February 10, 2021: Unit Protocol 🦆💵 and Fighting Fake News 🗞️

The Recap

Here are today’s trends to watch from Curve Market Cap

Introducing USDP: a Unit Protocol metapool now live on Curve!

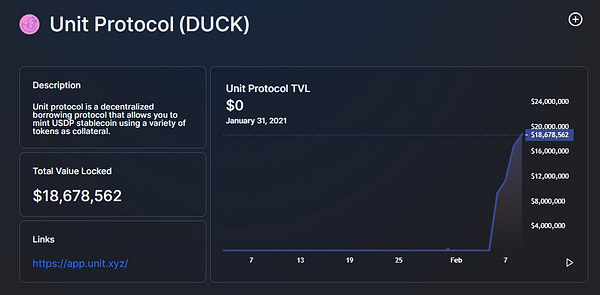

Unit Protocol is a decentralized borrowing protocol that allows you to mint the USDP dollarcoin using 72 different tokens (and counting) as collateral. Different forms of collateral carry different rates, so visit their homepage for current numbers.

The USDP contract is just over two months old, in that time $1MM has already been borrowed with $4.5MM in total value locked. Plus their mascot is a duck, and that’s awesome for our work from home era because ducks don’t wear pants.

Note that this pool’s launch is an authentic Curve announcement from their official channel. With Curve’s growing cred in #DeFi, every new project wants a nothing more than a big bear hug from the team. Remember that it’s only official when it’s burned into the blockchain.

In a recent kerfuffle, a lot of news headlines overstated the degree of a partnership between Curve and Equilibrium, requiring teams to clarify the nuances of the relationship:

These provisos aside, we’re quite excited about Polkadot, so we’re naturally interested in any way that Curve finds its way onto the substrate, whether through Equilibrium or any other group.

Of course, exciting news, even if inaccurate, tends to spread a lot faster and wider than boring things like corrections. It’s a trick exploited often by schlocky PR people. In the end the flashy headline is all people remember.

In a similar phenomenon, recent DeFi hacks got a ton of attention because they got everybody’s sulfolipids flowing and riled up into a state of fear. The responsible resolution of funds triggered no such emotional chemistry, even though a successful recovery (unhack?) of Yearn is arguably the more impressive feat.

Don’t trust anybody and do your own research! Heck, don’t even trust that advice. So, uh, maybe don’t do your own research if you don’t want?

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. The author performs development work for Curve compensated partly in $CRV, all content is otherwise independent.