In the global landscape of $crvUSD, there are nine figures worth of supply and almost all of it running through LLAMMA.

Undoubtedly we’ll see more external sites integrating $crvUSD into their offerings as the opportunity grows. Conic had previously held an outsized role in the ecosystem before its tragic hack. Silo is stepping up to reap the spoils (as we reviewed last week) and is already becoming one of the best possible destinations.

Despite a few external protocols starting to adopt $crvUSD, the epicenter of $crvUSD activity remains Curve itself. While Curve has disproportionate influence over the trajectory of $crvUSD, it’s been playing an active role. The past few days have seen a variety of governance proposals intended to shape the development of the stablecoin.

The most monopolistic behavior among these changes is the attempt to double $crvUSD trading fees.

We’ve got nothing but good things to say about this change. $crvUSD (shown in green below) is already a major source of Curve revenue.

The biggest losers would be the arbitrageurs’ profits, as it might cut into their profits. Presumably they’d still arb trade, since it would be profitable. But such trades might be less frequent, which could mean a slight loosening of $crvUSD’s bespoke peg.

This change, applied across all markets, could nearly double the impact of $crvUSD fees, with minimal impact to users. We might see a veCRV revenue source flippening with just a modest growth in $crvUSD supply.

$CRV shorters keep taking L’s…

New $crvUSD Markets

Over the weekend, we saw the deployment of two new markets. The new $sfrxETH market serves as a replacement for its initial test deployment of $crvUSD. The initial market was hampered by a low ceiling of $10MM, which was quickly hit. The replacement market carries a $50MM ceiling which could also be raised, among other improvements. About a third of the capital has already rotated to the new market, which sports a presently lower borrow rate to encourage migration.

The $tBTC market is a brand new market for Threshold Network’s $tBTC. The more decentralized Bitcoin wrapper has quietly enjoyed an “up only” market share since its launch earlier this year.

The $50MM market cap on this market could theoretically allow for the entire current supply to find its way to $crvUSD. At the moment, about 2.5% of the total $tBTC supply has already done so.

In our humble opinion, lending wrapped BTC (whether $WBTC or $tBTC) for $crvUSD, then seeking yield farming opportunities, is currently the killer use case for Bitcoin. There’s nothing particularly interesting to do with orange coin, except to sit and watch its price do nothing.

Converting it to $crvUSD to earn some yield, with good protection against losses, is a great way to earn some profits in the bear market (not financial advice!) Smart traders know that in a severe enough Bitcoin price tank, you could theoretically just use your $crvUSD loan to buy more on the dip. But we’re not smart traders, so we don’t know this.

It’s the same principle as we outlined previously with the $WBTC markets… except that $tBTC happens to better align with Bitcoin’s decentralized ethos.

July 3, 2023: WBTC Summer 🎆🗽

The first DeFi Summer is now but a distant memory. Nowadays the popular narrative is all about LSDs and LSD-Fi, thanks to staked Ethereum earning a raw rate of… :checks notes: … 4% Yesser, a whopping and wild 4%… a number that falls short of treasury bills… has got degens buzzing. LSD-Fi has seized the narrative and spawned a cottage industry of protocols built atop staked Ethereum.

Which way, maxis?

Peg

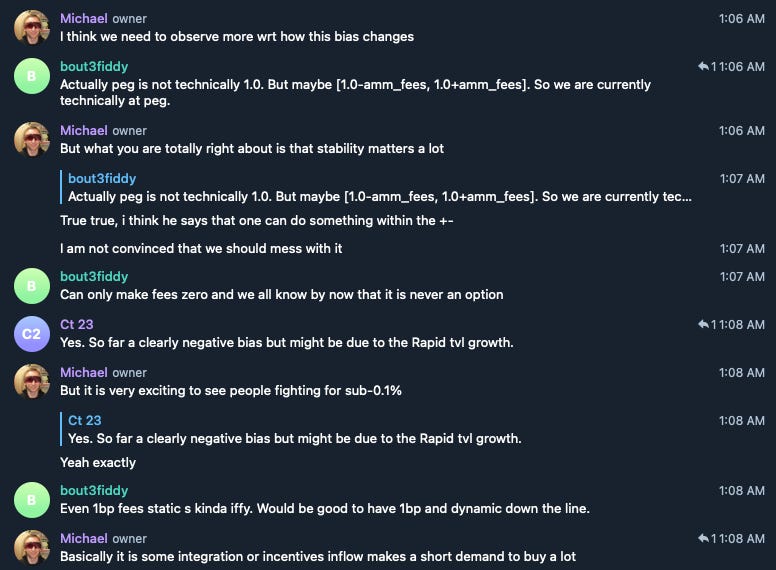

Among all the changes, worth keeping an eye on how the $crvUSD peg fares in upcoming weeks. The peg has been extraordinarily tight since launch, however some of the recent changes may have an impact. Above we mentioned how doubling fees may come at the expense of the peg.

Also, the disabling of Chainlink oracles has finally hit.

We covered this in much more depth last week.

August 22, 2023: LLAMMA Oracles 🔮⛓️

Under the radar, a serious and nuanced debate is occurring on the Curve governance forums about the use of Chainlink oracles in $crvUSD’s LLAMMA markets. Wait a minute! Just a month ago, didn’t everybody universally praise the use of lending markets relying on Chainlink oracles to source the price of $CRV externally? Had they relied on the borked CRV/ETH pool, the fear is we’d have seen even greater carnage in DeFi.

Meanwhile, the DAO is considering reducing the debt ceiling for the occasionally controversial $TUSD stablecoin. The risks team didn’t find any evidence to corroborate much of the FUD, but does have some concerns about transparency policies and suggests reducing the risk given that the stablecoin is systematically important to $crvUSD given its Peg Keeper status. Read the proposal for more info.

Over the weekend, the big brains in the Curve Telegram chat had a long and interesting discussion about the peg, the future, and several more topics. Well worth a read!