Slow weekend? Seems as if everybody was caught touching grass….

Except Curve, of course, busy as ever building out Llama Lend. Devs are shipping? Bearish!

Sure enough, after weeks of harping on the subject, we finally see the first activity in the $CRV short market…

Congrats to whomever just secured generational wealth.

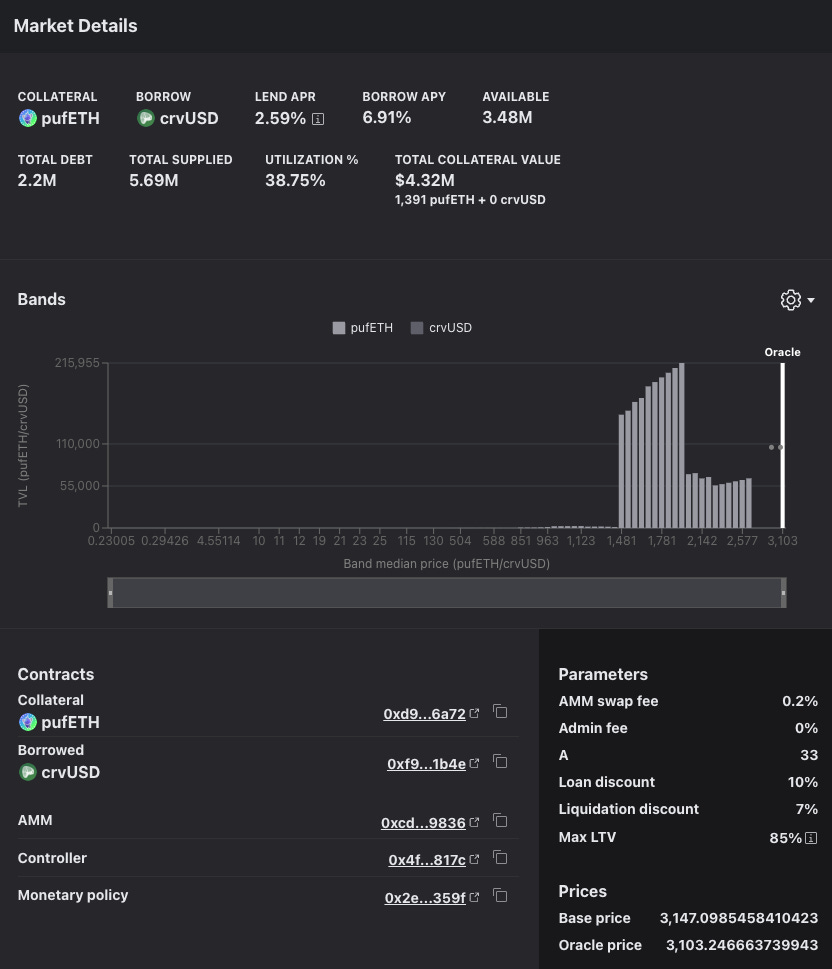

pufETH

Much of the action this past weekend was in the new $pufETH markets, as part of the continuing experiment in lending markets for ETH restaking. For more background, check our prior writeup:

But DeFi is supposed to be fast, right? So how to get some action kickstarted into this market…

You can glimpse the method behind the madness here. Don’t disappoint the death spiral00rs, but at scale lending markets don’t necessarily need incentives. The natural supply and demand should simply equilibrate with the broader market.

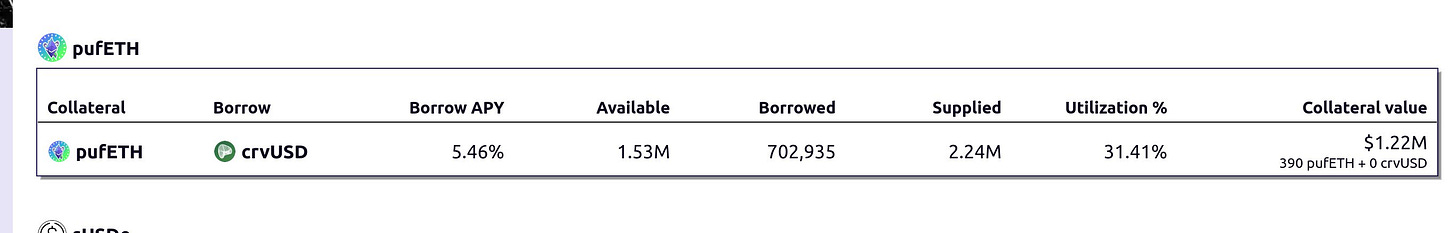

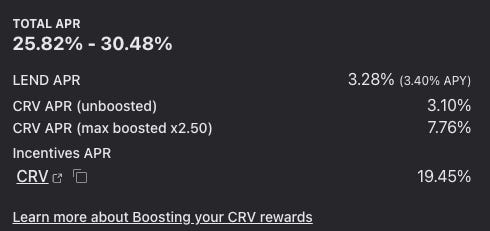

But at the moment, Curve is impatient for results and paying for acceleration. Here’s how it looked a few days ago:

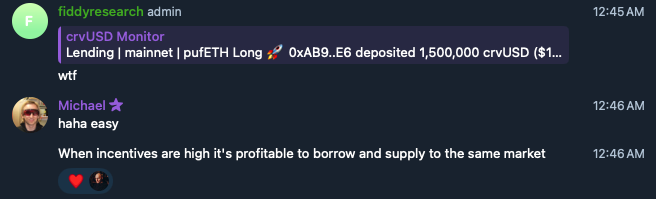

Then some gasoline got tossed onto the fire…

And about an hour later it started to stir…

The Curve Monitor channel watched as one trader quickly traded back and forth within the same market…

Fast forward to the end of the weekend, it would reach equilibrium at 5.69MM supply.

Supply rate stabilizing around the general range of markets

It’s part of our continuing saga in which we wonder whether or not markets are efficient, and if so, who makes them efficient.

May 13, 2024: Short Sighted? 🙈🧑🦯

The Efficient Market Hypothesis is almost more of a paradox than hypothesis. If markets are inefficient, it implies there’s free money just lying around — not usually the case, right? If markets are efficient though, then how did they become efficient? Somebody had to make a trade to bring it to equilibrium, and therefore they existed in an inefficient state.

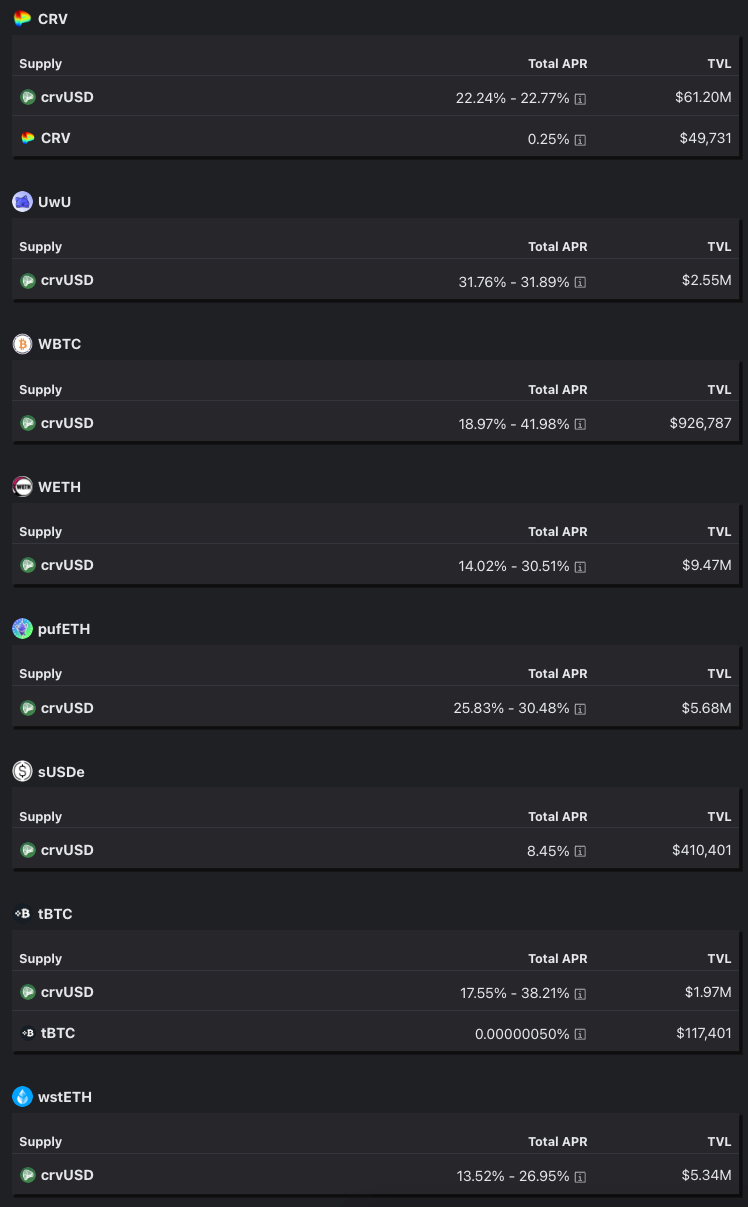

The supply APR for the Llama Lend markets theoretically tells us the next chapter of this story…

The more current snapshot…

In nearly all cases, these are above market rate for stablecoins, 20% or even as high at 40%. In theory, the higher rate means higher risk. In this case, it implies that supplying to the smaller Bitcoin markets ($3MM TVL between them) are higher risk, while the $CRV market that yields just 22% (with $61MM TVL) are judged as lower risk.

Or could it be that markets are in fact inefficient?

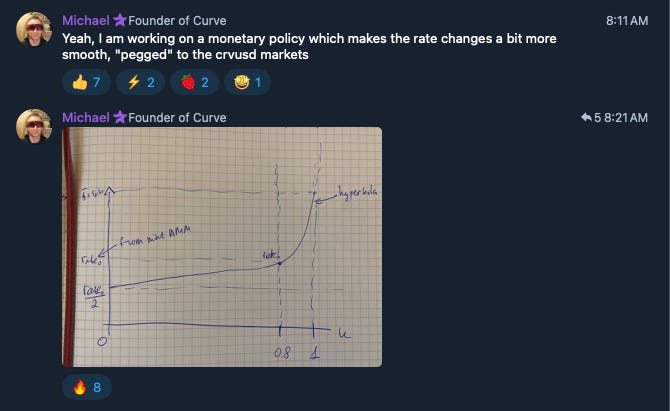

We can catch a glimpse of this with the new Secondary Monetary Policy…

But this article is getting too long so we’ll leave this for tomorrow…