The previous collapse of Multichain had left Curve’s cross-chain deployments in a rough state.

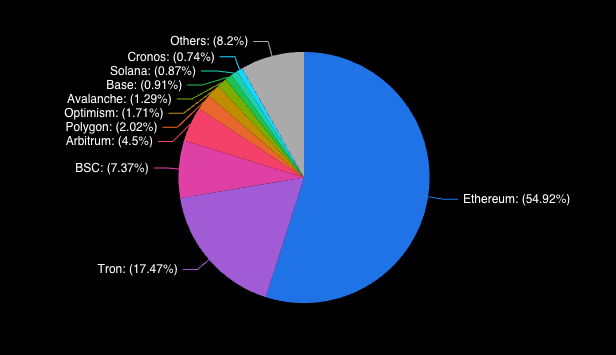

One might be tempted to say, “so be it” — the actual footprint of several of the sidechains where Curve has a presence are minimal anyway. Arbitrum has only a 4.5% global footprint, while it’s about 1.5% of Curve’s total TVL. So it’s footprint is a bit low, but so is the ceiling, right?

However, this is just looking at TVL. Take a look at the 24 hour volume chart, a measure of the actual activity taking place.

If we plot the share of 24 hour volume for the top ten chains here, and you see that chains like Arbitrum and Polygon punch above their weight.

Since trading fees still constitute the majority of Curve business, Curve needs to go where the trading happens. Curve needs its cross-chain infrastructure back!

Even when Curve soon witnesses $crvUSD revenue flippen revenue from trading fees, we still see urgency to make sure $crvUSD has a major presence on every chain.

Therefore, a major catalyst in Curve’s growth plans had been hampered by the sudden death of Multichain.

However, the gap will soon close, thanks to the release of Curve’s new xDAO.

The README here is scarce, but the contracts contained within this repo hint at an architecture allowing users to easily bridge assets like $CRV, $crvUSD and boosts across chains. Although this repository has some loose ends, it’s progressed to the “test in prod” stage with it already being deployed and tested in the wild on Avalanche.

As highlighted, the repository suggests a deliberate design flexibility. The initial bridge implementation is constructed atop LayerZero, however, the contracts have provisions for revoking/approving new bridges, and even aggregating multiple bridges together. This architectural choice not only adds a layer of redundancy but also ensures that the system can easily adapt to new or alternative bridge technologies in the future, thereby enhancing resilience and operational continuity.

The repo also introduces a slightly more modernized cross-chain version of $CRV, entitled CRV20

This version not only adheres to the standard ERC20 functions but also incorporates additional view functions to view $CRV inflation parameters.

The inclusion of a permit function is noteworthy, as it enables users to authorize spending via an elliptic curve digital signature algorithm (ECDSA), thereby streamlining transaction approvals and enhancing user experience.

People always ask around the Telegram and social media for alfa, but the Curve github account is where the real alfa happens. For instance, just this morning a series of Deleverage zaps were deployed, which one could easily expect can be used to deleverage a levered up $crvUSD position.

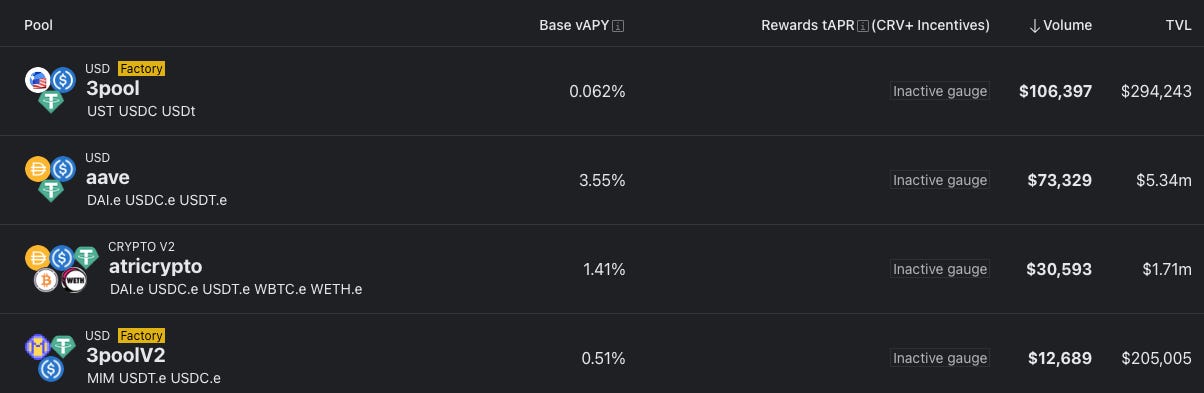

We’d recommend keeping an eye on Curve infrastructure at this level, since it can be real gains. For example, right now no boosts can be pushed cross-chain. So yields like this 8.5% yield on tBTC-WBTC, well above market rate, is an inaccessible mirage.

Yet if you happen to catch the Arbitrum xDAO deployment early, you could potentially move your liquidity in time to take advantage of this juicy yield.

That said, if you can’t wait, there’s far more accessible BTC yields by simply converting to crvUSD.

As mentioned above, Curve xDAO is already deployed to Avalanche.

The usage of the contracts in the wild can be better visualized from this proposal.

However, take caution — the first deployment of several Curve contracts tends to be mostly a test deployment to iron out any bugs in an experimental setting with relatively limited losses. Often times it takes a few deployments to get things right.

That said, we don’t exactly imagine there will be a big rush for users to bridge to Avalanche at the moment.

We recently saw in Curve’s deployment to Base that it can compete very well on cross-chains with relatively meager incentives. We could imagine sniping more volume on some of the more active sidechains once these get broadly distributed. See also, last week’s post on bringing $crvUSD to Arbitrum via a grant…

September 29, 2023: Steakhouse 🥩🍽️

Based on the following level of ecosystem activity, ask yourself, which token deserves the higher market cap. $BTC or $CRV? Here’s all the news that’s fit to print…crv.mktcap.eth is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Curve has taken the time to deploy basic infrastructure on several sidechains, it looks like the next year we may see Curve optimize their presence for success