February 12, 2021: Get Smart? Traffic exits ETH for BSC 🚗⛽

Curve Market Recap

Here are today’s trends to watch from Curve Market Cap

Big movement in the $BUSD pool, up to $40MM over the past 24 hours, driving trading fees north of 13% APY.

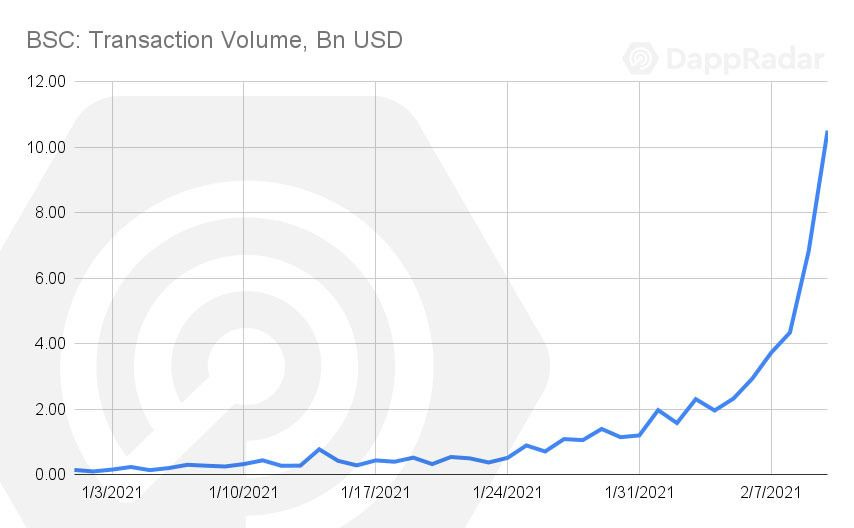

Perhaps it’s no coincidence that DeFi action is starting to move off the clogged Ethereum network onto the Binance Smart Chain. Transaction volume exploded from $15MM in January to already over $24B so far in February.

Much of this is due to the growth of PancakeSwap, the most popular DeFi app on Binance Smart Chain. It now boasts a total value locked of $1.5B.

Given the total of $40B locked in DeFi, Pancake is becoming a reasonably sized player. Curve, for example, is north of $4B, just under 3x the size of Pancake now.

Other DeFi apps are even looking to open services on BSC. Curve hasn’t announced any plans to move off Ethereum, but that won’t always stop other projects from making announcements on Curve’s behalf.

Theoretically, as long as there is sufficient trading volume, there’s little reason dollarcoin stable pools have any need to run on Ethereum. The gas costs of Ethereum, at times peaking above 400 gwei over the past week, look awfully expensive relative to the pennies paid on Binance’s Smart Chain.

Of course, Binance Smart Chain has plenty of disadvantages. For one, nobody pretends the chain is remotely decentralized, making it a scary place to lock funds.

We don’t expect Ethereum will lose its frontrunner status in the DeFi space anytime soon, but we do believe the marketplace will become more fragmented. Any moderately successful chain will inevitably have its own DeFi offerings, relieving some of the burden on the Ethereum chain and thereby restoring some degree of balance.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. The author performs development work for Curve compensated partly in $CRV, all content is otherwise independent.