Sept. 26, 2024: TOKEN2049 Redux 🇸🇬🗣️

Recapping @newmichwill's talks from the Singapore conferences

Wait, was there singing?!?

Do you have major FOMO from Singapore’s recent TOKEN2049 event?

Of course, spontaneous networking is the best part of conferences, something that can't be replicated online. We can’t help with that type of FOMO.

At the events you can often just skip the talks because the videos usually trickle online later. Instead max out the face time while you can.

Sure enough, two of the three videos of Mich’s talks have been posted. Below we recap the highlights:

BTC ECO Summit

The first part of this talk introduces the crvUSD soft liquidation mechanism to the audience. This conversion mechanism may already be familiar to readers, but we noted two other takeaways on the role of Bitcoin in DeFi from two quotable moments:

“Bitcoin has a much more suitable volatility profile for soft liquidation.”

The talk, focused to a Bitcoin crowd, contrasts the trading volatility profile of Bitcoin and Ethereum. Bitcoin, as the larger asset, typically experiences less price volatility.

Within $crvUSD’s soft liquidation mechanism, it does better when prices fluctuate slower (what the white paper dubs an “adiabatic” process in a nod to physics).

Therefore, Bitcoin users tend to experience fewer losses in soft liquidation compared to those using Ethereum or other more volatile assets.

This underpins the second takeaway:

“It’s become evident that we need to pay more attention to Bitcoin as a DeFi asset, because that’s where the demand is.”

This is an interesting takeaway, because Bitcoin was fairly central to DeFi v1 during the 2020 era. Many users, including the author, found their way to Ethereum DeFi from Bitcoin.

Bitcoin’s presence in Ethereum DeFi has declined slightly over the past few years. Pure BTC yield thinned out as wrappers (ie renBTC) went out of business.

However, the recent surge in Bitcoin price and strength against Ethereum appear to be sparking a renewed interest in Bitcoin as an asset on Ethereum. We’ve seen a variety of Bitcoin wrappers, as well as greater interest in lending products utilizing Bitcoin than previous DeFi.

“It’s become evident that a Bitcoin-based DeFi ecosystem is starting and demand is here. We just need to build and encourage everyone to use the most decentralized way of using BTC in DeFi.“

More on the recent flare-up of the wrapped BTC wars

Sept. 13, 2024: Wrapped BTC Wars 🪖💥

Is it too soon to dub this the wrapped BTC Wars? Coinbase has launched $cbBTC

Stablecoin Summit

The Stablecoin Summit featured a longer Q&A session with moderator Wayne Huang asking thoughtful questions and giving room to let Mich tell his story.

Origin Story

Mich opened the talk by sharing his DeFi origin story. Initially he was a user of MakerDAO borrowing single-collateral DAI because he didn’t want to sell ETH.

The biggest problem he faced was poor liquidity for DAI and all stablecoins. DAI to USDC was inefficient on the existing DEX (Uniswap v1, Oasis), a bit better on CEX (Coinbase, Binance) but still bad for trading.

From October to January he finished the math, smart contracts, and white paper for the Curve StableSwap invariant, which better concentrated liquidity, and released it. Through the process he learned that a UI or heavy userbase was largely unnecessary if it could plug into aggregators like 1inch, and TVL quickly followed.

In this way he solved a problem he needed (efficient stablecoin to stablecoin trading) and launched a large protocol.

Growing crvUSD Market Cap

What’s the best way to grow crvUSD market cap? Stable store of value? Medium of exchange?

Mich sees two sides to this question. On the demand side, he observes that users are willing to pay a premium for soft liquidation, or “liquidation without action” as a conference attendee suggested. He observes users are willing to pay up to 2x premium for soft liquidation, so he considers this side solved.

On the supply side, his concept is to “share” this demand premium with depositors of crvUSD to make some kind of “staked crvUSD.” As he sees it, st-crvUSD can support a “flywheel” for as long as the market supply rate is smaller than the rate borrowers are willing to pay.

He also believes st-crvUSD can serve as a useful asset in and of itself. For one example, he suggests it could serve as “more interesting collateral” for borrowing due to the yield. He points out this is not speculative, as yield-bearing stablecoins are popular.

Velocity of Money

Possible to grow velocity and then cut yields once this is sticky?

He sees this as more of a bizdev question, while he looks at these type of questions from the perspective of a dev.

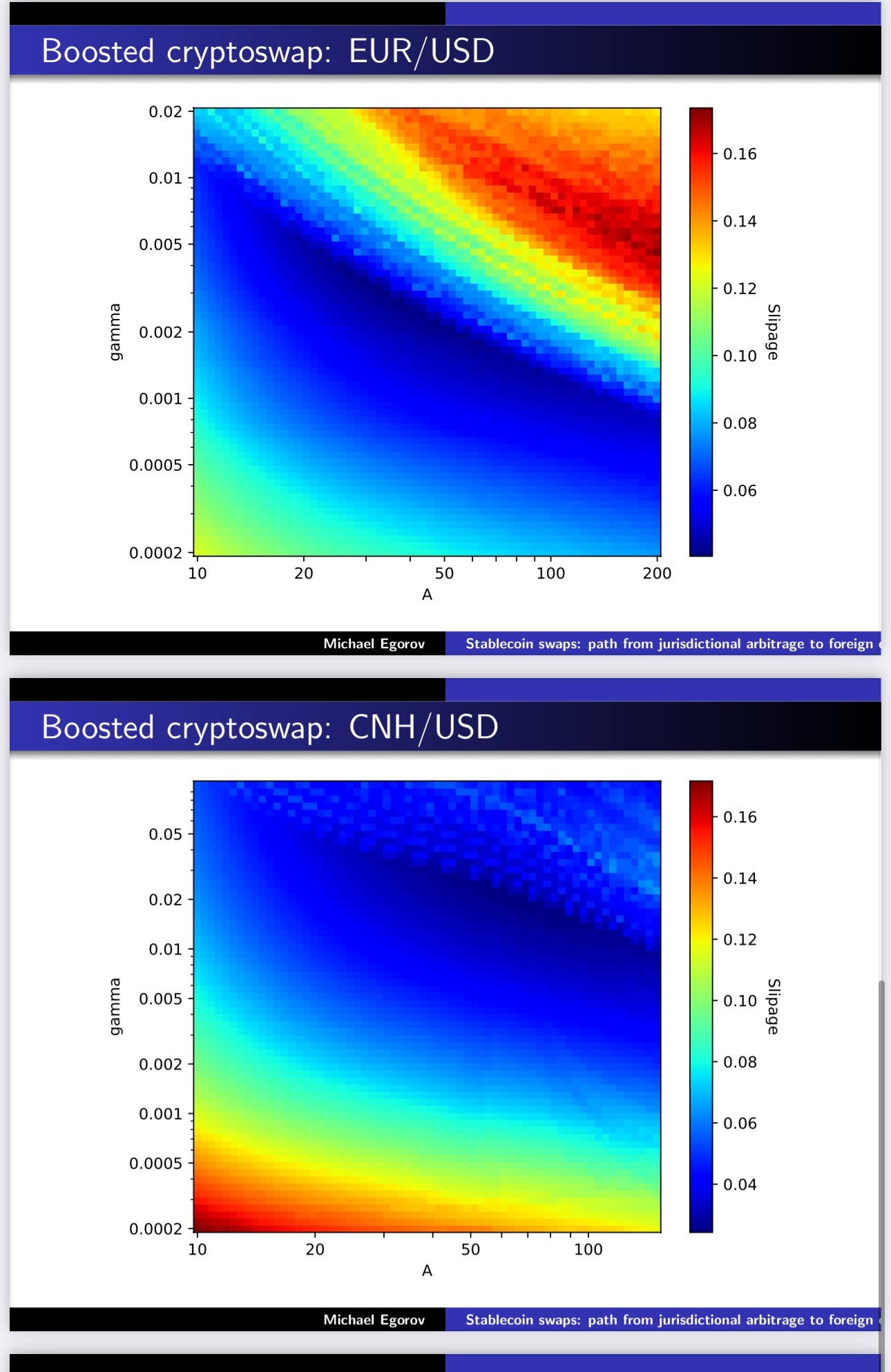

He suggests it may be possible to invest crvUSD into certain liquidity pools where it may be advantageous. By way of example, you can boost cryptopools to rebalance concentrated liquidity, where the loss from rebalancing is subsidized from crvUSD yield in a particular pool. This would make the overall system making more money than just crvUSD.

But he suggests other solutions may come not from the tech side but the bizdev side.

Regulatory

Mich opposes blocklists in decentralized stablecoins, as it turns the stablecoin into a centrally managed organization. He agrees that compliance requirements is necessary for redeemable stablecoins because they custody funds and therefore compliance is important to make sure the funds to redeem actually exit.

In contrast, if a stablecoin is managed algorithmically and nobody can intervene in this process, he argues it’s better to keep it this way.

Future

Mich has two answers here as to the biggest problems he sees in DeFi.

How to sustainably make good liquidity for stablecoins of different denominations, (ie USD/EUR)

He believes this problem can be sustainably solved with ample exchanges permitting arbitrage, though this cannot be consistently relied upon. The actual solution in the messy real world is more challenging.

How to eliminate “impermanent loss”

He doesn’t suffer this problem as much, as he sees it more as rebalancing, but he observes many users see it as a loss. He proposes it’s possible to solve the problem, with a more fundamental solution than printing tokens out of thin air.

Regrettably, the talk concluded before Mich could discuss the particulars of this solution, but solving IL is interesting.

TOKEN2049 SKY STAGE

The mythical third talk from the Token2049 Sky Stage has yet to make its way online, but per this thread by Haowi it appears that the talk covers Forex

Per the thread, it seems the talk includes a good overview of stableswap versus cryptoswap invariants, suggesting a middle path for forex. The talk also appears to include some simulation results, so we look forward to this hitting the web soon!