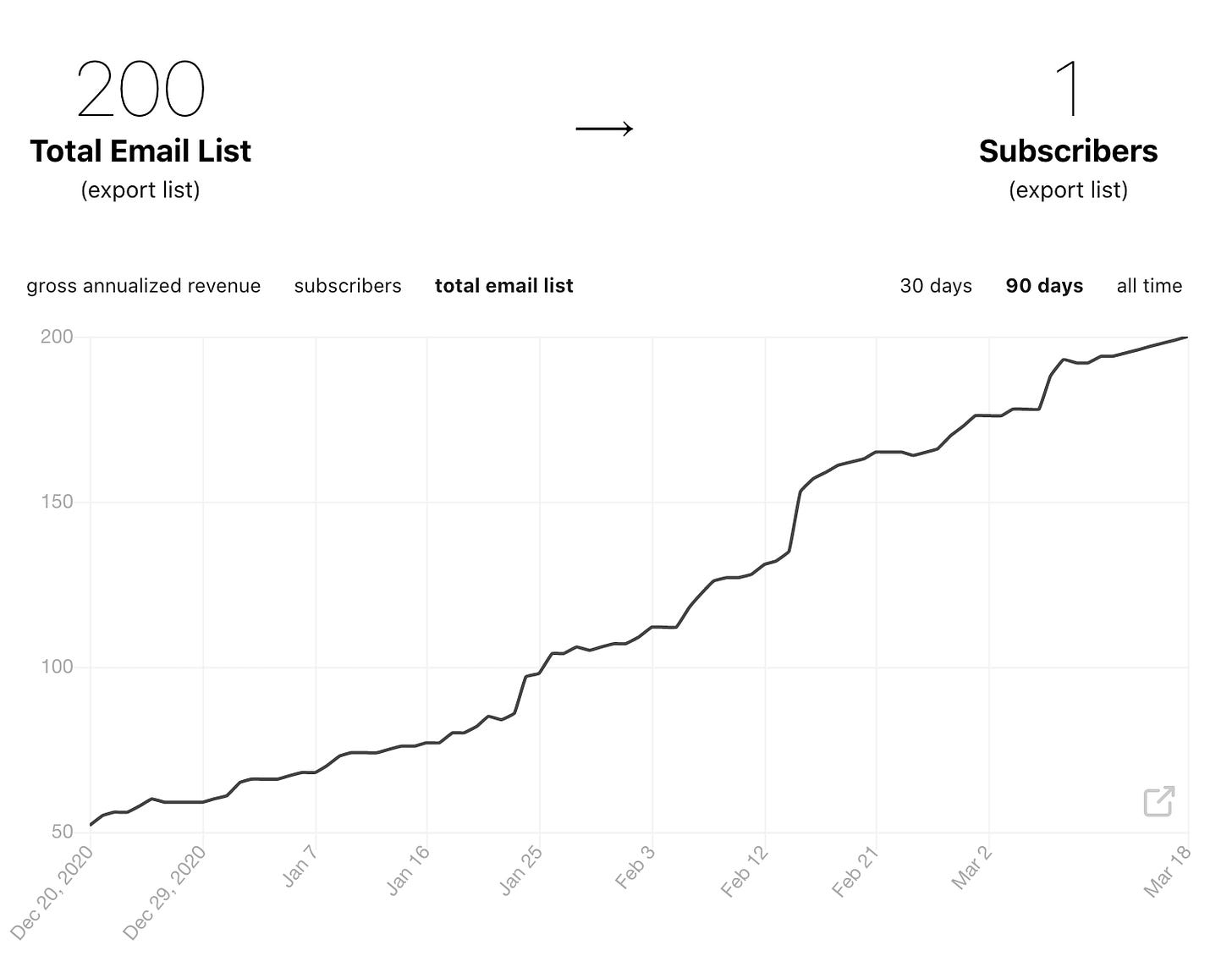

March 18, 2021: 200 Subscribers + 200 Gwei Gas 💯💯🛢️

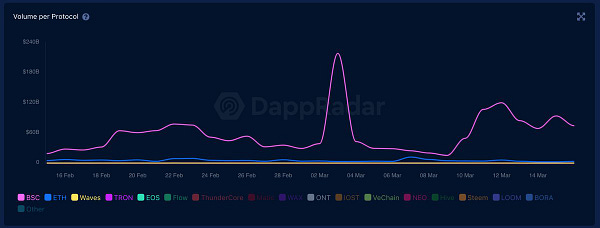

DeFi usage flows to cheaper chains amidst rising transaction costs

Thank you for getting us to 200 subscribers! Given that there’s maybe a hundred users in this entire industry, it’s a very exciting milestone for us. We’re glad so many of you enjoy our lewd jokes and crude understanding of DeFi. Thanks in particular for everybody who has shared, forwarded, commented, or engaged us in any manner.

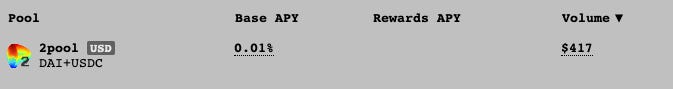

Gas woes remain a major problem across the Ethernet. Except, of course, if you happened to win the lottery by being early to Curve’s $TUSD pool, which put up numbers reminiscent of TRON’s supply.

Calm down apes — the first few hours of any Curve pool are always skewed. It’s since fallen back to earth a bit, sitting at a healthy but not quite Anchor-healthy 17.5%..

For any peasants who didn’t manage to catch lightning in a bottle, you’re probably still worried about gas. Nowadays, gas prices under 100 gwei are even rarer than active Solana users.

As we often point out, whales don’t care about gas prices, and Ethereum is a whales-first network. Gas prices only squeeze out the crypto plebs.

For example, consider Yearn’s awesome new integration with Zapper.

It’s a great service that’s generating a lot of buzz. It’s just not very advisable for small dollar transactions.

What is being done about high gas prices? Ethereum appears to be modeling the L2 rollout on EU health officials’ vaccine distribution strategy:

One handsome gentleman tried arranging a party bus to save people gas money. The consequences were disastrous.

While people wait for gas prices to calm down, a lot of activity is demonstrably moving to other chains.

BSC gets a lot of attention, but many people still have concerns about possible centralization, a claim CZ flatly denies.

Interestingly, in the recent hacks of Pancake and CREAM the centralized points of failure appears to have been GoDaddy

An active poll by Ankr suggests much of the mindshare is moving to Avalanche.

Avalanche has indeed been moving swiftly to bring as many integrations onto their chain as possible.

Another chain to keep an eye on is Fantom, on which Curve officially launched. At the moment volume on Fantom is low, but the Curve team have historically been quite good at predicting the future.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Newsletter is an independent roundup of interesting trends in cryptocurrency, never financial advice. Author is a $CRV maximalist, also keeps a little $ETH lying around.