We know Fridays are ordinarily for Llama Parties, but today’s tentative guest got… shall we say… deluged by events this past week.

So much going on the past few days, but here’s the most important four updates to be aware of:

Curve Fee Switch

Bad Debt Cleared

Llama Lend Leverage

Curve Wars

Curve Fee Switch

The vote on switching Curve fees from 3CRV to $crvUSD is live!

And unlike other protocols, this fee switch may actually happen… even despite the fact that it’s not actually certain to go through. There are a lot of people who prefer other tokens to earn fees… $CRV, TriCRV LP tokens… the list goes on…

For some more background, this has been in the pipeline for almost half a year. Good things take time…

Uptober 23, 2023: The $crvUSD Fee Switch 🎚️💸

Did you know that Curve is discussing a fee switch? By “fee switch,” we are literally referring to switch-ing the token used for collecting Curve fees from $3CRV to $crvUSDcrv.mktcap.eth is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Make sure to vote early and vote often!

Bad Debt Cleared

It was already cleared by about 90% by the time we published yesterday, but the remaining bad debt has been fully expunged from the system.

Mich has a ton of ideas for how to use the events to make Llama Lend even safer, which we’ll hopefully profile next week if no more black swans show up…

We’re preparing a post on the “worst takes” we saw in the aftermath of yesterday’s liquidations, but the insinuation that his behavior was intentionally malicious are particularly obtuse takes. His actions for the past several years speak quite clearly, but most particularly his work yesterday to clear up the bad debt in Llama Lend.

LLama LLeverage

Three leveraged long markets up on Arbitrum!

More resources:

Be careful, as leverage tends to be one of the main sources of losses. So you can still lose big even if the platform is the “safest”

Repeggening

We are delighted to see that despite the traumatizing events of the past 24 hours, the upshot is a frenzied interest in $CRV wrappers.

$sdCRV has been on an absolute tear

Nor does it seem to be the effect of a single major lock

A big beneficiary was Concentrator

Also, worth keeping an eye on Convergence if you are among the new $sdCRV stakers

Not to be outdone, $yCRV is also ticking back to peg…

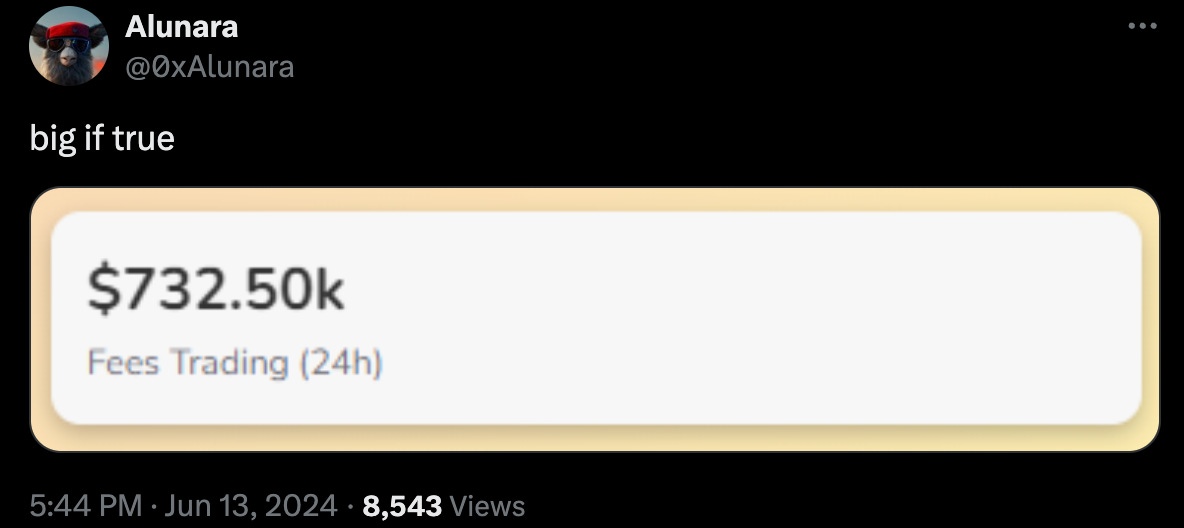

Pretty soon this 🌈✨ will resolve into a real number, and given the events of the past week, it’s possible it could make the haters even more jelly…

For more on the various wrappers:

May 2, 2024: Wrapper's Paradise 🎁📄

We’re doing everything we can to promote this good writeup by the legendary Pilot Vietnam, comparing Curve wrappers: They all earn rewards in a bit diff ways and have tradeoffs. For example, locking veCRV directly on Curve you know you'll exit 1:1 but of course you're not liquid. You can also earn around 35% right now, including bribes. those bribes have…

For more on $yCRV’s recent efforts: