September 28, 2023: Into the Deep 🤿🌊

Project Mariana uses Curve contracts for cross-border FX pilot. Plus, $FXN token launches

Yes, Virginia, you are early.

We often forget that the various flywheel tokens read as alphabet soup to the 99%+ of the planet not invested into this space. In truth, anything past the front page of CoinGecko is a dismal abyss. Unless you’re performing in-depth research, it’s extremely difficult to discover quality tokens when you dive into these uncharted waters.

Whenever you notice some blue chip flywheel token has some major developments and is ranked #999, the odds are pretty good that you understand it better than the market at large. The signal to noise ratio would be difficult to parse out for the average consumer. Quality projects that integrate smartly into the broader flywheel, however, tend to stand out.

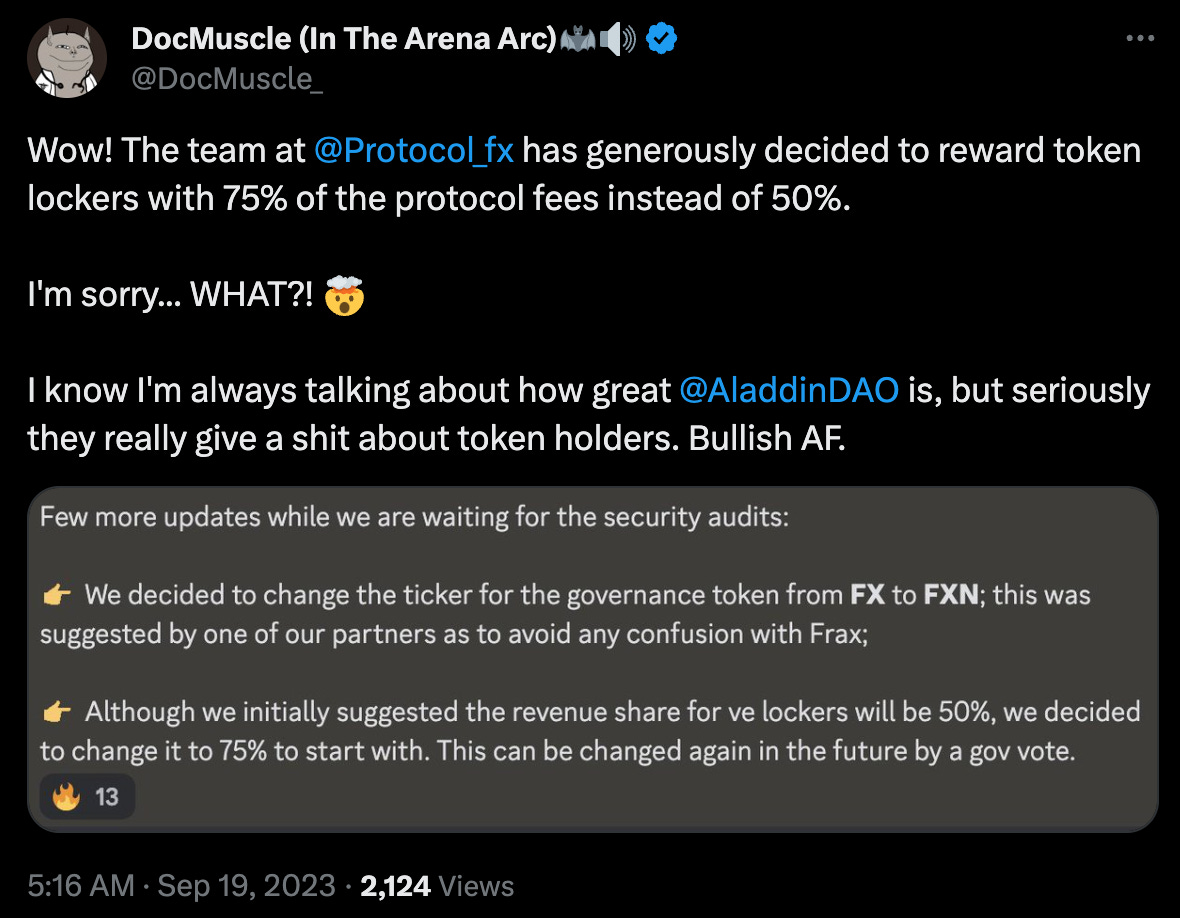

In other words, we won’t be surprised if tomorrow everybody suddenly tries to figure out why f(x) protocol’s $FXN token launch is the hottest story. But you, Virginia, you are early.

To clarify one question… there’s no planned airdrop for any of this (at least none that have been revealed to this humble, mild-mannered blogger).

Rather, Aladdin DAO’s other token launches ($CTR, $CLEV) have been stunning successes or failures, depending on when you acted, so traders may be eagerly awaiting an opportunity to gamble. We don’t know, we’re not traders.

We do know that the initial token offering sold out very quickly. We also know that the half dozen people in crypto with a long-term time horizon enjoy Aladdin DAO tokens because they often are built with generous cash flows in mind.

As of publication, the token is trading actively, with good utilization of its new Curve pool.

Project Mariana

Let’s go deeper… to the bottom of the sea!

In June, we took a deep dive into this project, dubbed “Mariana”

Project Mariana is a collaboration by several international banks to perform cross-border settlement onchain. The potential size of this market is in the trillions of dollars, dwarfing the largest cryptocurrencies, and hence it qualifies as the proverbial “big deal.” Naming the project “Mariana,” after the world’s deepest trench, is an appropriate analogy for what could become crypto’s deepest liquidity pool.

This month, the project released the final version of their report.

From the previous draft, many parts remain the same. Just as before, the final report notes they had evaluated several AMM designs, and Curve’s algorithm is the only one that checked off all the boxes.

What’s new is that they’ve actually gone into more detail about the specific criteria that the AMM had to fulfill.

They’ve actually begun architecting and testing their solution.

Testing involved adjusting a single parameter while holding others constant, as a way of landing on a final range of acceptable parameters.

You can also observe their work in the wild. The trades occurred on Sepolia testnet.

However, we really hope this isn’t the final version.

The good news is that based on the bytecode, they appear to be using Vyper!

The bad news is that it looks like one of the Vyper versions susceptible to re-entrancy attack!

We never hope anybody runs out and does financial transactions based on this newsletter, which is educational in nature and never offers financial advice.

It’s by no means clear that BIS would use Curve, birb pools, and otherwise engage in our ponzi games. DeFi being a dirty word in civilized society, it’s plenty likely they keep their distance.

We also know that Mich is often in collaboration with BIS. Whether or not they use Curve officially, the idea that BIS can trust Curve’s engineering is a major vote of confidence that the infrastructure may be used more broadly.

If you want to claim you’re in it for the tech, then you’ll have to join us in celebrating the breakthrough!

appreciate 🥰