bullish market. Curve historically had a tendency to drop new products right into the eye of market nukes.

Let’s watch what happens when you ship a product into silly season…

Soft Launch

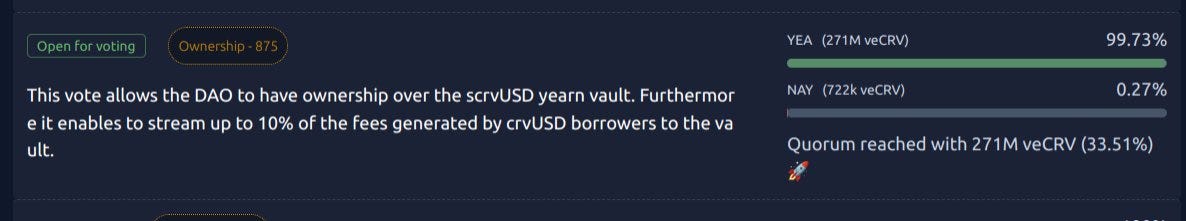

The $scrvUSD vote closed on November 6, hitting 99.73% yea votes with 33.5% of veCRV participating.

If you missed our article, a quick refresher… scrvUSD is the next evolution of crvUSD, intended to stabilize borrow rates by creating a liquidity sink that delivers a stream of up to 10% of crvUSD revenue to stakers. In other words, the yield does not come from token inflation.

Tech wise, it was rather quick to implement because it was built atop Yearn’s v3 vault, a good thread here:

No official UI is yet supported, but swift integrations by CowSwap, Odos, and an unofficial frontend created by scrvusd.xyz meant degens quickly jumped.

Thanks to the handiwork of MarcoV you can track the initial surge into the vault in the accompanying Dune dashboard.

Deposits quickly soared to $3MM where they’ve leveled off.

What has been the effect on broader markets?

Silly Season

A promise of $scrvUSD would be RATE CUTS. Would users be able to borrow dollars against their Bitcoin for just 0.001%? Not just yet, we’re afraid... rates remain sky high.

However, there’s precious little the $crvUSD system might hope to do under these conditions, which we consider to be “silly season.”

That is, users have become hyper-bullish on crypto in the past week, giving us our first taste of bull market vibes.

November 7, 2024: The Trump Pump 🍊✊

The United States has elected its first DeFi Founder to the presidency.

We see borrow rates generally are hyper-escalated, which benefit stablecoins that have exposure to borrow rates.

Ethena Labs provides a stablecoin that brings the Ethereum funding rate onchain to their stablecoins, and they’re reporting unbeatable numbers this week.

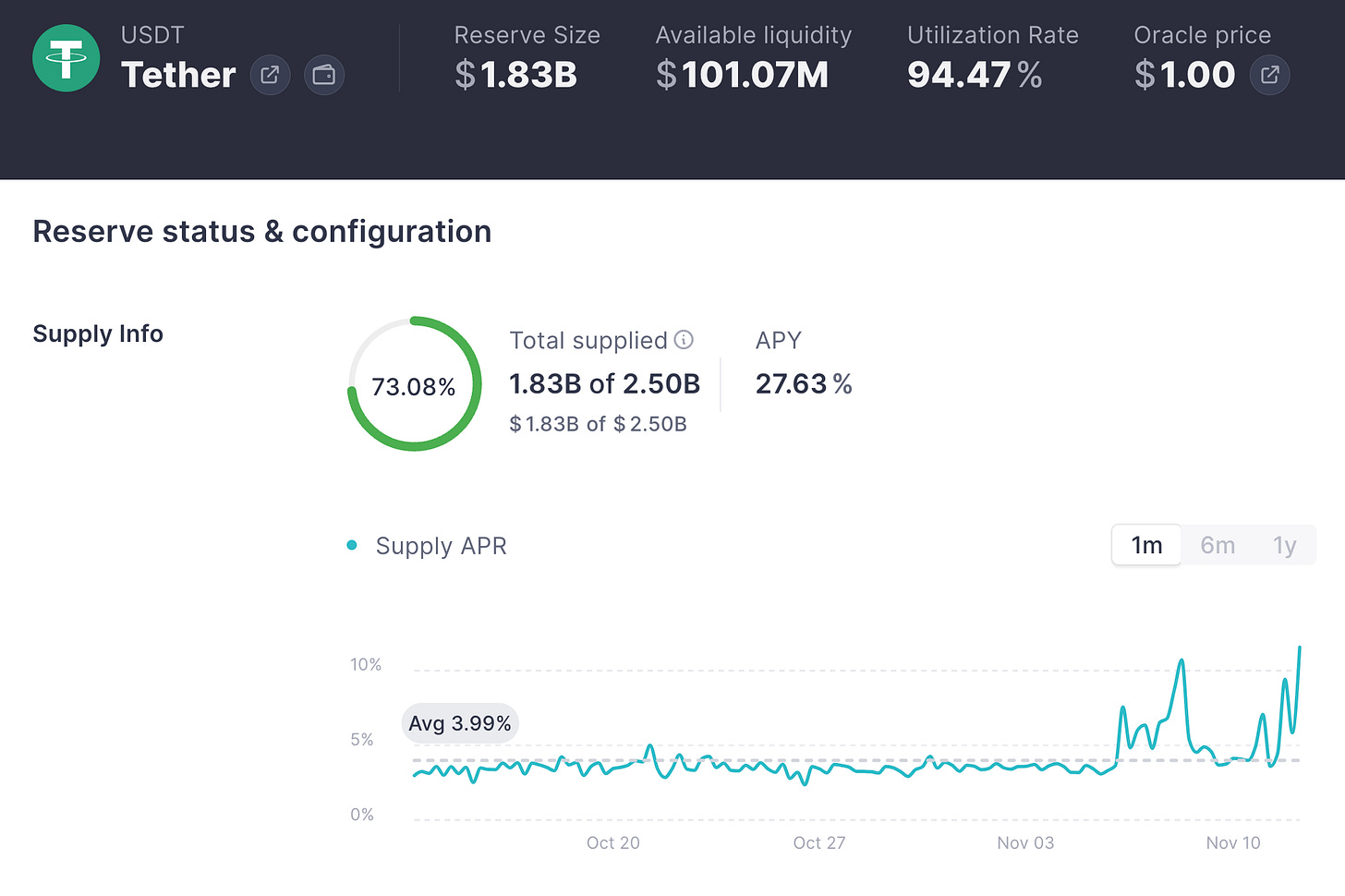

Aave’s willing to give 27% for your Tethers

When silly season strikes, double digit interest rates become the norm. Llama Lend looks relatively stingy only offering ~15% to lend $crvUSD.

Or, depending on your point of view, Llama Lend is offering relatively low borrow rates relative to the market…

Then again, we’ve seen historically that differences in borrow rates among platforms tends to be the norm in lending markets, as there is no atomic transaction traders can make to arbitrage rate differences among platforms (that we’re aware of, at least).

It becomes a useful property of $scrvUSD that users with $crvUSD have a one-stop shop to park their funds and get an aggregate yield that is quicker to converge on a market rate.

As of publication, $scrvUSD has almost $3MM $crvUSD staked and is projected to get 25%

If you enjoyed this, you may also enjoy reading about the $scrvUSD card