Didja catch the depeg, anon?

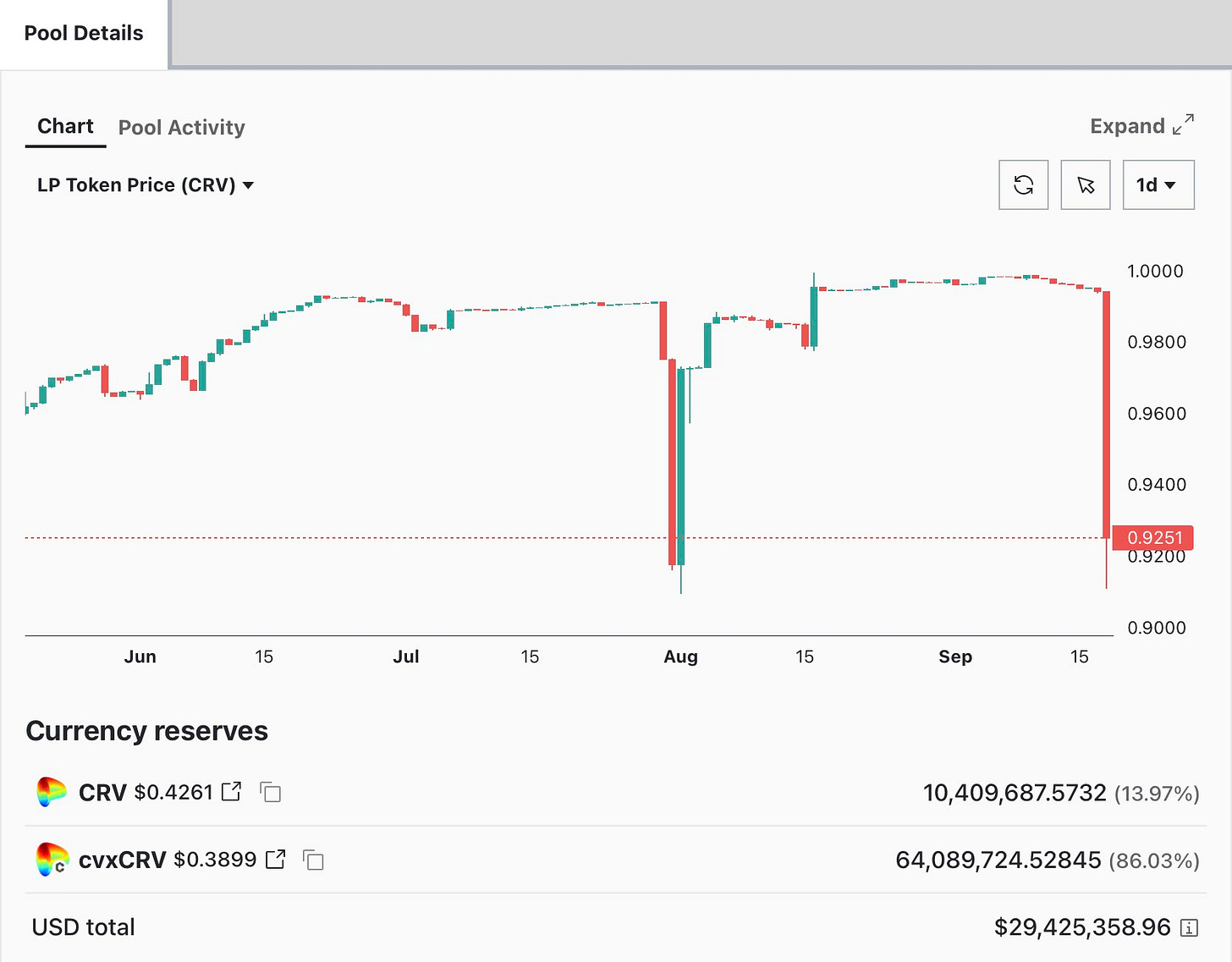

Last night, a large chunk of cvxCRV got deposited to the pool by a mysterious whale, causing a depeg on an order of magnitude not seen since last month’s exploit.

In ancient times, this would mean that cvxCRV would spend a long time wandering in the desert before it stumbled back to a repeg.

Yet over the past six months, the cvxCRV peg has been tight and getting tighter. This sale would close to a mere 3% discount within a few hours.

Convex itself bought the dip.

$cvxCRV has been very much in demand as Convex has been making some big moves. Just this morning they announced another big release that unfortunately falls outside the scope of this newsletter.

Incidentally, if you want an easy way to get your hands on some of this $cvxCRV, consider staking CVX. As we profiled last week, the rewards are soon going to stream to staked CVX as opposed to locked CVX. The latter of which has $154MM TVL, the former just $6MM TVL, scheduled to start receiving a firehose in rewards at some indeterminate point in the future.

September 15, 2023: Locks, Stakes and Two Smoking Proposals 🔒🗳️

Disclaimers! Everything that follows is educational in nature and not financial advice! Author has exposure to basically every alphabet soup permutation of CRV/CVX/FXS he can find Recovery An update on yesterday’s article on the recovery snapshot…

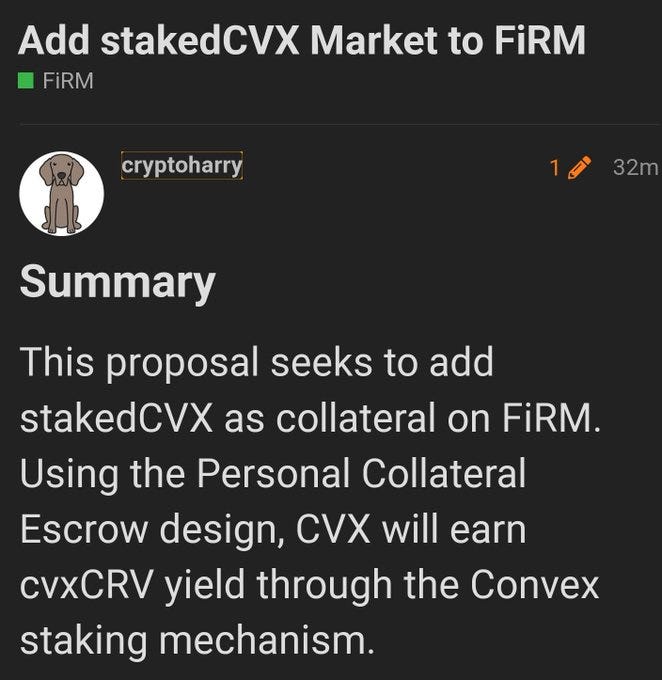

Since we published, Inverse Finance has already tossed up a proposal to add stakedCVX as collateral.

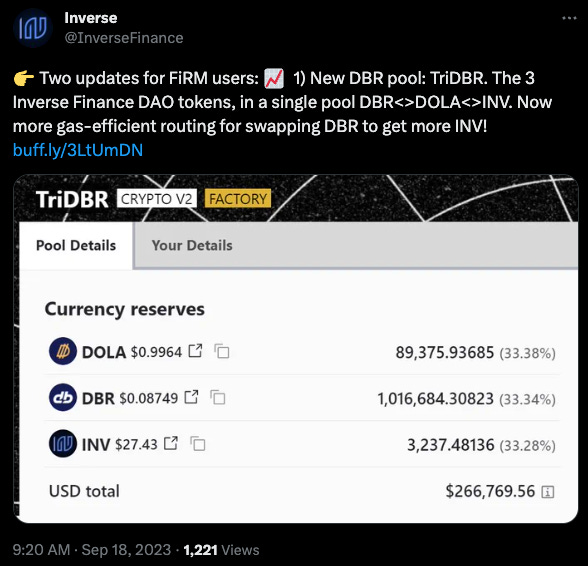

This comes amidst a few other big moves out of Inverse Finance, including a new TriCrypto pool for three ecosystem tokens and an sDAI market we may talk about more tomorrow.

The Wrappers

The success of $cvxCRV has not come at the expense of other major $CRV wrappers. If anything, the market has been fairly steady. Convex holds about 75% of the liquid veCRV among protocols, Stake DAO and Yearn split the rest after big run-ups.

In recent weeks, both $yCRV and $sdCRV have been major beneficiaries of big locks.

For Stake DAO’s case, some of these big mints came in a partnership with Accumulated Finance.

Stake DAO is aiming to creep up on Yearn’s second place position, blessed by a tight peg and strong yields.

If you’re new to Curve and interested in learning a bit more about why so many of these various wrappers came into existence, here’s a good thread.

In our Fren Tech lobby, I was asked which about these various derivatives to use. I’ve tried them all in fact, and occasionally rebalance among them!

For subscribers / keyholders, some thoughts: