Choosing between $CRV and $CVX is like a parent choosing favorites among fraternal twins. Yet people always prefer reducing complexity into the lowest entropy state. So which shall it be?

For those of you most fluent in GIF, the question reads as follows:

A spirited discussion has kicked up about this very topic. It’s a complex question, so we’ll annotate the discussion. In reply to the query, @CryptoMessiah wrote:

Convex advocates would point out that is overly simplistic, and neglects the significant yield one could get from vote locked $CVX (vlCVX).

We know “it depends” is not a satisfying answer, but the choice of Curve or Convex does depend heavily on circumstances. In a vacuum, Curve would not necessarily be useful unless you have the right proportions of locked veCRV and large quantities of other assets (stablecoins, Ethereum, wrapped Bitcoin, etc). Since veCRV reduces over time, properly balancing this can be quite difficult.

One such whale who does have sufficient capital reserves to benefit from Curve directly breached to offer the nuanced case for why $CVX is the superior play. Is it worth listening to the opinion of a sea mammal? One rags to riches trader offers a testimonial:

Tetra lays out the difficulties for regular users in maximizing gains directly from $CRV.

Absent the capability to maintain this proper balances, one’s best bet is to give Convex your CRV in exchange for CVXCRV, which provides great yields and could be traded back for CRV anytime if desired, provided the requisite Curve factory pool holds peg.

The CRV game is no longer easily affordable for regular traders, instead being fought among protocols. Therefore Convex becomes a better interface for most people, even without considering the bribes angle.

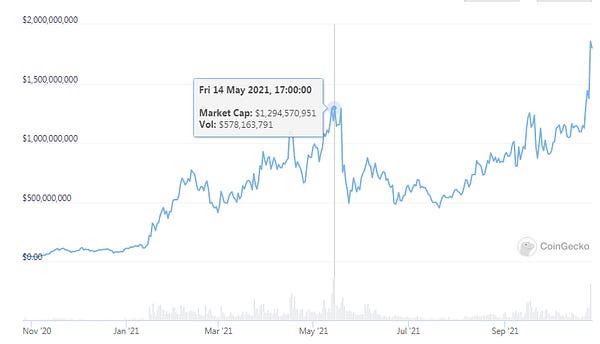

The bribes have accelerated over the past few weeks and have given even more oomph to the value of Convex.

Bribes are also likely to continue flowing towards Convex, as it is the optimized choice for protocols.

Note also the Convex just announced support for cross-chain voting.

Consider also that Convex is extraordinarily scarce.

This supply shock will have interesting effects on the distribution.

All of which sparked yet another philosophical debate:

Analogies are all flawed, but another analogy might be git and Github. The former is the core protocol powering all technology, while the latter depends on the former and makes it accessible to the mass of people.

If you’re still trying to wrap your heads around the complexities, read this thread:

A final point on the first question. If you’re trying to reduce it to a simplistic answer (ie “Convex beats Curve!”) you’re probably misunderstanding the flywheel.

An investment in Convex is necessarily a bet on Curve. Curve benefits from the effects of Convex. This is a symbiotic relationship.

Read Disclaimers! Author is a $CRV maxi who presently converts all new $CRV to $cvxCRV.

If you like this newsletter, consider subscribing for paid content, with all proceeds to benefit PAC DAO crypto activism: