Here comes the newest stablecoin?

Protocol f(x), on a mission to create the deepest liquidity decentralized stablecoin in DeFi, has dropped a new governance forum after rumors had been buzzing for weeks. Prepare for a potential new stablecoin.

For background, if you’ve not been following Protocol f(x), they are pioneering an innovative mechanism by which ETH is cleaved into assets with varying volatility. The lower volatility asset ($fETH) transfers most of the variability to $xETH, which serves as a leveraged long.

More background from our prior coverage:

May 16, 2023: f(x) Protocol 🧞💎

Ancient storytellers recount the legend of Aladdin, a poor urchin who fell in love with the daughter of the sultan Badr-al-Budur. With the help of a wicked magician, Aladdin retrieved an oil lamp from a hidden cave. From this lamp, he released a powerful djinn who had the power to grant three wishes.

August 30, 2023: The Strange Case of Dr. $fETH and Mr. $xETH 🎭🎩

In the dark alleyways of mainnet, not far from the bustling Curve marketplace, a tale of two tokens unfolded. The esteemed Dr. $fETH was a figure of stability in the community. With a consistent value, almost pegged, he was revered for his dependability. Many sought his company, believing he was the beacon of safety in the tumultuous world of cryptocurr…

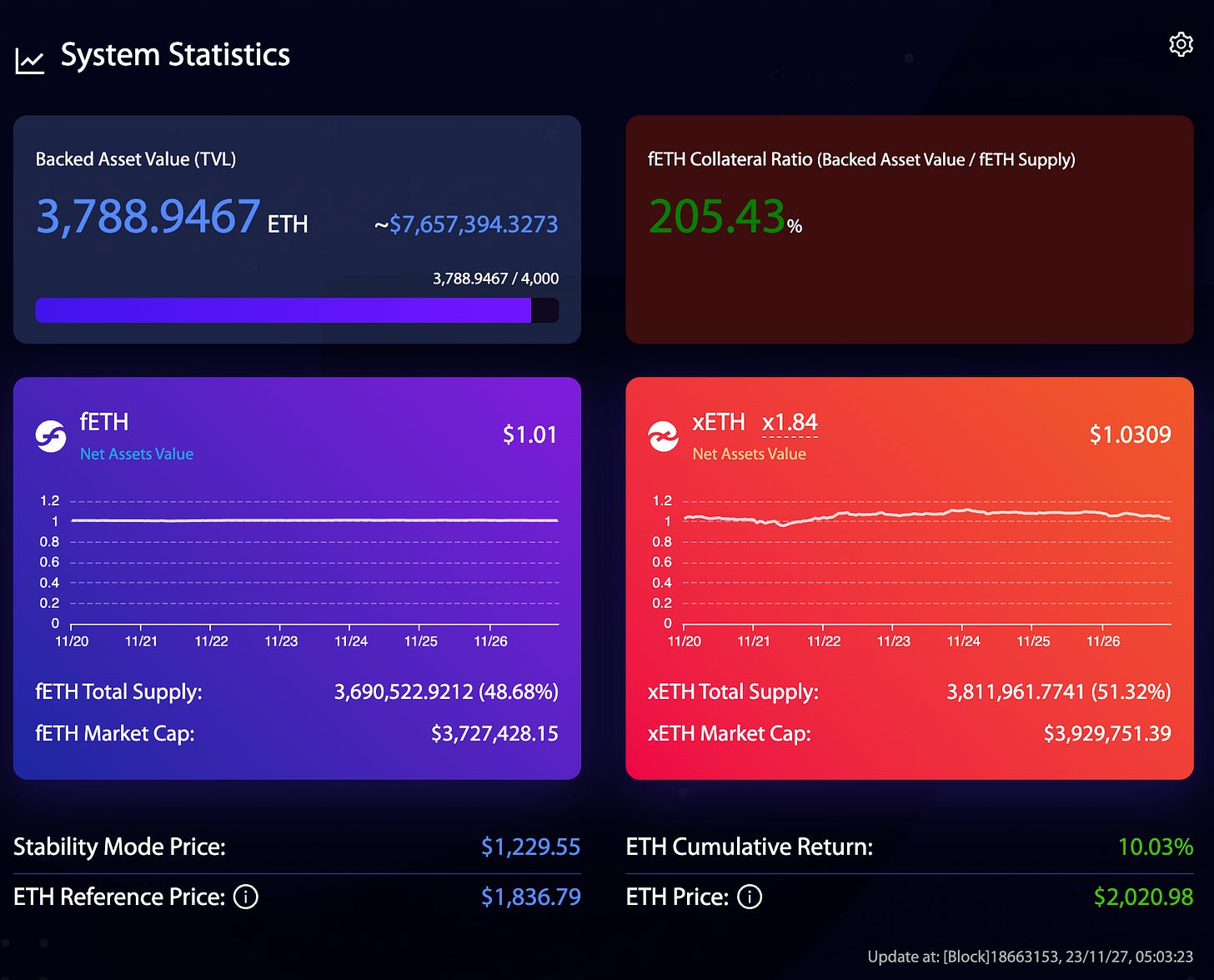

It’s been a very successful launch, now with nearly 4K ETH in their system.

One interesting nuance from the earliest days has been the slight volatility of $fETH. By transferring the volatility from fETH to xETH, the protocol has the ability to make $fETH as volatile (or stable) as the protocol likes. They arrived at a beta of 10%, with the idea that $fETH would be mostly stable but still provide some upside in the event ETH went to the moon.

In practice, $fETH has ended up as one of the stronger pegged stablecoins, thanks to the relatively stagnant market, trading currently over peg by a penny. Yet there’s still been significant demand for a pure stable. Protocol f(x) can do this simply by adjusting their system to hold a beta of 0% instead of 10%, and transferring all the volatility to $xETH.

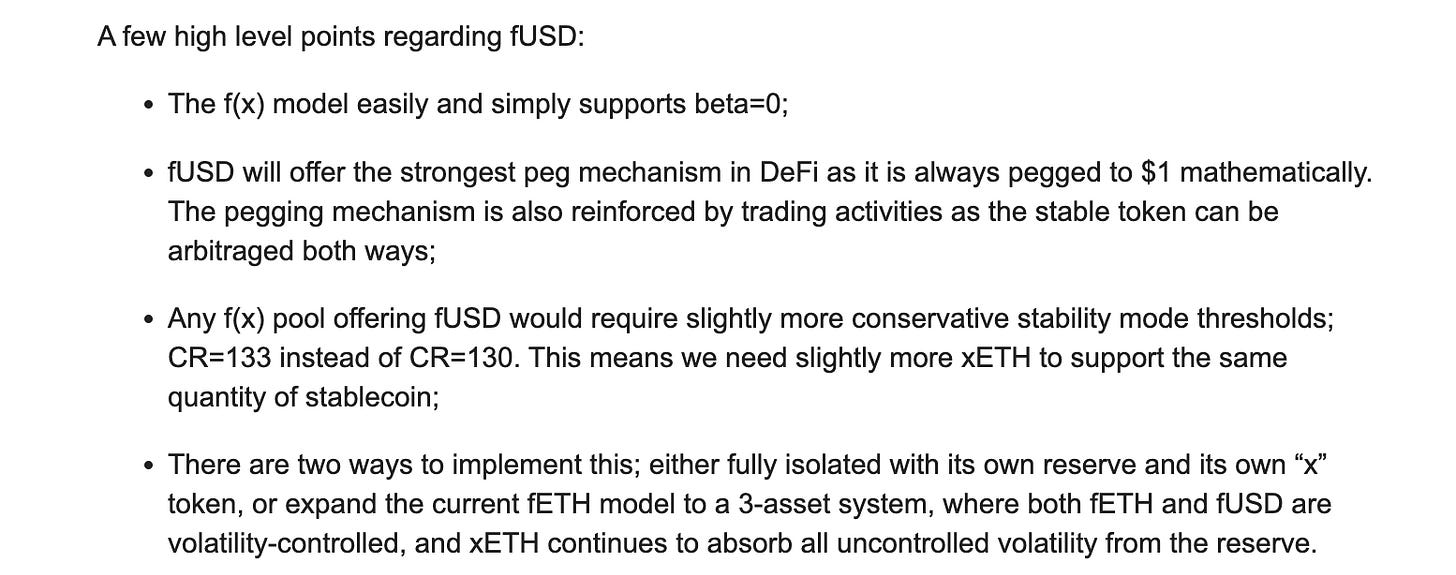

The governance forum kicks off discussion on a possible approaches to $fUSD, (the “f” of which appears to reference the eponymous Protocol f(x), not an expletive):

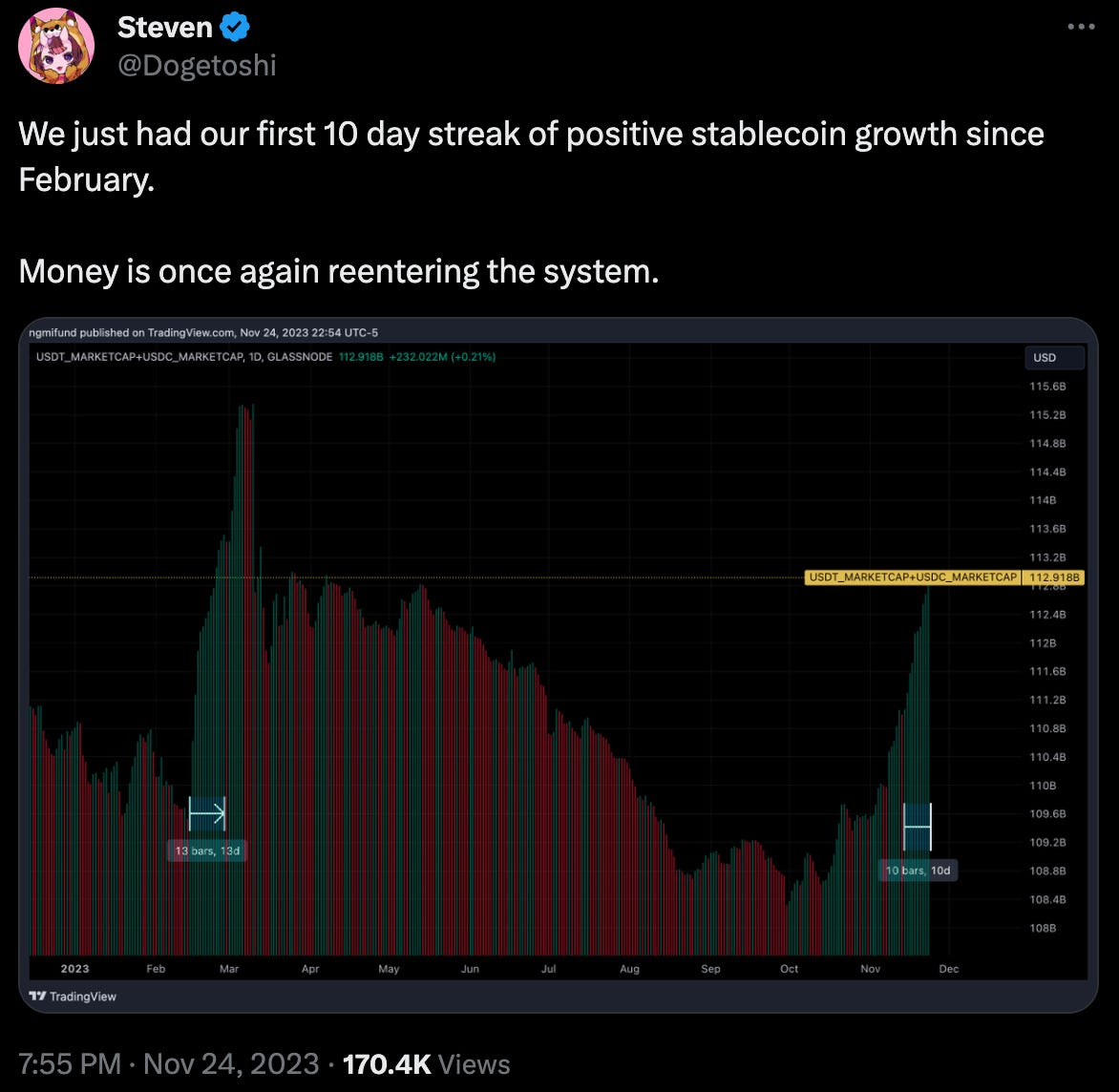

The discussion comes as stablecoin season begins to heat up again.

Most notably, the once thought dead $UST is leading the charge.

The rising tide may also be working to the benefit of $crvUSD. The better pegged stablecoin is seeing sustained all time supply highs, even with the DAO intervening to push up borrow rates.

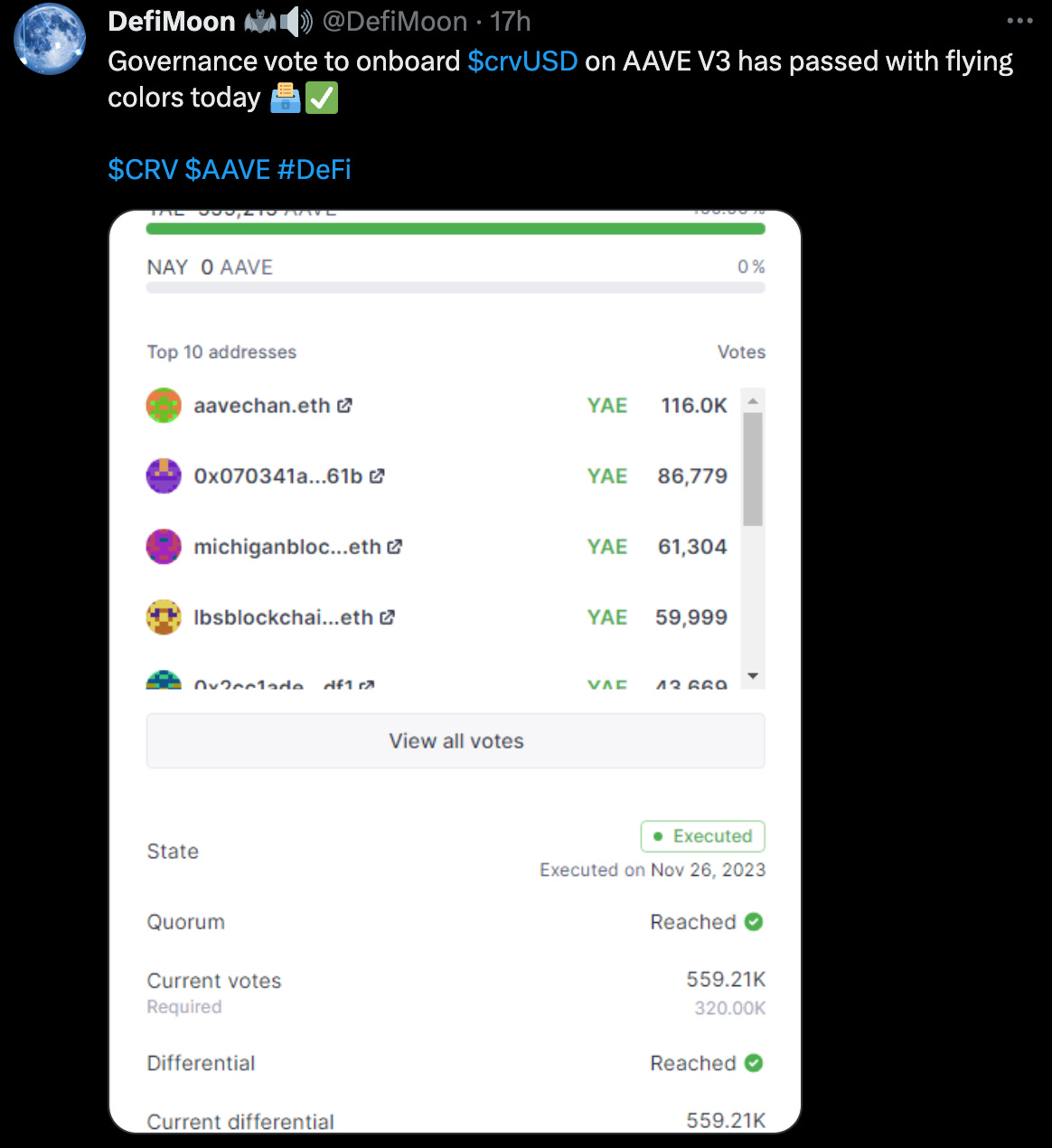

The stablecoin is also being onboarded onto AAVE v3.

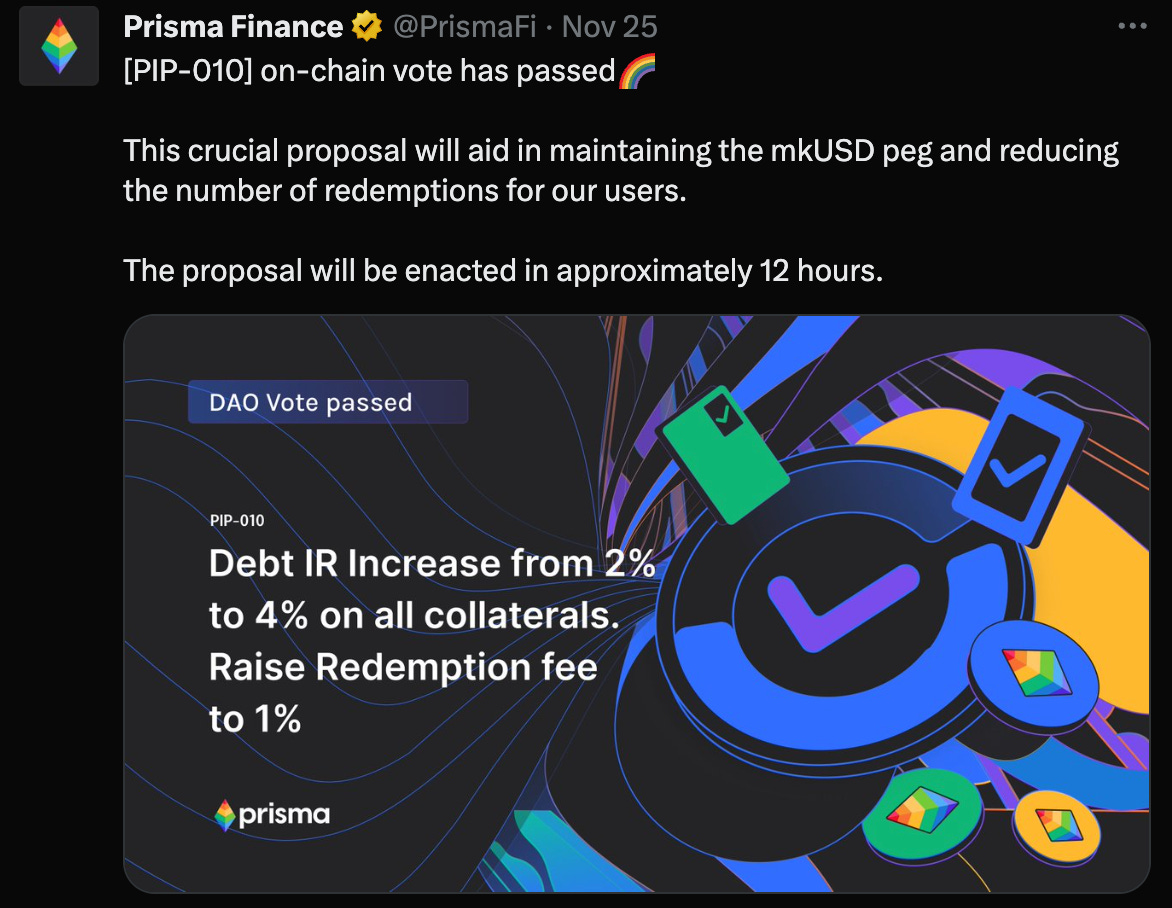

Prisma is similarly intervening to bolster the $mkUSD peg.

Prisma is also stepping up their birb game.

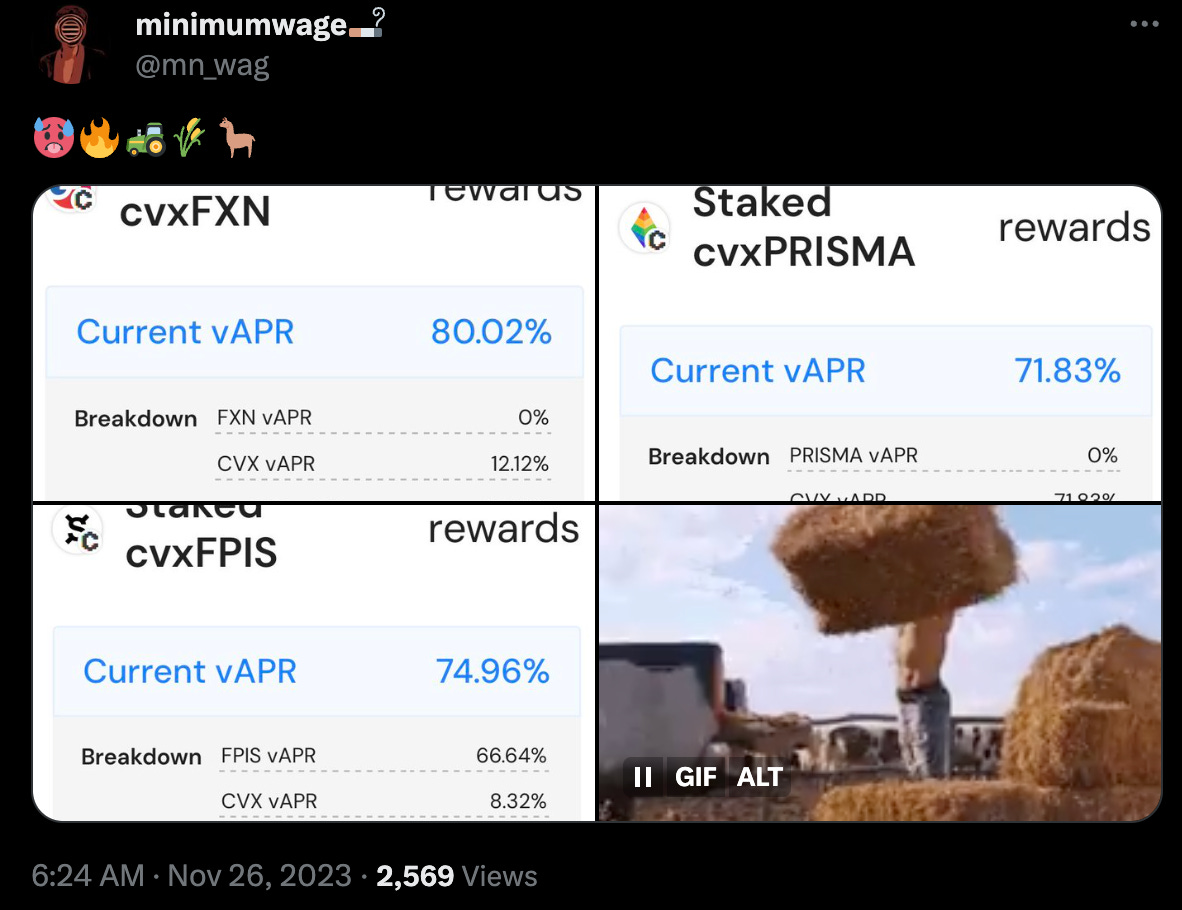

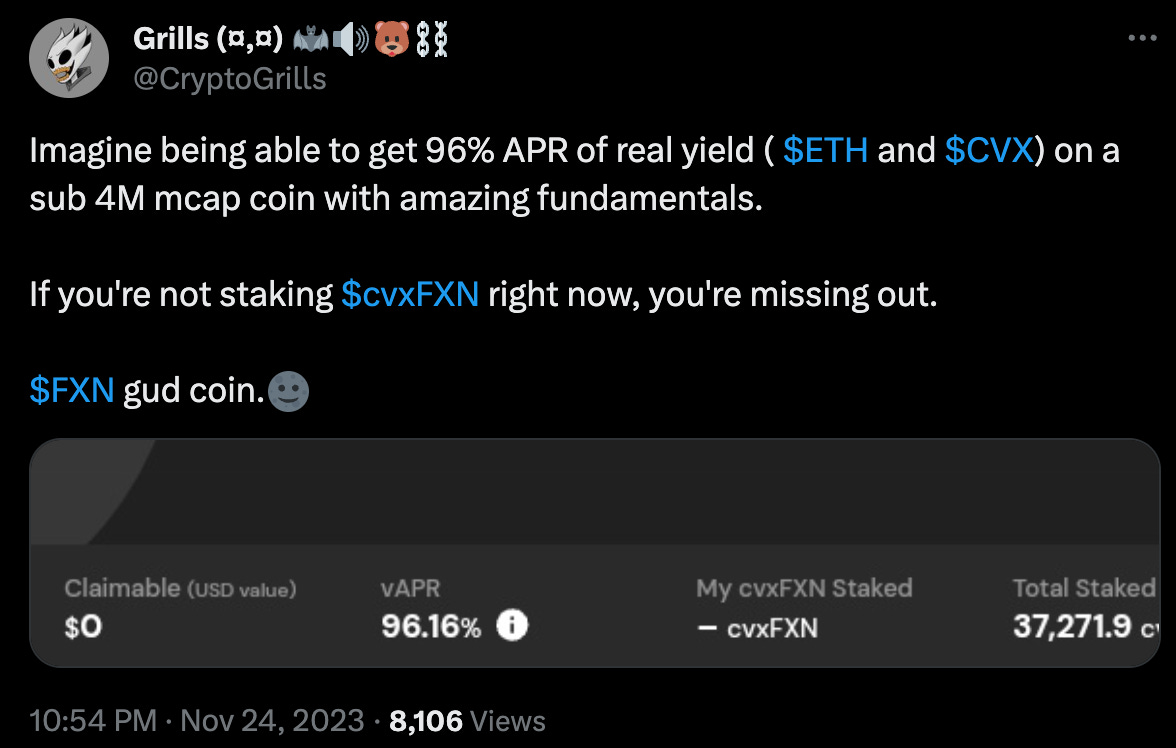

Convex has wisely positioned itself to corner the entire flywheel.

For the case of Protocol f(x), this may prove particularly prescient. The nascent protocol has been up only.

While $122 may look like a lofty price on the sticker, note the total supply is a mere 2MM, and only 44K is circulating at the moment. This means a present market cap of just $5MM, and a fully diluted cap of $121MM.

Not financial advice of course, just some numbers. For more on the bull case for Protocol f(x)…