Two 🔥 threads dropped over the past week. We’d be negligent if we didn’t give them proper attention.

Defi Made Here

The first mega-thread came from DeFi Made Here, whose profile pic channels early TA pioneer Richard Wyckoff.

It’s overall a thoughtful thread. A few specific points in particular deserve comment.

Early the thread cites a common misconception about trading volume.

There’s a lot of inaccurate data sources for Curve trading volumes, so if future thread000rs ever want to make their death spiral threads more credible, always make sure to default to DefiLlama.

The data shows Curve volumes are not nearly so close to DODO as indicated, but what is up with that .53 utilization?

Admittedly, we’d never even heard of DODO before today, but something is a bit confusing. A heavy chunk of DODO comes from something called $ALTA, which doesn’t appear to exist on CoinGecko or CoinMarketCap, so not quite sure what to make of it. Anyhow, Dodo volume is seemingly trending down, so maybe just some funky data? #Extinction

That said, although the specifics of Curve trading numbers may be off, Ser Made Here’s point that Curve should increase its trading efficiency is directionally correct — after all, who wouldn’t want to see Curve improve liquidity utilization?

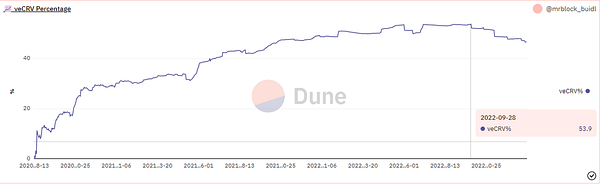

The strongest piece of the thread is pointing out the recent decline in veCRV locking.

We’ve also drawn attention to this trend, though this narrative doesn’t appear to have gained traction with the general public. We’ll know it’s penetrated the mass consciousness when death spiral0000rs start routinely hammering Curve on this point. At the very least, we feel “veCRV locking FUD” has more credibility than the insipid and unsubstantiated “price bad FUD.”

The bulk of the thread points to the fact that it would be beneficial for Curve to increase trading volumes. We imagine nobody particularly disagrees with this point. In fact, a common refrain from the main Curve Twitter account is its emphasis on celebrating periods of high Curve volume and its effect on trading fees. In our experience, the Curve core team cares significantly about trading volumes, and cares quite little about the highly speculative $CRV price.

An understated corollary to the thread is the acknowledgement that Curve’s high inflation is indeed a transient phenomenon (provably transient, not a punchline like the Fed’s “transient inflation.”)

Curve inflation is on a similar schedule to Bitcoin, though Curve may be on a path to generate sufficient trading fees to cover its emissions far quicker than Bitcoin. $CRV flippen $BTC watch?

In other words, it would undoubtedly be preferable if Curve trading fees ramped up aggressively in 2023, but it would be sufficient for Curve to merely survive until emissions reduce in maybe 2024.

In interviews, Curve chad founder Mich has always expressed this long-term view: his thesis appears to be $CRV valuation as a simple exercise in identifying the intersection of decreasing inflation with protocol revenues.

Defi Cheetah

A second notable thread came from @Defi_Cheetah. The thread alludes to @Defi_Made_Here, but doesn’t serve as a direct rebuttal. Instead, Ser Cheetah lays out a bullish case for Curve as a trading platform, and strongly bearish on Uniswap.

The first key argument in this thread is the concept of “pricing power.” DeFi Cheetah posits that for any asset, it will primarily be traded at one particular source, which has “pricing power.” Alternate liquidity sources play catch-up to the source of pricing power, and thereby suffer the effects of short-term price discrepancies.

Ser Cheetah cites Curve as having pricing power over stablecoins by way of example: when a coin is depegging users check Curve to know the “actual value” of the coin. **cough cough USDD**

We don’t disagree with the concept, though we’d be interested to see smarter minds than us express “pricing power” as a strictly quantitative phenomenon, as opposed a qualitative phenomenon.

Defining pricing power as the “largest source of liquidity” would seem incomplete: Ser Cheetah cites Curve as the source of stablecoin pricing power, but for USDC/USDT their respective issuers have the most liquidity and fix prices at 1:1.

Similarly, might the “highest trading volume” may be considered to have pricing power? Yet Curve was cited as having pricing power for stablecoins, but Uniswap has higher volumes.

To the point that one source leads and all else bleeds, we agree. Ser Cheetah expands on this point to suggest this causes toxic order flow.

The concept of “toxic order flow” is the subject of a prior thread which is mathematically heavier, but critical to understanding this thread. The ELI5 version is that if arbitrageurs “take” profit when pushing any given liquidity pool towards a peg, in a zero-sum game they are taking from LPs who absorb the business end of the mispricing.

To flesh out the bearish $UNI thesis, Defi Cheetah argues that Uniswap v3 does not have pricing power (evidenced by the fact that 70% of volume is reactive trades in the form of MEV bots taking profits). Lacking pricing power, the always tormented Uniswap LPs end up suffering from toxic flow and other ill effects.

However, Uniswap isn’t in a position to do much. A potential “fee switch” for Uniswap would further erode LP profits. So Uniswap is left with a token that has no utility, a protocol without revenues, and a heap of trouble. Bearish!

Our Take

Both threads articulate important thoughts on what could cause a “death spiral” for both Curve and Uniswap. Given how many people we’ve seen rekt in cryptocurrency over the past year, we want everybody to be aware of any possible risks.

However, we take exception to death spiral predictions for both $CRV and $UNI. In our opinion, the theoretical concerns of death spirals are too frequently countermanded by the experimental evidence: neither has death spiralled in reality.

“The great tragedy of science - the slaying of a beautiful hypothesis by an ugly fact.”

—Thomas Huxley

For the case of $CRV, concern trolling about what would happen amidst negative price pressure has become so common as to be utterly cliche. The real flippening will be when $CRV death spiral claims outnumber Tether FUD.

The past year has provided ample evidence of precisely how Curve will function amidst negative price pressure. It has been… fine. In some respects, better than it performed at the top.

We don’t know exactly why prior thread000rs deleted their takes, but it’s entirely possible it’s because past predictions simply didn’t age well.

We’d argued at the time that $CRV death spiral arguments would need to address the real smoking gun: the price correlation between $CRV and $ETH, and consequently the myriad coins also correlated with $ETH. If price of $CRV declines alongside everything else, then yields hold up proportionately.

None of the FUDsters bothered to respond to these argument. We’d argue our take has aged exceptionally well, as everything played out exactly as we predicted. Not that predicting things correctly has ever persuaded anybody, but maybe we can print it out and pin it to the refrigerator. If you’re interested in why failed prophesies cause believers to harden their beliefs, go reread When Prophesy Fails. In other words, why Curve’s persistent survival will continue begetting Curve death spiral000rs.

One final point on the subject of $CRV price, where I somewhat disagree with both thread000rs, is that the entire Curve ecosystem is necessarily beholden to the price of $CRV.

My simple counterargument to this claim would be that the largest Curve pools by TVL are all almost entirely not directly dependent on $CRV emissions. About two thirds of Curve liquidity are yielding in the low single digits.

This is most strongly the case with $LDO, which completely foresakes $CRV governance in favor of streaming its own $LDO token. In this case, the team uses Curve due to the fact that Curve’s proprietary pool format is useful for peg mechanics (or possibly for historical inertia). Whatever the reason, it’s the most successful pool by TVL.

Indeed, the top five pools all carry rather low $CRV emissions. They are all dollarcoin pools with yield inferior to treasuries. For 3pool and Frax/USDC they are successful as building blocks for other pools, which are themselves incentivized — the property that makes these pools successful is moreso the composability within the Curve ecosystem, and only indirectly via emissions.

We of course agree that if $CRV decoupled from other ERC20 tokens and rapidly dropped to zero, it would still have a devastating effect on the ecosystem. Absent other actions, LPs would flee, protocols would move on.

However, we’ll note Curve existed successfully launched and operated for about a year without any $CRV token. We presume it theoretically possible the entire ecosystem could readjust to operating in the absence of $CRV emissions, albeit the protocol’s influence would be a mere shadow.

Finally, to throw some cold water on my own team, I’d also argue that the same observational evidence that rebuts the “$CRV death spiral” can also be used to rebut the “$UNI death spiral” argument. There’s a million good arguments for why the $UNI token is dogdung and properly valued at $0, and why LPs should stay clear of Uniswap pools to avoid getting rekt.

Yet all the rock-solid theoretical arguments in the world can’t change the fact that, in practice, people still buy $UNI and add liquidity as LPs. It may offend all logically thinking persons, but we can’t argue against our lying eyes. Perhaps it’s just “greater fool” theory on steroids, but until we actually observe any evidence of systemic Uniswap decline, we can’t give it credence.

Our view is that both Curve and Uniswap serve important roles in DeFi. In fact, the more competitive AMMs that exist, the better. Curve focuses on high liquidity, low fee and low slippage trades, which tends to fill a niche for whales. From our perspective, Uniswap appears to focus on smaller size trades along the longer tail of assets. The latter may be a better fit for tokens themed around canines and vulgar body-fluids, while the former may be a better building block for DeFi, but both serve a useful purpose.

Disclaimers! Author holds $CRV, no $UNI, and just one doggie-themed token

Final assessment is spot on.