The USDP pool is overflowing with over $100MM in volume the past 24 hours.

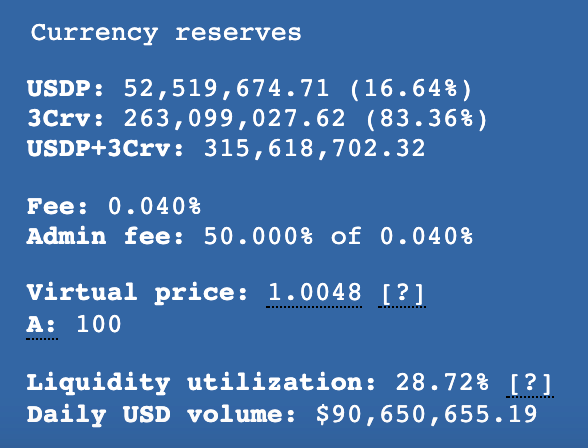

Most of this volume represents a massive outflow of USDP, resulting in a major imbalance in the pool, (sitting at 71-29% as of publication).

This drawdown opens up what you might characterize as an arbitrage opportunity, if you presume USDP will correct course. A rival duck spells it out in fine detail:

At the moment USDP trading slightly below its peg, the exact opposite of the May nuke, when it traded slightly above.

The crux of the panic, as we detailed yesterday, is the discrepancy between MakerDAO slashing their borrowing fees at a time Unit Protocol maintains much higher fees.

A feisty Telegram discussion covered the difficulties of attracting supply if the fee would be greater than yield farming, which is USDP’s primary use case.

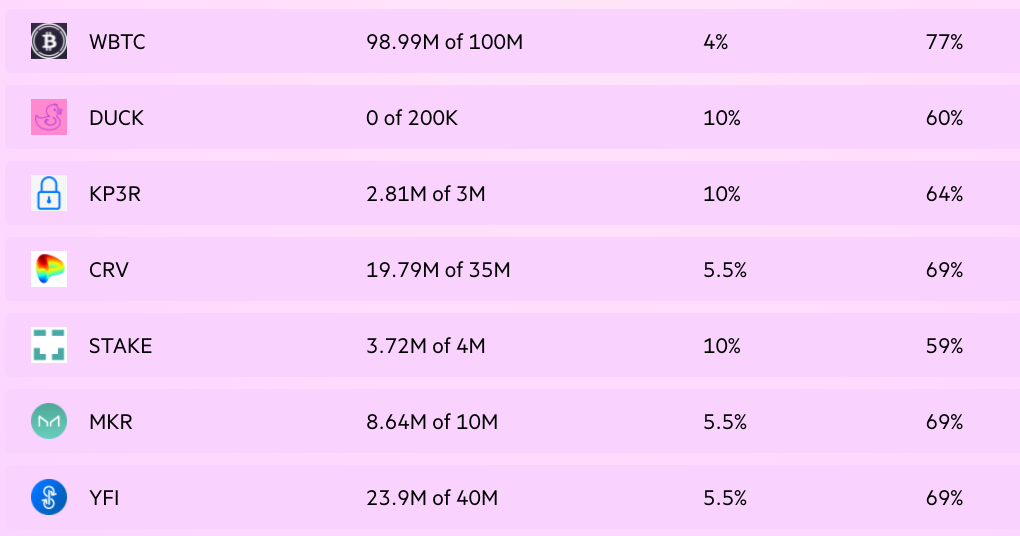

At the moment, most of the Unit Protocol assets remain close to maxed out, with a few notable exceptions.

The 0/200K DUCK token has been doing nothing but sinking over the past several months.

Will Unit react to become more competitive?

The protocol still has several fans.

However fans count for precious little in a space where all loyalties are to optimized return.

Other protocols are smelling an opportunity to vulture up the émigrés.

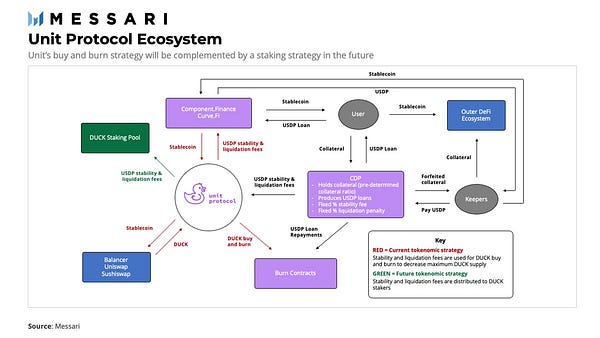

If you’re not familiar with the mechanics of the duck, good on you for reading to the end anyway! You might try reviewing this recent report by Messari and rereading to see if it makes more sense:

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist and has a position in the $USDP pool.