In addition to comparing tokens, you can also see chart history of the LP token price, and see a log of activity in the pool.

Governance

Yesterday, we began covering the first half of governance action affecting Curve, with a focus on the pieces touching $crvUSD.

June 20, 2023: Post the W 📣🎉

The Curve ecosystem is becoming so active, it threatens to flippen itself with each new week of governance votes. We’re preparing a pair of posts covering all the recent governance action. Today we cover all the latest votes affecting $crvUSD, tomorrow the remainder…

Of course, we can’t type as fast as the fast-paced world of DAO governance. Since this article, a new $crvUSD pool has already been launched and submitted for a gauge vote, with $SUSD now joining the ranks of $DAI and $MIM in pursuing a gauge vote.

We’ll mostly leave the subject of $crvUSD and focus on other DAO votes going on at the moment.

TriCrypto:NG

TriCrypto:NG remains the understated hero of DeFi Summer 2023. For the moment, keep an eye on the aggregators. As support for next generation TriCrypto pools pick up, the aggregators increasingly prefer routing through the gas optimized pools.

TVLs remain below the classic Tricrypto v2, but we can see users are already abandoning the legacy pool for what will surely be better incentives.

At the moment, migrating to the new NG will roughly triple incentives, from ~7% boosted to ~21%…

Or you might hold out for the newest kid on the blockchain.

Over the past week, we witnessed the birth of TricryptoLLAMA. This new pool is an interesting blend:

$crvUSD for the dollar coin

$wstETH for the Ethereum component

Threshold Network’s $tBTC for the Bitcoin piece

This pool may become a popular route for $crvUSD to be traded into BTC/ETH. It may also become a good option for speculative LPs, who can supply $crvUSD into the pool if they believe BTC/ETH are likely to appreciate in value with less exposure to volatility. Observe the Tricrypto v2 LP token price history through the roughest patches of the bear market.

TricryptoLLAMMA is up for a gauge vote! Vote now, or read up some more details on the governance forum.

Presuming the gauge goes live, it may be worthwhile to park yourself early into the pool if you’re looking at migrating from TriCrypto v2 to one of the NG pools. The Threshold Network plans to incentivize this pool.

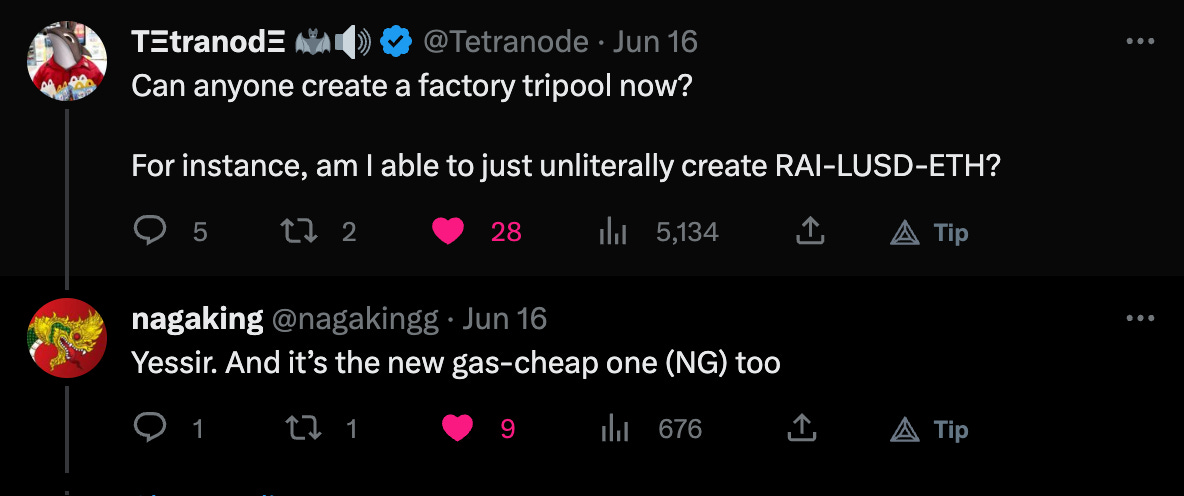

We also note the three Tricrypto:NG pools have been launched directly through a factory contract onchain. It’s fully possible for anybody to deploy their own Tricrypto pools, although without the UI you have to be a wizard at interacting directly onchain to accomplish this. Expect many more interesting trios to pop up.

Gauge Votes

The Curve DAO is voting on a variety of other gauge proposals this week. We haven’t dug into these to be able to issue recommendations (and our recommendations would just defer to the Llama Risk team anyway), but we’ll list them out here at a very high level:

Current Gauge Votes

ALD/ETH

You may have followed many of Aladdin DAO’s projects, Concentrator, CLever and more recently f(x) protocol. $ALD is the token that ties it all together.

Coming soon!

ZUSD/FraxBP

We previously detailed Zunami Protocol:

April 5, 2023: Here Comes the Zunami 🌊🚢

If you’re hunting pure stablecoin yield, you may find yourself tempted by the Zunami UZD/FraxBP pairing, currently in fourth place by yield among pure dollarcoin pools.

While it looks promising, note that we’ve yet to see a Llama Risk report on the protocol, so we’d probably hold off until the team has had a chance to review.

DOP/ETH

We thought this might be something new from Dopex, but actually is an NFT-fi protocol named Drops. We know nothing about this particular protocol, so recommended to do your own research!

Recently Added Gauges

Tomorrow is Thursday, which means changes to gauge weights!

Remember when you see screenshots of sky-high APYs getting shared that newly streaming gauge rewards don’t often last. Still, it can be beneficial to be early. Recommend to pay attention to this page ahead before new rewards kick in and you might be the first to drink from the faucet.

Here are few of the pools that just went live demonstrating this effect.

ETH+/ETH

Definitely interesting, though it’s cooled off to casual 26% as TVL nearly tripled.

PENDLE

This one, on the other hand, is still delivering about 18%, and Pendle is making a lot of noise lately.

3 legged tricrypto llama. nice!