January 25, 2023: Everybody's Gauge! 💰🎂

New $CRV Gauges include $MATIC, $LDO, $CLEV, $T, $JPEG, $MIM, $STG, $MET + more

What’s does every crypto project want nowadays?

For boomers back in the day, it was a Binance or a Coinbase listing. That’s outdated nowadays, because we sincerely hope the events of 2022 convinced everybody to abstain from even the safest of CEX.

Where should protocols look instead? Lately, the DeFi parallel is achieving a Curve gauge.

In many respects the Curve gauge is better than a CEX listing, since it basically amounts to the Curve DAO spending its precious emissions to subsidize liquidity for your token.

Some background for the several new readers… (we just passed 5K subs!), any token can permissionlessly launch on Curve. You can use the factory to launch a v2 pool containing any pair of assets (commonly a token and ETH). Once the pool has been seeded, the tokens will trade forever with 24/7 uptime, automatically rebalancing and updating prices internally as users trade and arb the pool. Pretty cool.

A handful of projects are harnessing the power of these pools. Consider…

The Conic Finance pool is a great example. Conic has no CEX listing, so the Curve pool serves as the primary source of liquidity. It’s been printing fees, because it’s the only place to trade a token that’s been quite volatile.

Since anybody can launch a v2 pool, the real excitement is not simply in launching a pool, but in earning the coveted Rewards Gauge. Conic’s pool has managed to succeed without a gauge, but usually a little something extra is helpful to convince LPs to take the risk and deposit. This is desirable, because small projects often need means of bootstrapping liquidity.

The CNC/ETH already did a decent job bootstrapping liquidity — the token has a $75MM fully diluted market cap, so the $3.5MM sitting in the pool (half of which is $CNC) is pretty good. That is, the pool can handle trades of around ~10 ETH size, which would only move the price about 1%. Pretty good, but what if you want it to be big enough to accommodate whales?

Enter the value of a $CRV rewards gauge. Curve has an aggressive emissions schedule. It started even more aggressive, but it drops rapidly towards zero over the course of 300 years, on a schedule similar to Bitcoin. These emissions are directed by DAO vote towards LPs in the various Curve pools with rewards gauges.

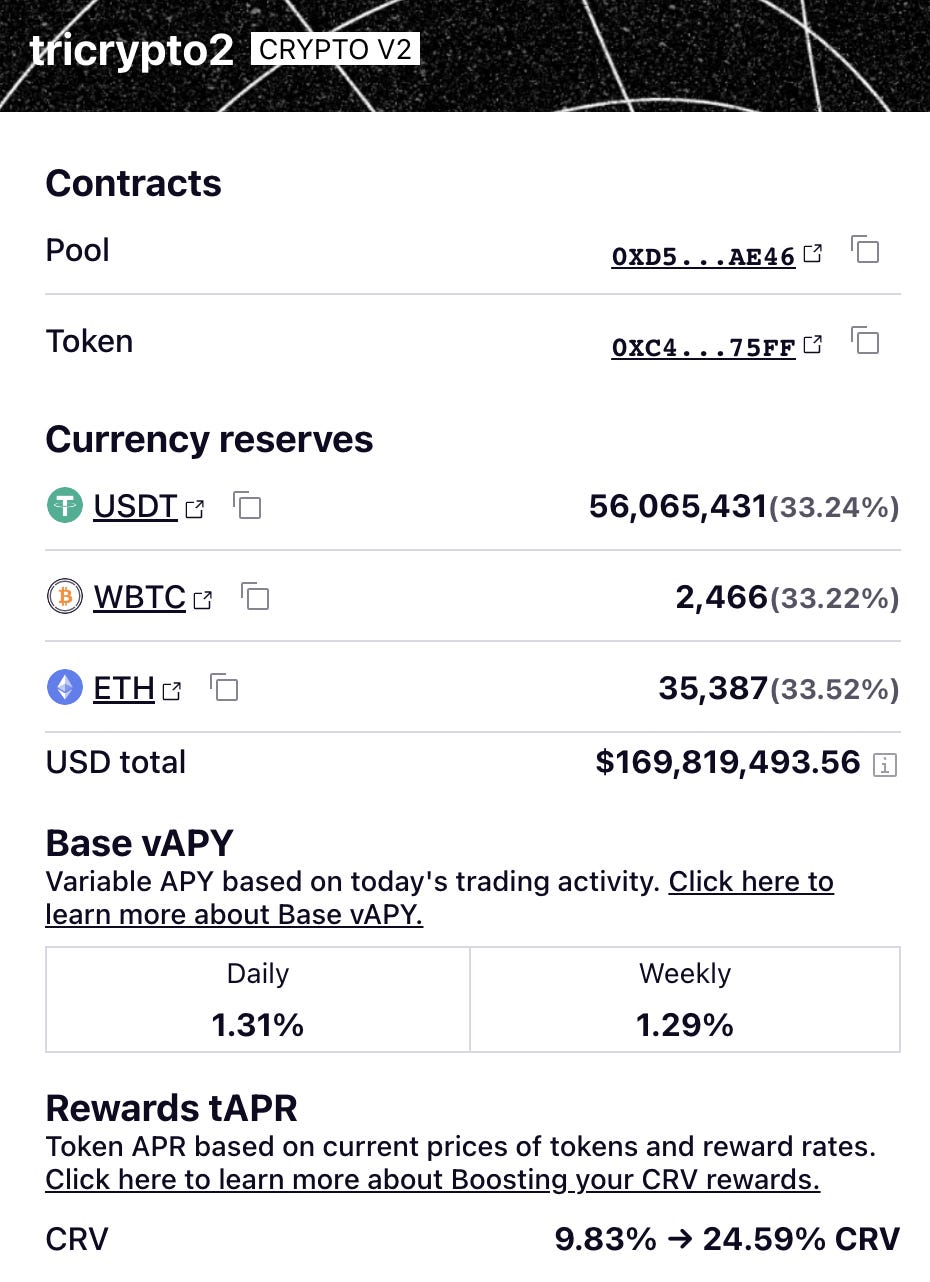

$CRV emissions sweeten the pot for LPs. For instance, if you are an LP in the flagship TriCrypto pool, your impermanent loss/gain is sensitive to the volatile price of Bitcoin/Ethereum.

Yet if you’re able to hit the top end of these emissions (25%), you can theoretically LP and make a profit even if the price dumps around this range. Pretty cool!

Hence the reason a lot of pools are trying to achieve Curve gauges. Hefty incentives attract LPs. Big holders are more incentivized to park their stash in the pool and farm rewards.

@TaoWang1 has a great breakdown on the guts:

For protocols interested in obtaining a gauge, the best first step is usually to post on the governance forum to allow for discussion. The forum becomes a good predictor of which pools will be yielding heavy in a few weeks time.

It can also be helpful to contact the Llama Risks team, who may perform in-depth research on your protocol to issue a recommendation. A positive report from Llama Risks makes it significantly more likely your protocol sails through governance with an affirmative vote.

As these pools continue to gain momentum, we’ve seen a torrent of great protocols make their way through the governance process just over the past week. Most of these votes have already passed quorum, but here’s the rundown.

Polygon ($MATIC)

The largest token by market cap is $MATIC, the token powering the successful Polygon chain. Curve of course already has a major presence on the Polygon chain, so a healthy pool here will surely be valuable to traders.

Incentives are already approved here, so keep an eye on what comes next.

Lido ($LDO)

Another top 100 pursuing a gauge is the leading LSD: Lido Finance. The Lido team had already used the Curve stETH pool extensively to keep its LSD so liquid.

The pool is off to a strong start, incentivized directly by $LDO rewards. This is the only current governance vote that has not already been resolved in the affirmative. Go vote!

Threshold ($T)

Since the ren ship capsized, Curve’s needed to all but rebuild its entire Bitcoin farm ecosystem from scratch. In fact, a separate gauge vote sees Curve killing multiple gauges wholesale.

From the ashes, a thriving BTC ecosystem is rebuilding quickly. Curve first launched the new WBTC/sBTC base pool, then a multiBTC pairing, both of which are providing strong rewards.

The Threshold Network, which has always been very active in pushing Bitcoin onto Ethereum, has launched their v2 of tBTC and is ready to join the fun:

It’s catching fans worldwide (check the token’s recent price movement to figure out why):

Abracadabra ($MIM)

$MIM probably requires little introduction at this point. In a turbulent year for every protocol, Abracadabra Finance has still had it notably rough.

Yet $MIM has sailed through gracefully. The protocol has a good chunk of flywheel assets and is using them to great effect. This gauge vote brings $MIM rewards to Optimism, so keen observers should take a look onto the L2.

JPEG’d ($JPEG)

The highest yield for your ETH is not actually frxETH or even sETH… it’s yield coming from the wacky world of blue chip NFTs.

JPEG’d is launching a new frxETH pairing for its pETH, which is an interesting way of unifying two of the highest yielding ETH pools. Both protocols have a huge stake of flywheel assets and have used it to great effect.

Stargate ($STG)

Stargate has been something of a day trader’s favorite token, given how often it’s occasionally ripped during its lifetime. It’s also easy enough to see why it’s exciting… a product launching into the bear market with clear traction and a compelling use case.

Metronome ($MET)

Metronome DAO is joining the Curve wars!

The relatively new protocol deserves a more thorough writeup than we can get to in this newsletter. Suffice to say, they are launching gauges for both their msETH and msUSD tokens, and given the votes have already passed we can expect to see them participate as a player for some time to come.

ETH VOTE: Curve | Convex

USD VOTE: Curve | Convex

Aladdin DAO

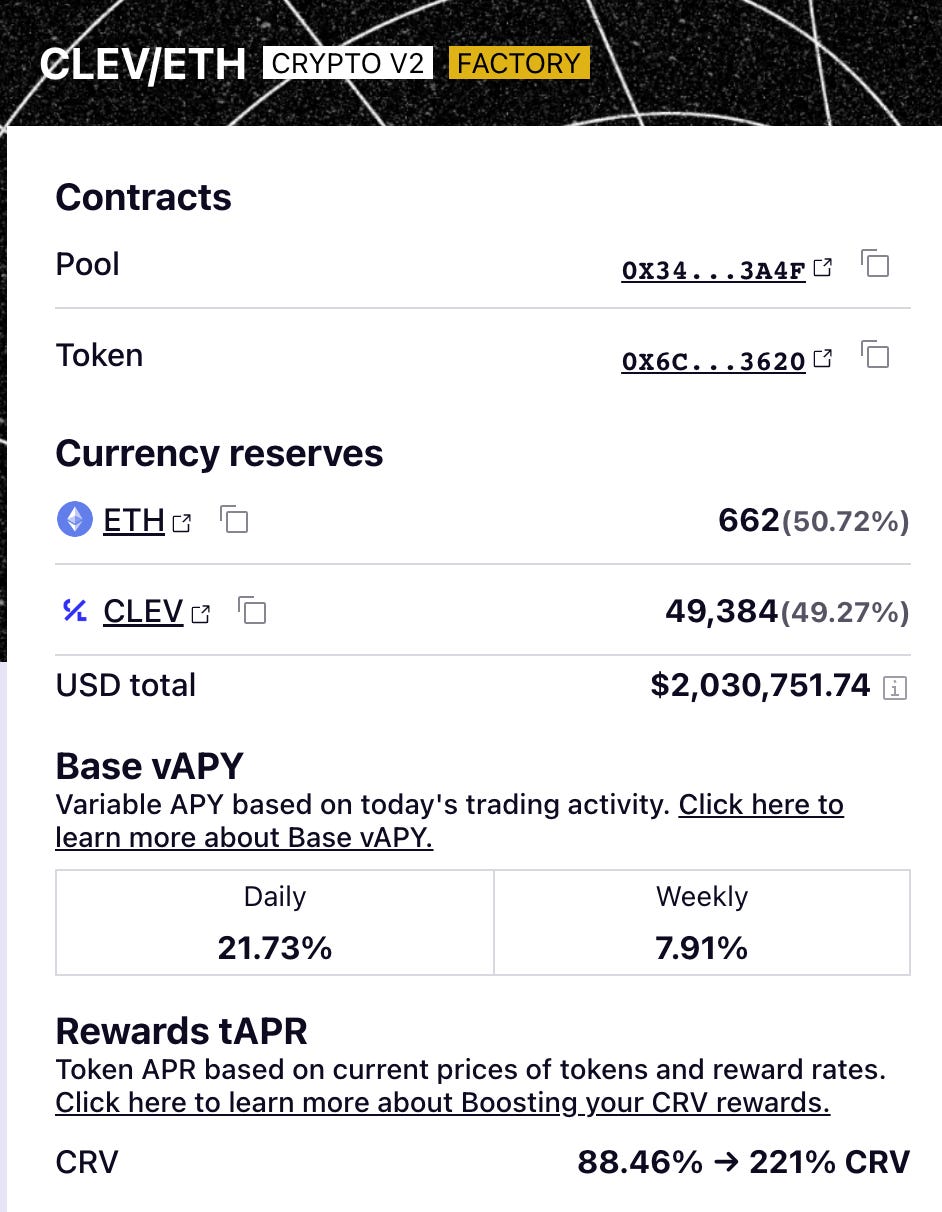

Last but certainly not least, worth highlighting that the gauge votes from earlier this month for the various Aladdin DAO pools have all passed. We bring it up because… holy moly, look at those rewards.

Of course, these rewards just went into effect so they’re sure to drop, but it’s often quite pleasant to be the first one swimming in the pool…