The past few years haven’t precisely been the best time to launch a crypto project. We have the utmost respect for everybody who has the courage to launch and ship into the headwinds of a grueling bear market.

Today we provide updates on two projects newsletter readers may follow closely: Napier and Prisma.

Napier

Napier Finance officially postponed the Llama Race points program amidst plans to scuttle their v1 and shoot straight for v2.

If you don’t want to read through the entire Medium post, the TL/DR is:

Llama Race “points program” is paused

NPR token generation event is postponed

Users who deposited should follow instructions to withdraw (all funds are safe)

More specifically, the project had boasted ambitious plans to allow for bringing Pendle-style yield trading to Curve pools. However, building it out proved more complex than anticipated. Specific issues they faced:

Efficiently calculating certain pool compositions

Lack of support for flashswaps

Challenges in use of pool oracles

As the team abstracted away certain features to address these challenges, many features of the v1 roadmap eroded. For one example, the need to increase withdrawal windows to several days conflicted with the concept of immediate redeemability assisting the overall protocol health.

While it’s a rough blow, it’s by no means the end of the road for Napier. Better understanding the particular issues they hit in building v1 vision, the team have refined the concept into a v2 they believe will be viable, which they dub as a Modular PT/YT which could “approach the scale of traditional financial IRD markets.”

We look forward to seeing what the team continues to build out, and hope the backers who took a chance on them by engaging with the v1 Llama Race points program return as they build out v2.

Some of our prior coverage on Napier:

September 26, 2023: Napier Protocol 🏴🔢

Recently, the crypto community was abuzz about Napier Protocol. It’s great to see this on many levels, if for no other reason than to perhaps raise the profile of its presumptive namesake, John Napier.

Prisma

Far more frustrating for followers has been the steady erosion of $PRISMA.

Over the past several months, a number of frustrated investors reached out to me directly asking for thoughts. We’re as much in the dark as everybody else.

Lest you suspect we’re withholding any hidden alfa, our recommendation to everybody is that you mentally write it all off to “zero.” We sleep so much cozier having already sped through the five cycles of loss.

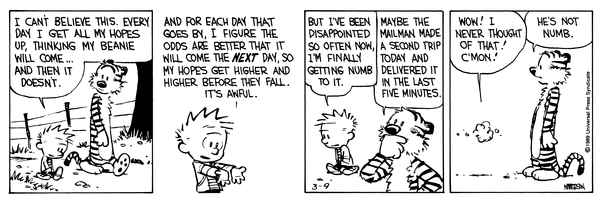

We feel everybody would be better off accepting a total loss. The emotional roller coaster of raising your hopes is not an enjoyable ride.

Small Cap Science shows how to concede defeat.

Sifu discusses rugonomics

Do you officially agree you have surrendered all bullishness? Have you been fully cured of your hopium addiction?

Continuing to read this blog constitutes a legal contract that you concur your $PRISMA bags are officially worth zero and shall never budge from such lows.

The last public communication we saw from the team outlines their current situation and path forward:

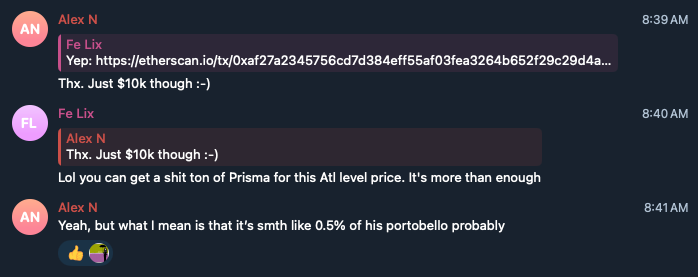

Lately there’s been some premature enthusiasm that whales are buying.

Remember, by reading this far you contractually agreed that $PRISMA is worth $0. Any honest observer would note that this purchase rounds to zero. Take some perspective about how much celebration a five-figure purchase size should properly warrant.

We don’t suspect the Convex team has any particular inside information on $PRISMA. We do know that Convex the protocol has invested hefty effort into capturing revenues from the Prisma ecosystem, so for the sake of Convex we’d enjoy seeing revenue growth.

The Prisma path forward is likely to be a long and difficult slog. If you are interested in supporting the team in their journey, please temper your expectations. We don’t speculate on prices in this blog, but we’d propose a “bullish case” might look something like a four year timeframe during which the $PRISMA price might crawl up 20% to reclaim $0.03

Of course, this is not financial advice, nor even a likely realistic scenario, but we want to dump a bucket of ice water on any smoldering expectations that the token might do a sudden 50x that bails out anybody who bought the picotop.

For our sake, as cash flow enjoy000rs who have accepted our investment is permanently underwater, we confess to being amazed that the token still provides revenue streams as the protocol continues to operate apace without depegs or other issues.

The way we play it is to lock any $PRISMA we do happen to accumulate as vePRISMA (or into wrappers), which is easy enough to do after you have mentally written the token as being worth $0 — anything up from $0 represents infinite gains…