2021 has enjoyed two crashes that were particularly memorable in the history of cryptocurrency. The May crash was notable for it swiftness and severity.

This weekend’s tumble was relatively anodyne by comparison, but may always be remembered for its meme potential. From peak to trough, the market dropped from BTC $69K to $42.0K. Whoever’s manipulating the crypto market has deliciously juvenile sense of humor.

When you’ve survived a few dozen crypto crashes, you can easily set aside the emotions and use it to observe and collect data about how your favorite tokens perform in a bear market. Let’s go hunting!

ETHBTC

Broadly speaking, this market crash was perhaps most notable for the strong performance of $ETH relative to $BTC.

The ETH/BTC ratio is now hovering around 0.085, a steady upward climb since the ICO bust kneecapped Ethereum’s early potential.

Coupled with Ethereum’s dwindling supply, we’re presently nearly halfway toward an Ethereum flippening.

Naturally the $BTC and $ETH maxis took the opportunity to clash, with some ruggedly independent Bitcoiners clamoring for government intervention.

I’ve recently discussed the issues with both $BTC and $ETH maximalism. I have a lot of respect for maxis from both communities, and personally identify as a $CRV maximalist. Yet all low-entropy maximalists inevitably become predictable to some degree.

OK, in fairness, the latter came 40 minutes before the former, but it happened to show up in my timeline that way and made me lulz…

$CRV

The market tumble only hardened my own $CRV maximalism.

Crypto market cycles are tough to predict timing wise but relatively routine in their effect. We know to expect roaring gains punctuated by even more epic crashes multiple times a year. We now have sufficient data to predict that trading activity on Curve will always be outstanding during these periodic tumbles.

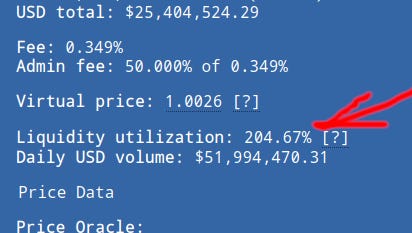

Anytime markets tumble, traders need to take sudden action, whether to escape highly leveraged positions or to buy the dip. Curve is the high liquidity, low fee, low slippage routing of choice for panic sellers.

In the largest market panic since EIP-1559, gas fees stayed relatively stable throughout the duration. Consequently, Curve was easy to use, and daily volume nearly hit a record of nearly $2 billion.

In case you’re keeping track at home — in a frenzy, traders relied on Curve, a coin with a market cap of $1.3B, to move over $2B worth of stablecoins, ETH, and BTC in a single day. 🤡🤡🤡

Seriously, if anybody knows any Curve bears, they have a standing invite to take over this newsletter for a day. Surely a bear case can be made against Curve. Yet parked comfortably within cozy cognitive dissonance, I certainly don’t see it. Through my rose-tinted glasses $CRV is simply stupidly undervalued, and therefore a prime opportunity to keep acquiring while it’s cheap.

At this point massive bear crashes means the crypto world freaks out, while Curve just fine-tunes a few parameters and watch both tokens and fiat pile up.

This also marks the first major crash since Curve v2 pools hit. Incredibly, v2 pools perform even better.

Not only do Curve v2 pools outperform classic v1 pools, but also other liquidity pools.

Today you can count the number of Curve v2 pools on one hand, but it won’t be long before they become so numerous people give up counting.

So what is next?

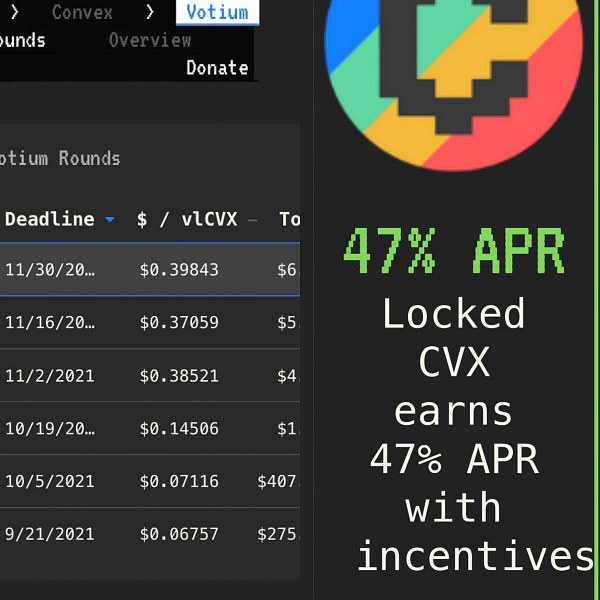

$CVX

Downstream from Curve is Convex, another great shelter in a storm.

In a bit of a Freudian slip, Curve revealed the next V2 pool is in fact likely to be a CVXETH pool.

$CVX actually held up quite nicely throughout the crash. The supply of $CVX is incredibly constricted at 100MM total. 77% has already been issued. A few protocols are maneuvering behind the scenes to make seven figure purchases of the remaining supply. Bears selling $CVX is senseless in its suicidal streak.

If you ever catch $CRV, $CVX, or even $ETH dipping, keep an eye on some basic math. Join the passive incooom clooob!