June 20, 2022: If You Wanna Synthesize, I Empathize 🎹🎛️

Synthetix Hits $200MM Daily Volume

They keep tryna’ say DeFi is dead. Unfortunately for “them,” Curve keeps stubbornly thriving.

Depending on your favorite coin, you can pick the bull thesis that suits you.

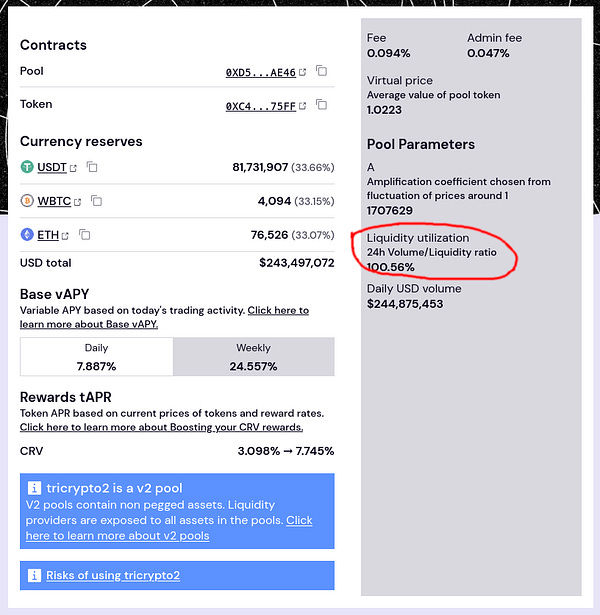

If you investigate these heavily utilized pools, you’ll notice the action is not just in v2 pools, which have really cleaned up on the recent crypto volatility. Now it’s also the Synthetix pools ripping.

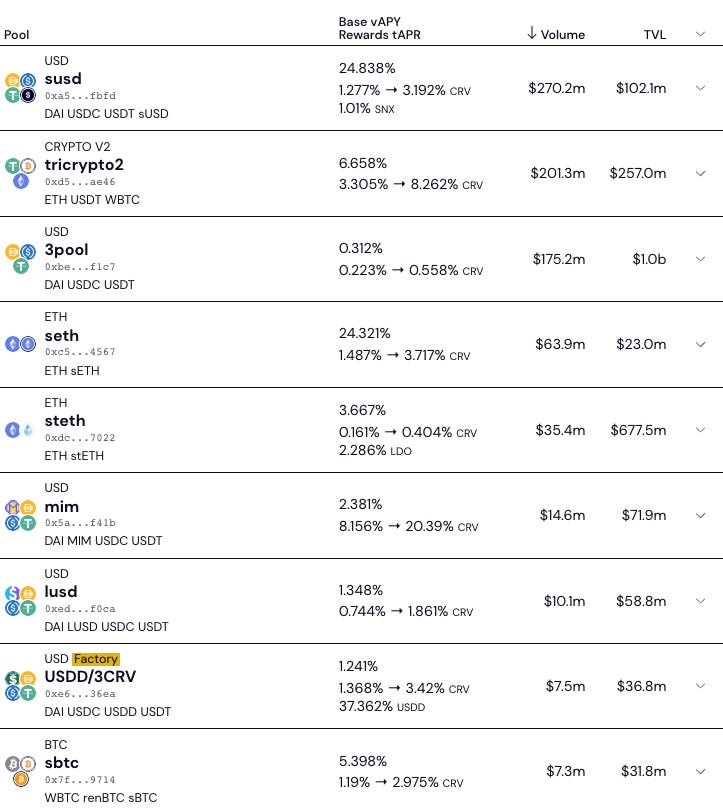

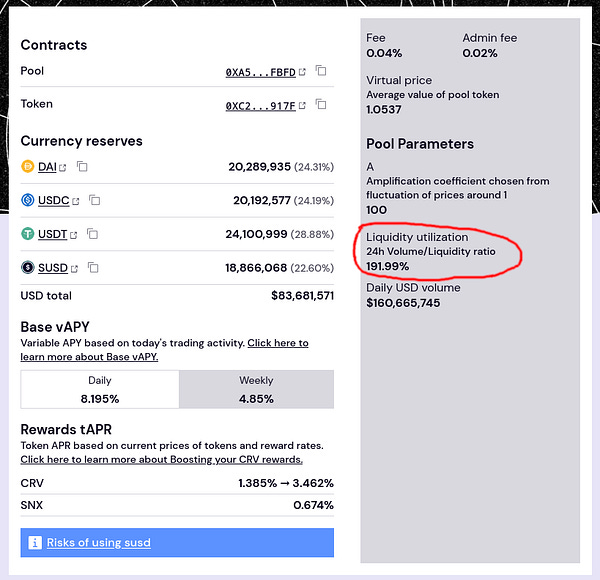

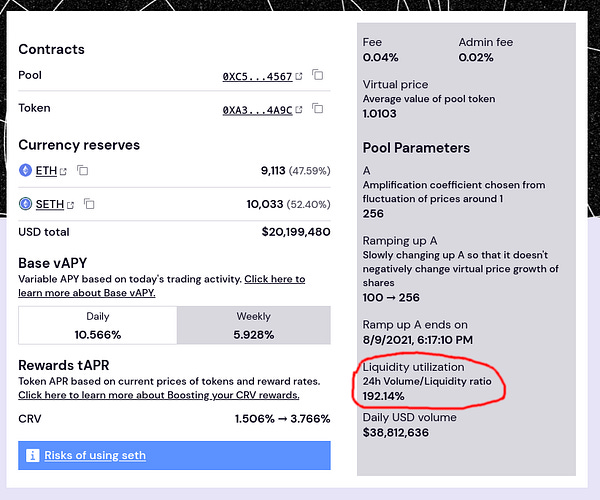

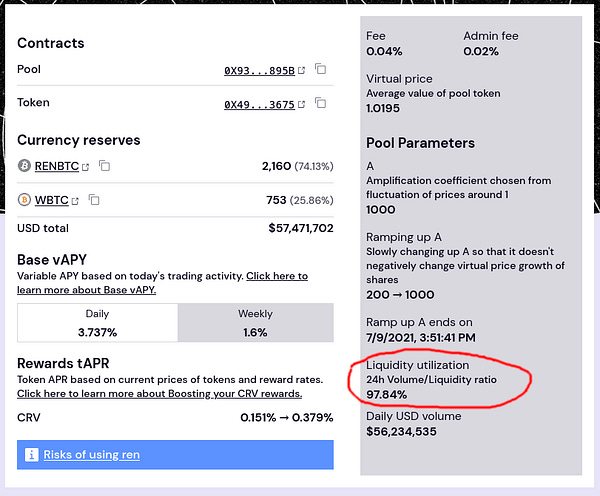

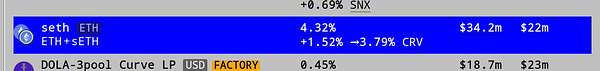

The Synthetix revolution also reflects on the list of Curve’s top pools by 24 hour volume.

The list is well represented by Synthetix pools (sUSD, sETH, sBTC). In some cases, these pools are showing even higher trading volume than TVL.

Notice also for Synthetix pools, the trading fees are significantly larger than $CRV emissions. Yet further evidence against the utterly baseless “death spiral” hogwash.

Naturally whenever you see double digit returns anywhere in DeFi, you should be skeptical. Always study carefully before you ape. So what exactly is going on here? What’s got our Willy so aroused?

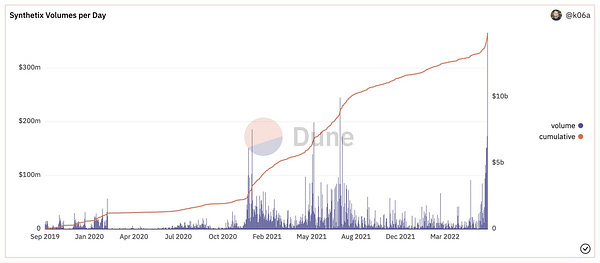

In fact, the groundwork for Synthetix’s recent success represents the fulfillment of hopium from as far back as April 2021.

Back in this bygone era, before Nayib Bukele would become a household name, Synthetix was already mapping out their path to domination.

At the time Synthetix, had already created an on-chain way of transacting among differentially priced assets. Synthetix created tokenized versions of popular assets and allowed conversion among these assets on their platform, with Curve pools used to wrap and unwrap from Synthetix to the base asset.

From a mechanical perspective, it all worked flawlessly. However, it would take about 6 minutes to settle the transaction, far too slow for busy Zoomers.

At the same time as this was kicking off, erstwhile degen Andre Cronje also pioneered SIP-120, which would be instrumental in tightening the process.

We’ve seen several instances of protocols getting hosed through improper utilization of price oracles, which can be tempermental in periods of extreme volatility. SIP-120 provided an improved method for cross-referencing prices. Specifically, it compares Chainlink prices (subject to update latency), Uniswap v3 TWAP (lag behind spot), and Uniswap v3 spot (subject to flashloan/sandwiches). Using all three can get reasonable price and trigger a circuit breaker in times of extreme volatility.

It would take over six months to implement this properly, finally going live in November:

With SIP-120 live, it suddenly became possible to run atomic trades. This allows for cross-asset transactions to take place within a single block. The implementation of the functionality was the subject of SIP-198. Earlier in June, further tweaks were put into place to make life even friendlier for traders, allowing for settlement of trades at the Chainlink price and expanding destinations beyond sUSD.

The last piece to make it click occurred when 1inch did the heavy lifting of integrating this into their aggregator. Busy apes can’t always bother to shop around for the best prices. Therefore the key to driving usage is to offer superior rates and hope aggregators will think to include you in their routing.

Fortunately, 1inch is well-incentivized to sniff out these best rates. The protocol earns money on positive slippage, so they have plenty of reason to find trading bonuses like can happen periodically on Curve. The 1inch integration caused Synthetix volume to explode, passing $100MM into the $200MM daily territory.

One shouldn’t expect Synthetix is going to stop with 1inch. The team is working on integrations with Paraswap and additional services.

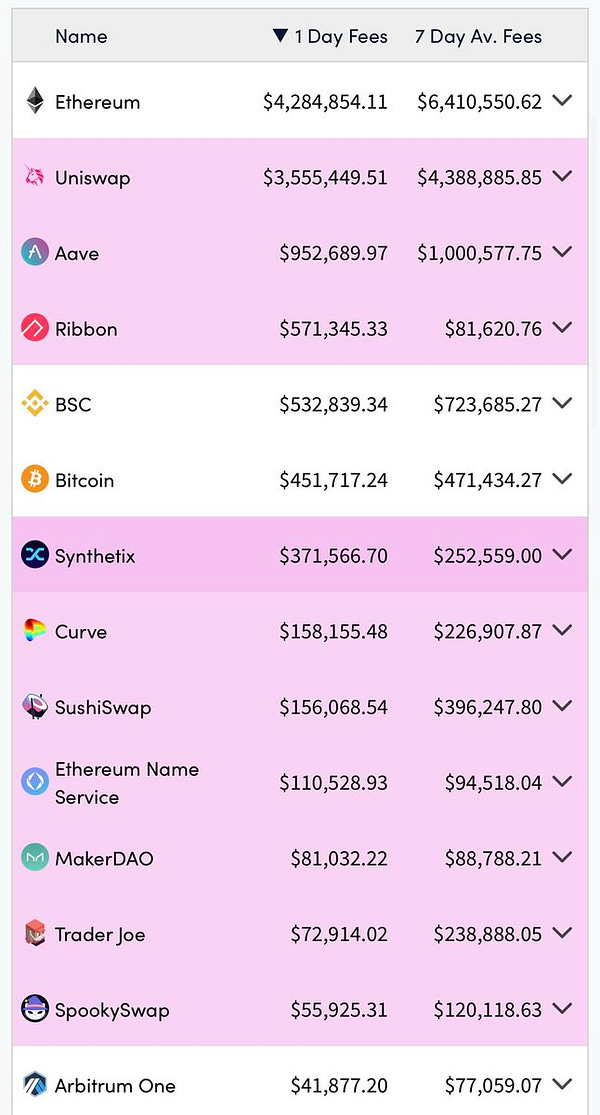

The fees $SNX collects from this uptick in activity flow to $SNX stakers, which are suddenly hitting 6-7 figures daily.

Although CryptoFees.info data cited in the above tweets are often disregarded because they badly undercount Curve fees (it’s very difficult to measure v2 fees in realtime), their tally of Synthetix activity passes the smell check.

A confluence of traders rushing into $SNX to capitalize on these trading fees happened at the same time the snakebitten Celsius team is allegedly shorting the token. Whoopsie.

All this good fortune for Synthetix is finally earning the team its propers across the crypto ecosystem.

Fortunes are made during the bear markets. The champions of the recent dip are DeFi protocols and I’d be highly skeptical of anybody who claimed otherwise. Congrats to the Synthetix team on the well-earned success!

Thx also to themerge.eth for the great thread and sharing resources:

Disclaimers! Author has exposure to $sETH.