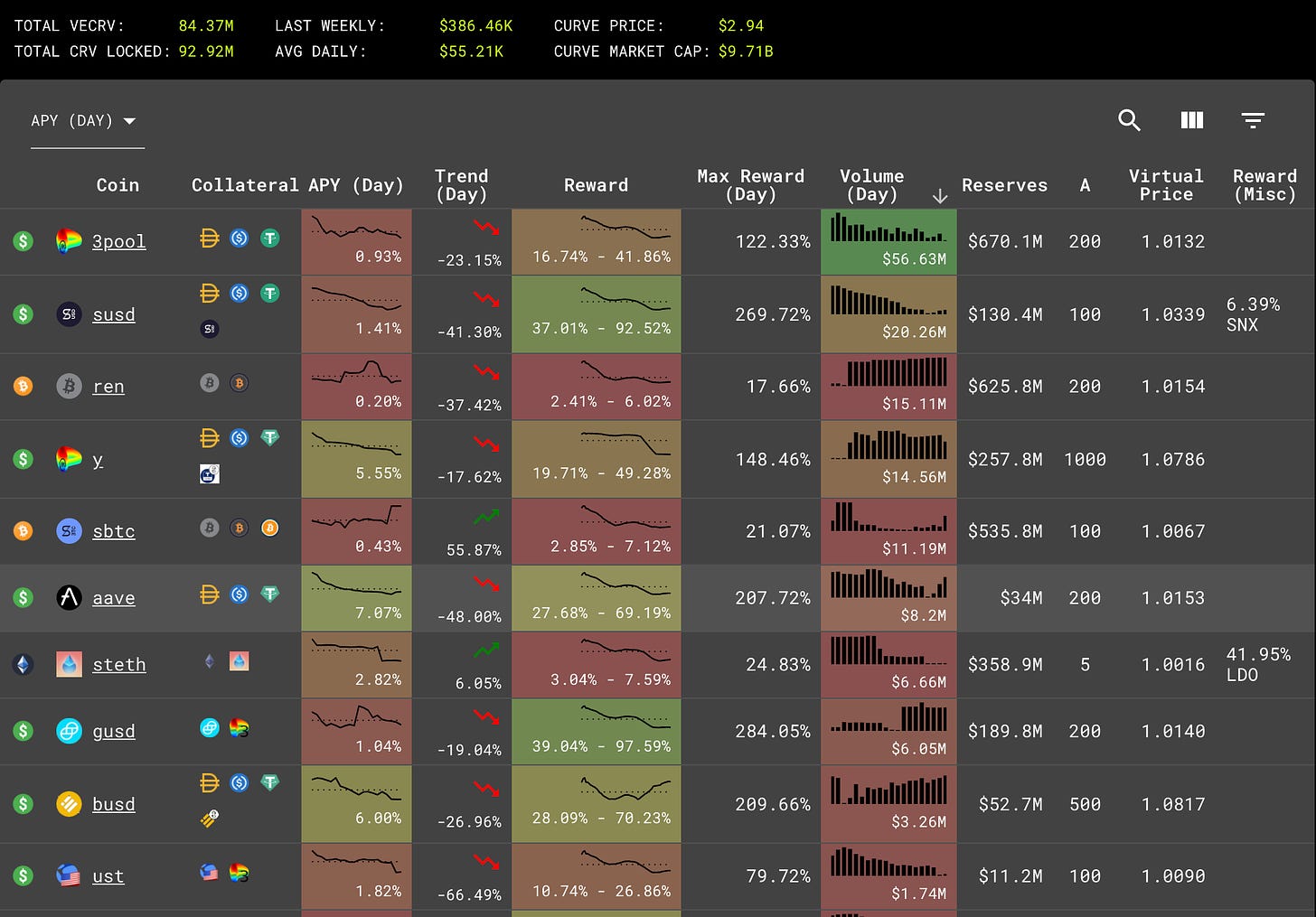

Here are today’s trends to watch from Curve Market Cap.

Today we highlight the third of the three new pools Curve is adding, the $SAave pool. We recently featured the other new pools, $ankrETH and $yv2.

The newest pool is here to $SAave the day! Welcome to the $SAave pool, the fulfillment of sCIP#16 from November 2020, proposed by the DeFi Dollar team.

The pool targets “decentralization maximalists who want to hedge against any particular centralized stablecoin failing.” Unlike many other Curve pools, $SAave has no exposure to Tether, a persistent source of anxiety and FUD.

$SAave is only exposed to two assets, the Aave SUSD and the Aave DAI stablecoins. Both of these can themselves see gains on their own. The proposal notes: “it is common to see Dai, sUSD, giving out 30%+ APR but only for a few hours.” Indeed, the Curve team has teased “interesting rewards to come.”

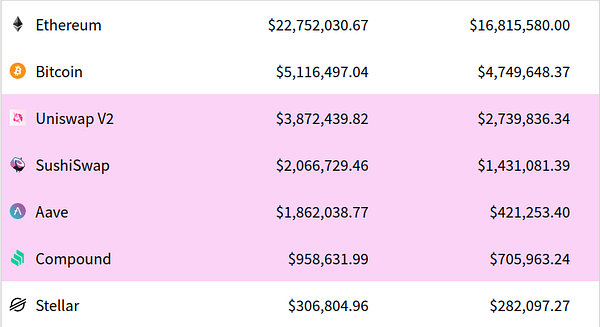

Aave has emerged as a cornerstone of the DeFi ecosystem, recently passing the $5 billion mark.

Aave has definitely been a hit since the first Aave pool launched on Curve in late 2020. The pool now regularly falls within the top ten by daily trading volume:

Like many protocols, Aave is busy actively migrating users from V1 to V2.

The migration efforts have largely been successful so far:

The incentives are nicely set up and growing fast. This week they introduced a proposal to add liquidity incentives for v2:

If you want to learn more about the vision for Aave, founder Stani Kulechov has been hitting the circuit lately:

In the middle ages royalty had difficult relationship with the church. Nowadays thanks to the magnificence of Aave, at least one King has bent the knee:

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. The author performs development work for Curve compensated partly in $CRV, all content is otherwise independent.