Sept. 9, 2022: The Amazing Adventures of Kava Chain & Curve 📚🌌

Curve Deploys onto Ethereum-Cosmos co-chain Kava

For the first time in half a year, Curve has deployed onto a new chain. Welcome Kava!

Kava is a unique Ethereum/Cosmos co-chain, using Tendermint as a consensus engine. This architecture allows developers to build and deploy their projects onto Kava using either the EVM or the Cosmos SDK execution environment.

Given Cosmos boasts $60B in value on 30 chains, Kava is well positioned in offering a seamless connection between two of the most innovative cryptocurrency environments.

Kava has been building furiously throughout its history. The chain is upgrading its infrastructure over the next month onto version 11 to help accommodate their rapid growth and improve the user experience.

Kava’s launched as far back as 2018, and really started coming into their own over the past year. Their website recently launched a full suite of Defi primitives, including native apps for lending, minting, and trading.

The chain offers users the sort of sky-high APYs you should of course do a bit more research on before blindly aping — big rewards often come tied with big risk. Yet it’s quite comforting for DeFi degens to know there’s already a large ecosystem of services and supported assets.

In March, they unleashed their USDX stablecoin to underpin this ecosystem. The coin is primarily earned from borrowing via the aforementioned apps. At present the coin carries around $100MM total supply. The stability of the coin is “derived from market flows and influenced by Kava governance decisions,” the full mechanics of which are outlined in a post.

All told, Kava is already the 15th largest chain on DeFi Llama with a quarter billion dollars, primarily locked within these three apps.

The chain is spending big to expand this ecosystem. This summer they announced their “Kava Rise” Developer Incentive Program, offering 200MM in Kava tokens disbursed over the course of four years, what was at the time of announcement valued at $750MM worth of incentives. Rewards are offered to projects based on the time weighted average of TVL each month, as calculated by DeFi Llama.

These incentives are fueling a rush to the chain, and the recent launch of Curve is likely to bolster these efforts. Curve’s presence is small at the moment, with $1.5MM TVL and just one factory deployed 3pool.

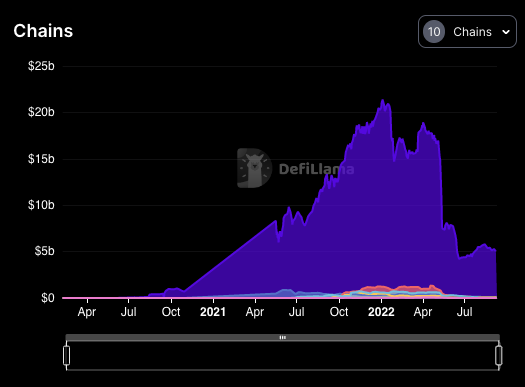

This may not make a huge impact on Curve in the short term. Curve sees very low TVL outside of Ethereum, despite its footprint across nearly a dozen chains. It looks more like a longer term bet on sidechains growing their footprint.

In addition to the recent Curve deployment, Sushi has also been announced as partner.

A variety of other partners, including Beefy Finance, Multichain, Autofarm, and B. Protocol, ensures the Ethereum side of the ecosystem will be well fleshed out. Given that the chain also has great exposure to the Cosmos ecosystem, the composability of these two thriving chains may unlock great new innovations.

The chain even supports an NFT platform with a clone of punks.

We’ve seen agglomerations of DeFi protocols on L2s and sidechains evolve into innovation hotspots, most notably on Arbitrum, which features just 4x Kava’s TVL.

Will Kava become the next hotspot for DeFi? The ability to better access the innovation throughout the Cosmos ecosystem is a big advantage for the chain. Let us know your thoughts in the comments!

Gdzie gold