Another phenomenal read by Llama Risk on the before/after of the $CRV hack, as well as how various lending markets handled the events.

The piece highlights how some protocols, such as Aave v2, were forced to move quickly through governance to limit potential contagion. Fraxlend needed no governance action, with its clever design providing good terms in good times and predatory terms in hard times.

Where some protocols were forced to rapidly shutter the door to $CRV after the collapse of CRV/ETH, several others moved quickly in the wake to capitalize on the turmoil. We’ve previously looked at Silo Finance, which was the biggest beneficiary.

August 21, 2023: Silo Llama 🧑🌾🦙

Friends! We joined Friend.tech despite our asocial tendency to ignore most new social media. So far we’re impressed by several facets of the UX, such as the mobile-only interface that bypasses the app store and the backgrounding of the cryptocurrency and bridging elements.

And markets liked it!

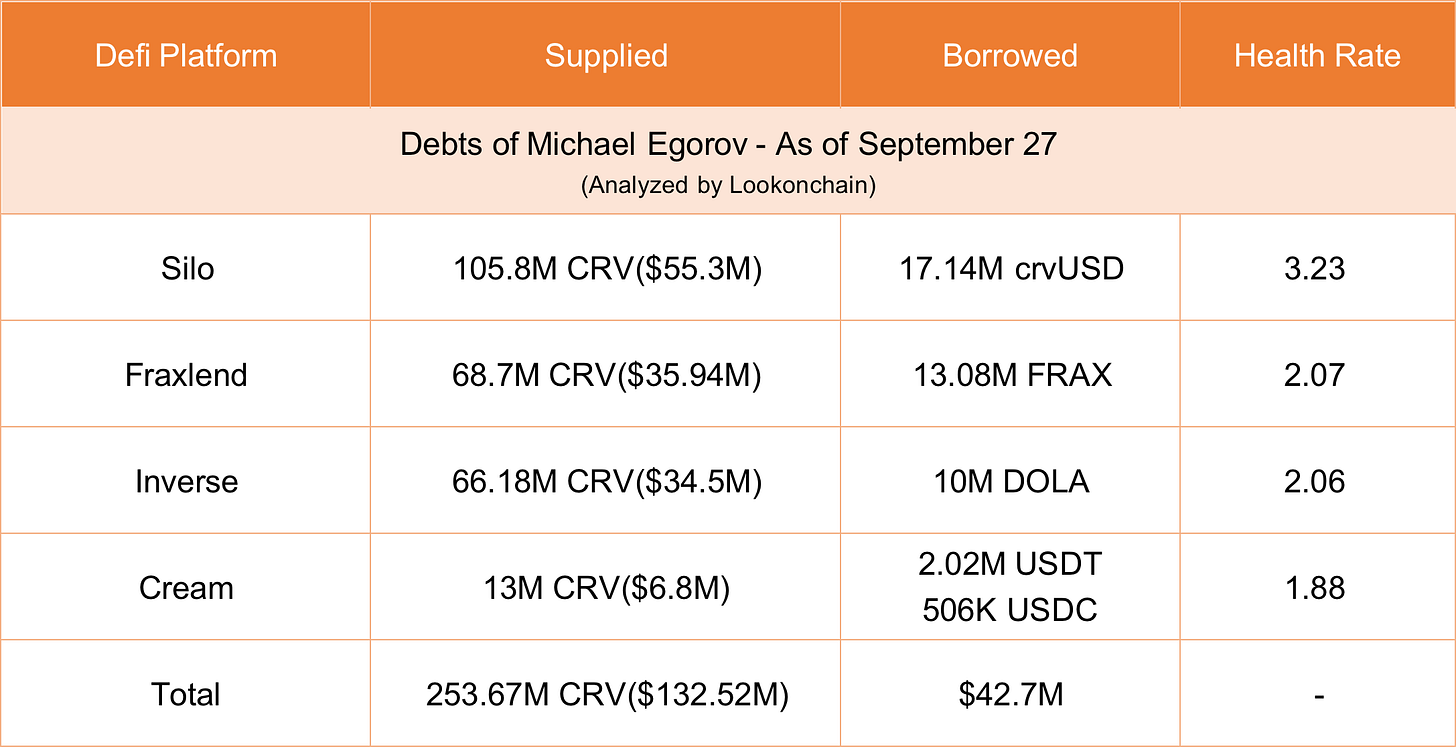

We also looked at the ultimate destination of all of Mich’s $CRV tokens, as Silo received only a plurality of the master trader’s largesse.

September 27, 2023: A New Era 🌄🌅

It’s the end of an era! Several years, dozens of thread000rs, and millions of eyeballs. All amounting to precisely zilch. In a just world, everybody who inaccurately predicted a bloody outcome to this chapter would be forced to watch as their own reputations death spiralled towards a karmic zero.

Although Silo benefitted the most, the spread was rather even among Silo, Fraxlend, and Inverse, with a token amount tossed toward CREAM.

In our opinion, the case of Inverse was arguably the most interesting.

Inverse

Immediately in the aftermath of the hack, Inverse posted to the governance forum in an effort to reduce exposure to $CRV.

What’s funny is that if this was the intent, it had no real tangible effect.

$CRV kept trickling into the system anyway at pretty much the same uptick. With borrowing paused, the risks are reduced. It’s still notable to see this collateral creep upwards, although some amount of this appears to be Mich.

His position, just like all of his lending transactions, remains well managed, so we doubt this ultimately becomes an issue.

With this corner of Inverse basically attaining homeostasis, the rest of Inverse has been otherwise extremely successful at building and scaling. The past few months the protocol has been utterly ascendant.

One big brained move has been the swift adoption of Staked $CVX. A few weeks ago we thoroughly reviewed the clever reweighting of $CVX to push activity from vote locking towards staking.

September 15, 2023: Locks, Stakes and Two Smoking Proposals 🔒🗳️

Disclaimers! Everything that follows is educational in nature and not financial advice! Author has exposure to basically every alphabet soup permutation of CRV/CVX/FXS he can find Recovery An update on yesterday’s article on the recovery snapshot…

At launch the returns on staked $CVX was in the 30% range, and has since trickled down towards the 20% range. Inverse was quick to pounce on this opportunity. Their fixed rate lending markets allow you to loop this up to 8x, and Inverse’s fixed rates provide more certainty than variable rate markets.

Thus far the market has attracted $370K worth of $CVX with 228K still available to borrow. More information about this move in the following thread, as well as their accompanying blog post.

Inverse hasn’t stopped there. They also recently re-opened $INV staking and borrowing.

Staking your $INV now utilizes a Curve EMA oracle for extra safety, and offers yields in the form of streamed $DOLA Borrowing Rights ($DBR). Full details on their blog.

$DBR is the token that allows for borrowing of their $DOLA stablecoin through their lending markets. The full mechanics are explained in this video:

The shipping energy of Inverse Finance in the depths of the bear has been an inspiration. The protocol is hitting TVLs not seen since last year’s hack.

The token’s price has moved in tandem.

So should you ape, or did you miss the boat?