TRIGGER WARNING: This post contains potentially suggestive imagery, discretion is advised…

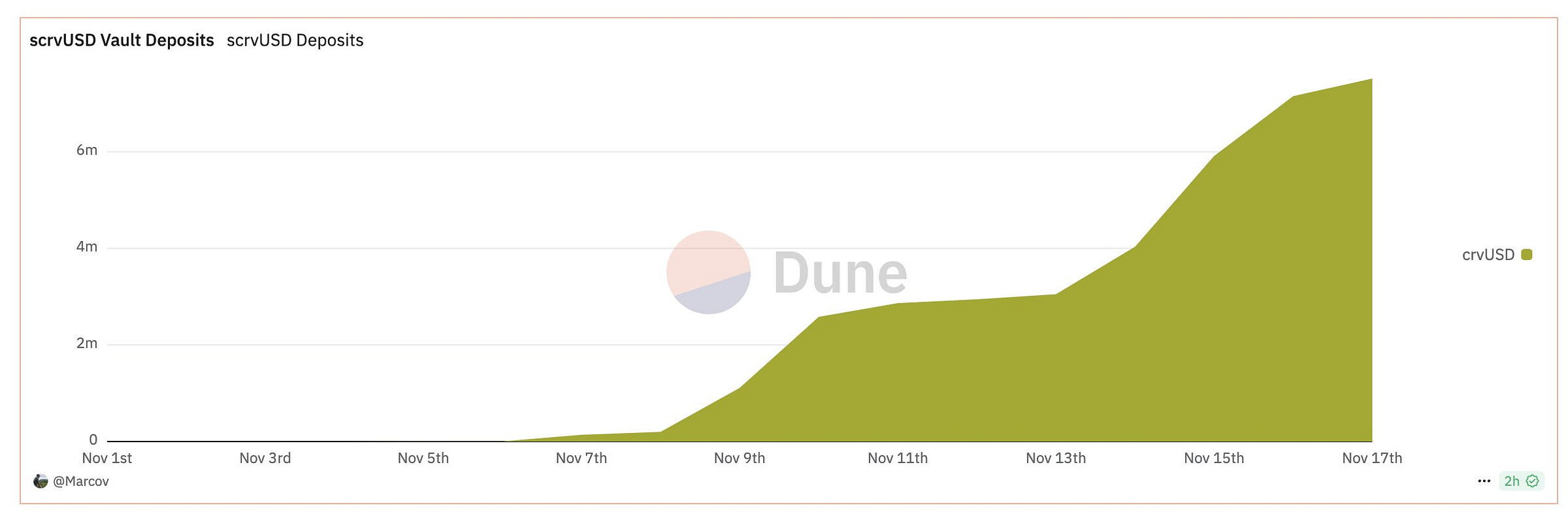

It’s been about a week since $scrvUSD launched, have we arrived at the fabled Valhallama yet? We’ve seen encouraging adoption of the vault, in that TVL has been up only…

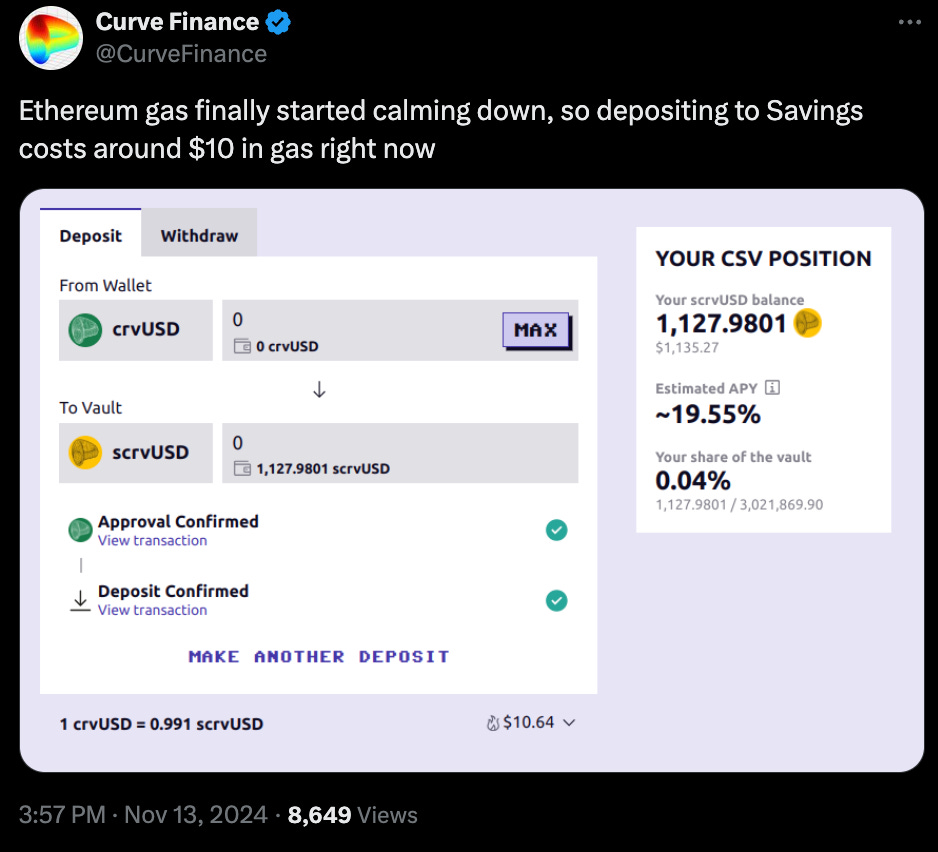

As of publication it was pushing towards $8MM and continuing to rise, with an APR of ~13%. This is a good rate for your $crvUSD, but it can also be occasionally beaten by the other major $crvUSD liquidity sink that is LlamaLend.

It’s in line for even more fees this week, so we’ll see how the flywheel spins…

At present on mainnet, nearly a dozen vaults can actually offer competitive (or better) rates than $scrvUSD for lenders.

Does this mean that $scrvUSD growth is going to plateau? Maybe, maybe not. Lending to these vaults carries surplus risk, in that lenders funds are at risk of any bad debt that may be accrued in the vault. Additionally, these APRs are likely to fluctuate wildly as activity in the pool varies, so it may require occasional juggling to make sure your APRs stay above market rate.

An advantage to staking $crvUSD as $scrvUSD is that it removes risk of bad debt, although risks still remain (for instance, the inherent smart contract risk in any new release). Additionally, while the APR is certain to fluctuate for $scrvUSD, there can be some presumption that as a key piece of the $crvUSD architecture, it is more likely to stabilize around market equilibrium.

Additionally, a “set and forget” destination is friendlier to smaller depositors who cannot afford to profitably rebalance when gas prices spike. Further aiding the smaller fish, the contracts are also optimized to be gas-friendly.

With a few liquidity sinks now in place for the Curve stablecoin, have we yet seen any effect on $crvUSD? There may be some loose evidence, in that the $crvUSD supply is up $5MM since launch of $scrvUSD, which is in a similar scale as the amount of $crvUSD staked as $scrvUSD.

Rate Cuts Incoming?

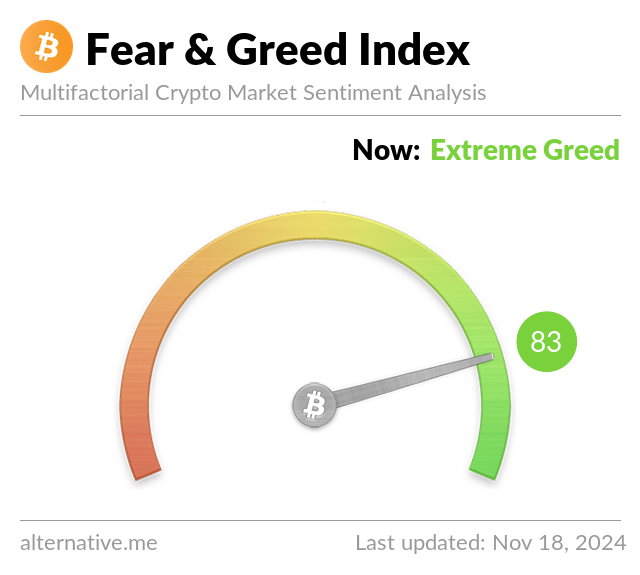

Borrow rates remain elevated, which was a pain point $scrvUSD was supposed to help mitigate.

However, this may be symptomatic of the broader market euphoria, as demand to leverage long on crypto assets is nearing a peak.

Given the incentive structure that’s been established here, there’s presently “free money” on the table for some parts of the ecosystem. For example, if you’re holding $CRV, you could use it to borrow $crvUSD at a rate of 10.72%, which you then stake to earn 13.4% — about a 3% bonus.

However, there may be enough other destinations to earn yield for $CRV that this particular strategy may have relatively less appeal:

Borrowing is not the easiest game, but thanks to a recent launch, it’s become at least a bit easier. This morning Curve released a helpful LlamaLend Monitor Bot.

Conceding to the reality that explicitly suggestive images tend to outperform on social media, the article exposes a bot that always stands at full attention. Consider it your pocket companion… one throbbing with data and excited to emit info whenever pressed just the right way. A mighty package to prevent premature liquidations!

It’s one key piece of infrastructure in the $crvUSD ecosystem, as the ecosystem continues to develop around it. We’re starting to see other pieces falling into place. The Union is developing a frontend:

CoinGecko now supports the token:

New tokens are being built and launched against it

And the first pools containing scrvUSD are starting to get hooked up to gauges

Is there reason for bullposting again?

For more background, we can point you to this research piece by DeFi Llama’s research wing:

Or the official Curve announcement:

Our prior coverage

Nov. 4, 2024: Vote for $scrvUSD! 💵🗳️

The vote is up! Vote for $scrvUSD like the fate of the free world depends on it! crv.mktcap.eth is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Disclaimers! Author holds $scrvUSD