The hottest heat coming out of Miami was the announcement of El Salvador’s plans to accept Bitcoin as legal tender. Overnight within the crypto community, Nayib Bukele has become a household name.

And oh my, check out that sash!

Needs to grow out his beard if he’s going to hit the big leagues tho…

Suddenly everybody has an opinion!

That’s a pretty safe take, even if you strike out the words “El Salvador.” Here’s what we’ve pieced together about this situation.

Dollarization

The modern story began when El Salvador gave up their currency in 2001 in favor of the US Dollar. They rang in the new will-ennium with promises of what a dollarized economy could bring. Per an Economist article from the time:

In Ecuador, dollarisation was a desperate measure, aimed at staving off hyperinflation. In El Salvador, the motive is different: the country has been a model of free-market reform, and has one of the world's most open economies. The colon had been fixed at 8.76 to the dollar since 1994. The current-account deficit is small, thanks to the 1.5m Salvadoreans who live in the United States and who last year sent a record $1.6 billion home in remittances… El Salvador is finding it hard to match its high growth rates of the early 1990s. The conservative government hopes that dollarisation will cut borrowing costs, which start at around 15%.

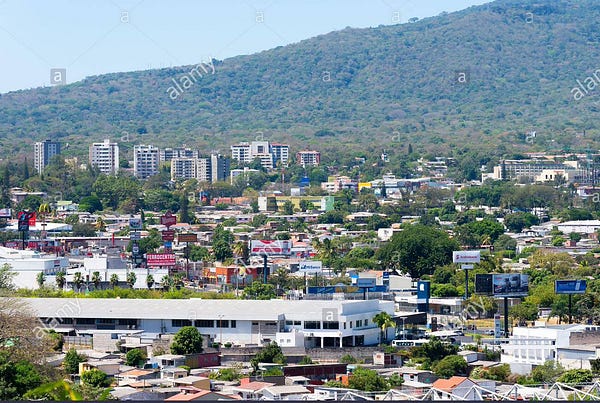

In the years since dollarization, El Salvador has not fared quite so well as hoped. Articles at the 10 year and 20 year marks lamented that these promises did not materialize. El Salvador today is a land of crime, poverty, and wealth inequality.

“They sold dollarization as the panacea that would cure all the ills of the economy and that rivers of milk and honey would come, and it was the opposite,”

Interestingly, the Roberto Cañas quoted appears to be this gentleman, who was once a political rival to Nayib Bukele for mayor of San Salvador. Perhaps he had an axe to grind against the incoming president? Still, he’s hardly the only critic.

Although El Salvador’s economy didn’t exactly take off, one thing did stay consistent between 2001 and 2021, which was the central role of remittances to the economy. Family remittances from the United States to El Salvador grew from $1.6 billion to $5.9 billion in 2020, about 22% of the country’s GDP. You can see why the country would have an interest in efficient cross-border payments.

After 20 years of dollarization, a new panacea is being peddled. This time it is not US Dollars but Bitcoin that will lead to the promised land. Sound familiar?

Bitcoinization

We don’t yet have the details on the proposed legislation, though the BBC reports it will be accepted a form of legal tender alongside the US Dollar. The legislation will be introduced in the upcoming days or weeks where it’s all but sure to pass.

President Nayib Bukele won a landslide election as an outsider party last year. He not only enjoys enormous popular support - around 90% approval rating in some polls - he’s also been effective at crushing opposition. He’s famous for stunts like sending the military into parliament to lobby for legislation. After the El Salvadoran Supreme Court ruled his extremely harsh COVID lockdown measures unconstitutional, he simply gutted the court.

Although US think tank types have harshly criticized these actions, we can’t honestly pretend to have any thing like an informed opinion on the subject. We can comment on our own community though — for decentralization advocates, why are so many Bitcoiners overly eager to bend the knee to any new ruler?

Some of the hero worship is perhaps a calculated effort to provide cover. El Salvador, which receives billions in foreign aid, is likely to come under intense pressure from opponents of cryptocurrencies. A generation that confuses social media with reality is all too happy at the thought of fighting a battle from the comfort of their couch.

Some amount of crackdown may have already even started, though it looks to have been reversed.

Localization

To some degree, it appears Bukele’s move is simply bubbling up the success of the local Bitcoin Beach project. For a few years, a team of volunteers has been working to create a local economy built on Bitcoin’s lightning network.

The team has made significant progress and attracted international attention for their efforts.

Eth-heads like to position ETH as being superior in all regards to BTC. While Ethereum’s technology and use-cases are certainly superior (I use ETH maybe once a week, while using Bitcoin maybe once a year), but there are trade-offs as with all things. No movement ever wins on all fronts, just the battle lines it presses.

While Ethereum is clearly winning the race to be a global computer and all that entails (ie stablecoins, DeFi, NFTs, et al), Bitcoin is really putting in the work to be the global store and transfer of value. Bitcoiners are undertaking the grassroots organizing activity to implement and integrate Bitcoin into local and community economies is noteworthy. We don’t particularly see Ethereum advocates building hyperlocal ETH communities in this manner, so we give BTC the edge in this domain.

On the other hand, a major drawback is that Bitcoiners’ organizing vision is apparently a hideous form of hyper-urbanization. Some of us don’t particularly dream of living in sprawling futuristic cities…

Salvation

President Bukele is making the most of his time in the spotlight, offering a compelling case for recruiting crypto talent and wealth towards the tropical country.

The capital gains tax is a pain point for cryptocurrency adoption, so this is a particularly strong argument.

My understanding (correct me if I’m wrong), is that US expats would still be on the hook for capital gains taxes as long as they maintained citizenship. Yet perhaps other countries with different tax codes could benefit here.

Nobody has yet called out President Bukele for making a classic pitch deck pitfall though. If you ever want a one way ticket away from Sand Hill Road, just compute TAM as: “if we just get 1% of this huge market… wow!”

At any rate, listen to the speech directly and do your own research.

Conclusion

Our take? The snarking and scoffing sounds like jealousy. We’re excited and amazed by this move. It really is a big deal.

We don’t particularly care about the reaction of the Bitcoin price, which can be readily be manipulated by enemies powerful enough to manipulate currencies. We get excited by the prospect of progress, be it technological or procedural.

Flippening nations is the penultimate boss for Bitcoin. It’s always required one country to jump first and take the blowback. This just happened, and now the floodgates can open. Sure enough, within days of El Salvador’s announcement…

While you’re celebrating, take a minute to congratulate Curve! 10 billy!

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice, or even coding advice. Author is a $CRV maximalist, also owns BTC and ETH.

![THE DICTATOR Trailer 2012 - Sacha Baron Cohen - Official [HD] - YouTube THE DICTATOR Trailer 2012 - Sacha Baron Cohen - Official [HD] - YouTube](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fa65ed1ea-81a8-468d-ba58-d55b73ef1ecf_1280x720.jpeg)