September 13, 2023: $USDM Part 2 ⛰️💵

Mountain Protocol launches regulated, permissionless, yield-bearing stablecoin

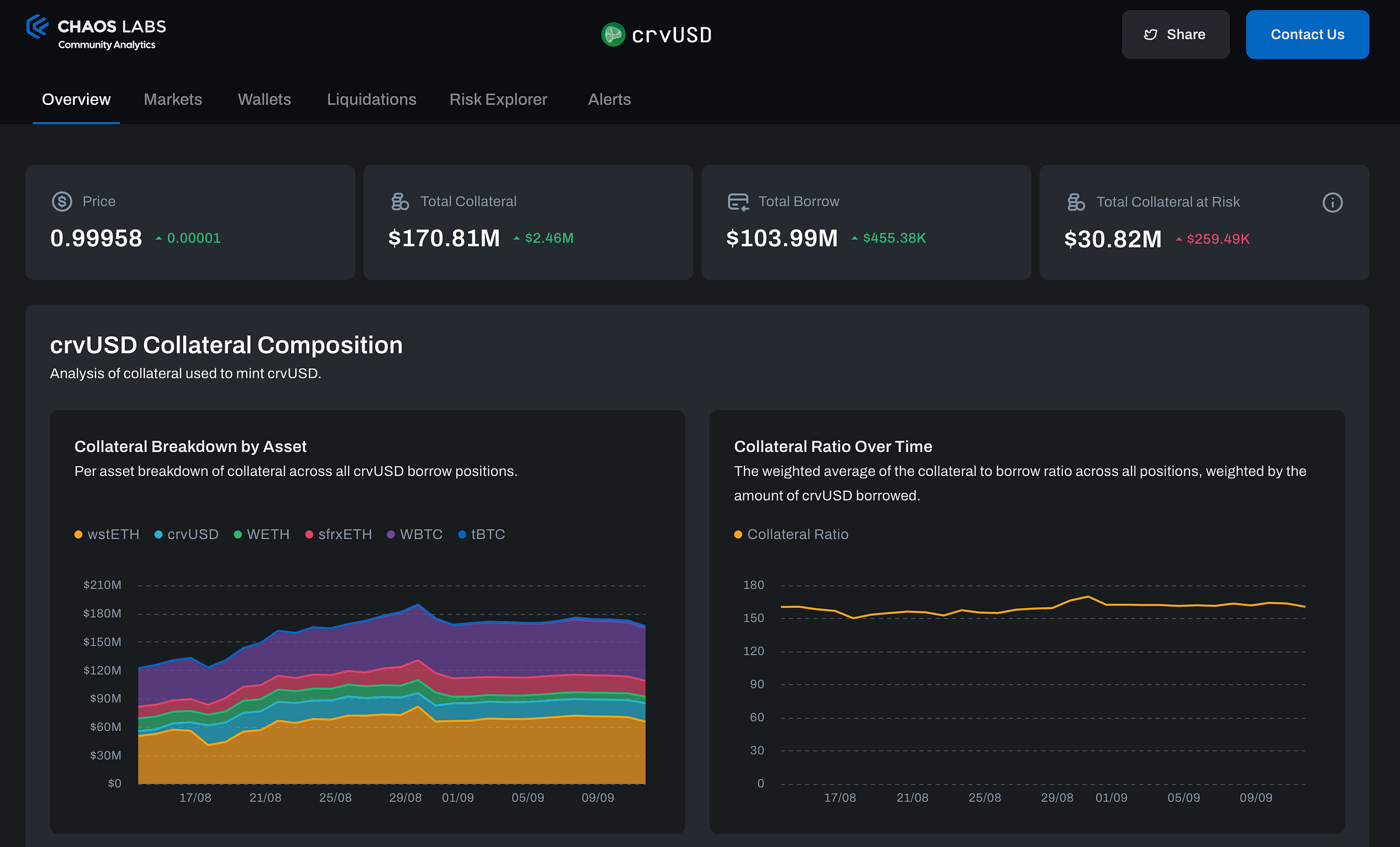

If you’ve muted the right people on social media, then over the last 24 hours your timeline was probably buzzing about Curve, particularly about this gorgeous new dashboard from Chaos Labs:

Congrats to the Chaos Labs team, what a beauty!

If you enjoyed, thank the Grants Committee. This dashboard was the direct result of a grant, which we delved into yesterday.

September 12, 2023: SubDAOs 🌊🔱

Forgive the late post! This post was getting too opinionated, so we got delayed in redrafting some of our arguments to deploy them onto the even playing field of the forum. Let’s take a look inside the sausage factory that is the Curve grants team.

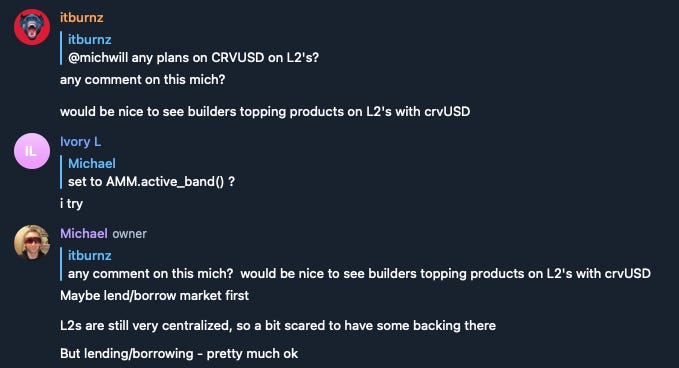

As for $crvUSD on L2s, don’t hold your breath.

L2s being “too centralized” preclude this becoming a major hub of $crvUSD minting, however isolated lending markets may well open up SOON™️

August 17, 2023: Isolated Lending Markets 💳💸

We know “hopium” is a tough sell these days when the timeline is peppered with “despairium” BUT…crv.mktcap.eth is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber. If you’re able to remind yourself that the token price ain’t nothing but a number… a number subject to the influence of nota…

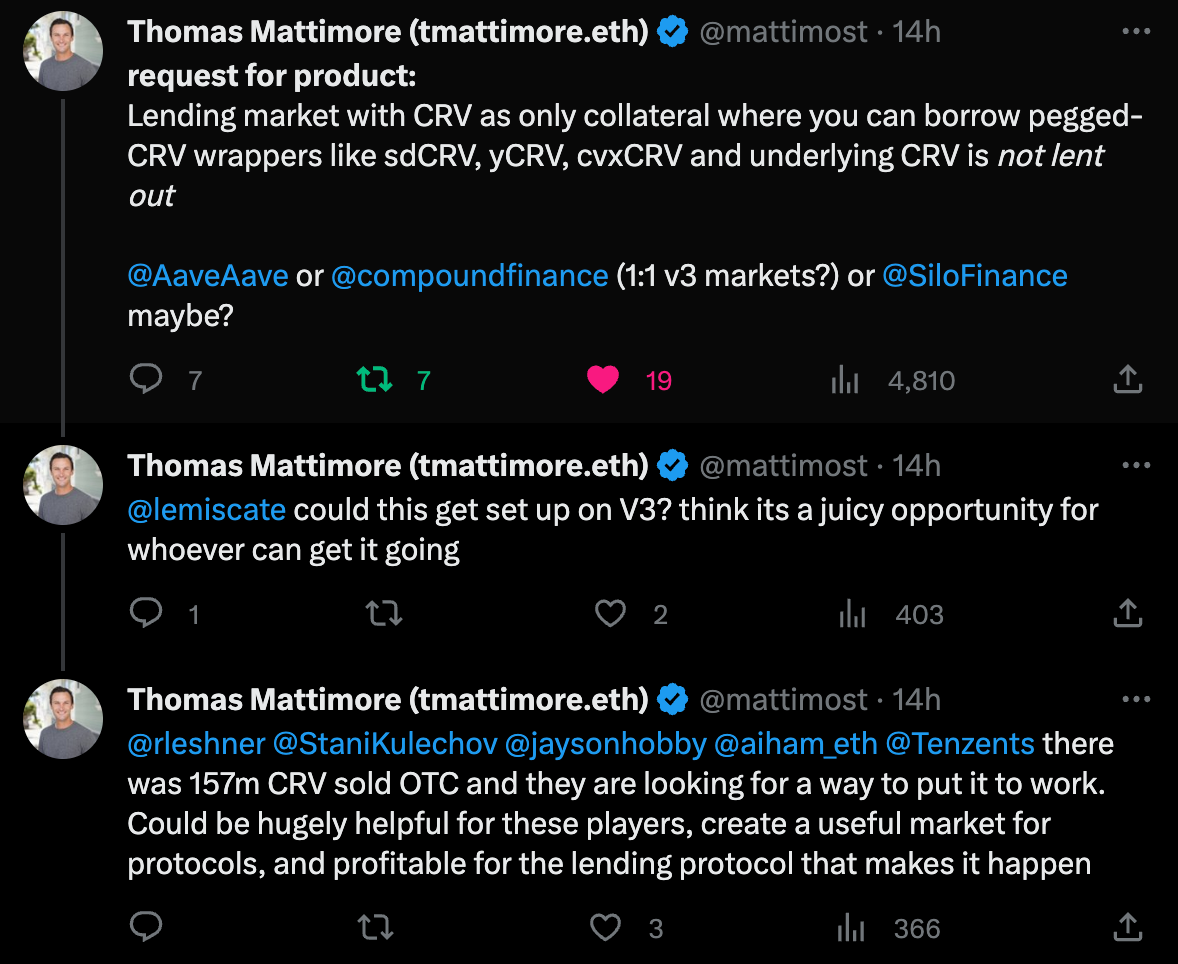

The explosion of lending markets more broadly in crypto surely must be a sign of the times. Is builder activity on Ethereum the proxy for BTC hashrate? It feels as though shipping hasn’t slowed even as prices fall. So it makes perfect sense that we see a ton of products that would play well in a downturn.

In recessions, the thriving storefronts that tend to pop up are businesses like payday loans and beauty salons. The latter is less applicable to crypto at the moment (unless you count FrenTech/OnlyFrens?), but for the former we see this all over in crypto. It’s a bull market for lending markets.

This interesting idea caught our eye…

C’mon Llamas, let’s get this badge up and running. Right after you knock out this even more crucial one…

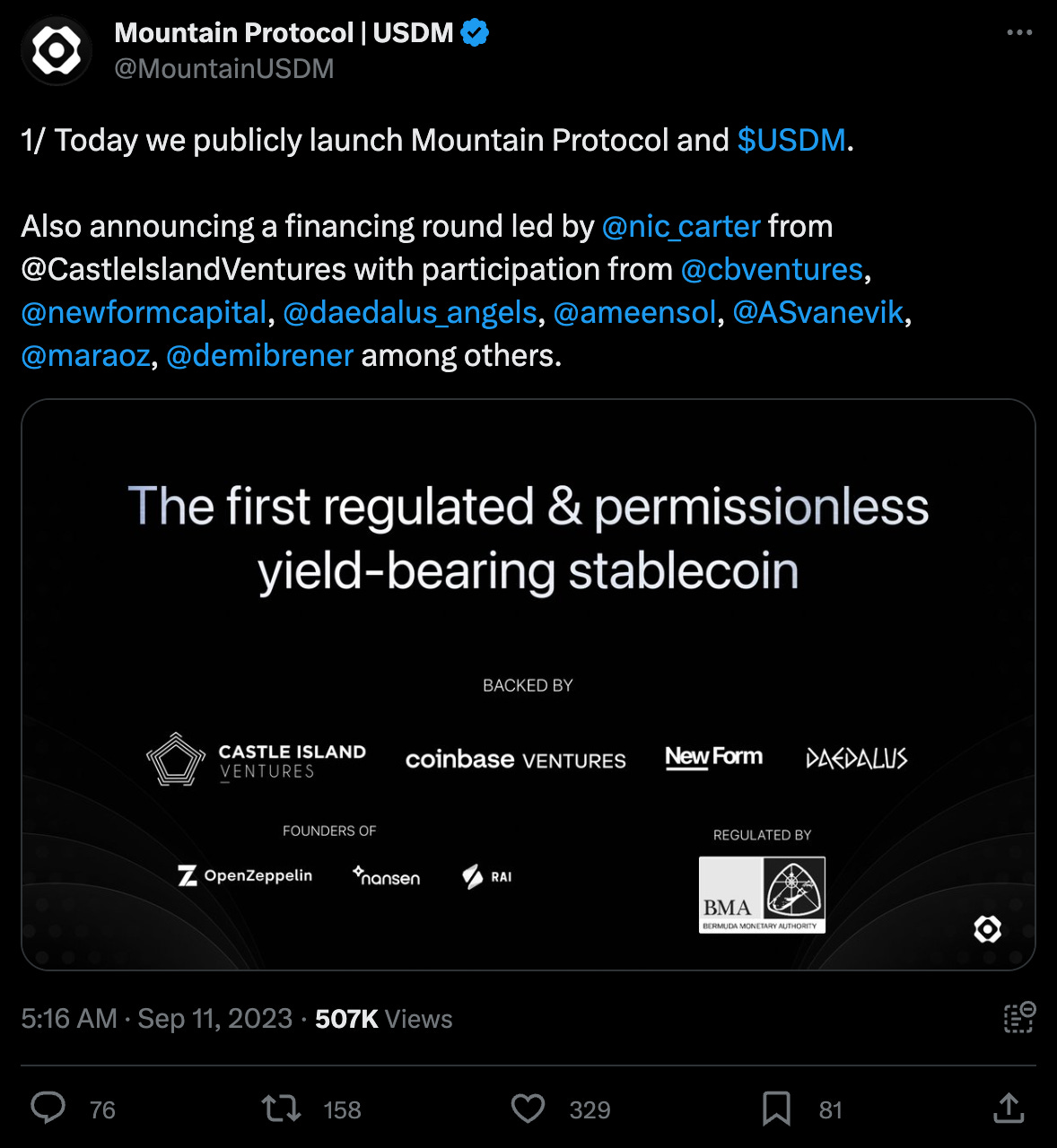

Mountain USDM

Wake up fam, a new stablecoin just dropped!

Onchain access to treasury yields in an ERC-20 token? Great news for us burgers who are tempted to ramp our net worth back offchain and park it into Treasury Direct, amirite?

Oh right… the whole oppressive overlords thing… at least it’s still good news for the more intelligent hemispheres of our planet.

Following the success of the PayPal Curve pool becoming the gateway to relevancy for the new stablecoin, the natural question is, of course, about a $USDM pool.

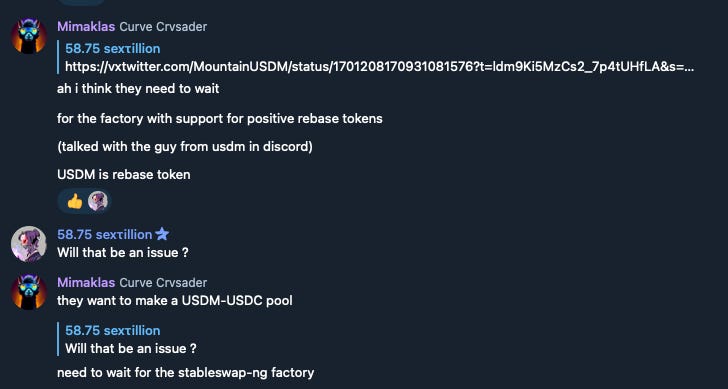

At least some people from the Curve team are chatting with the Mountain team, but it appears this one may be stalled…

The StableSwap-NG factory is coming SOON™️, but we’d wager devs don’t feel too pressured to launch a new USDM pool. The last one was an utter disaster…

Incidentally, don’t see the USDM-3CRV pool on the UI and yeet wildly in anticipation of betting big on the stablecoin… this pool belongs to a defunct stablecoin.

In the meantime, enjoy spending a bit of time doing your own research, starting with this Twitter space