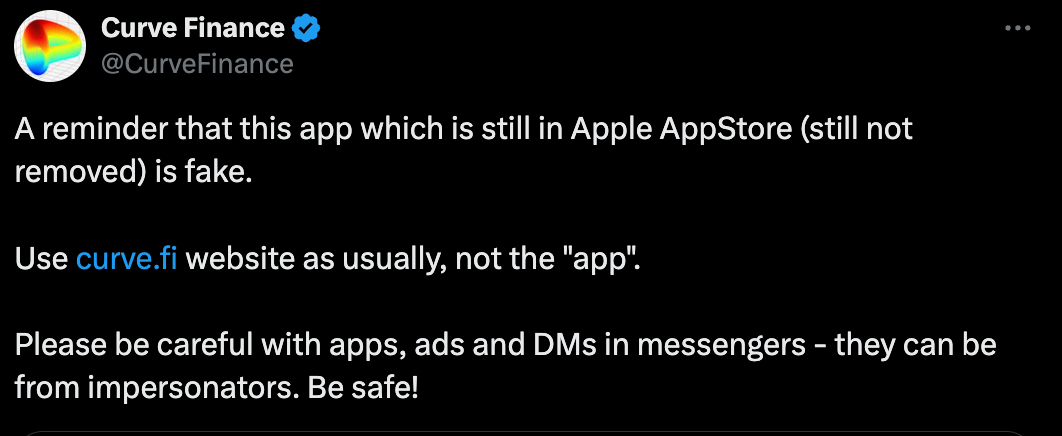

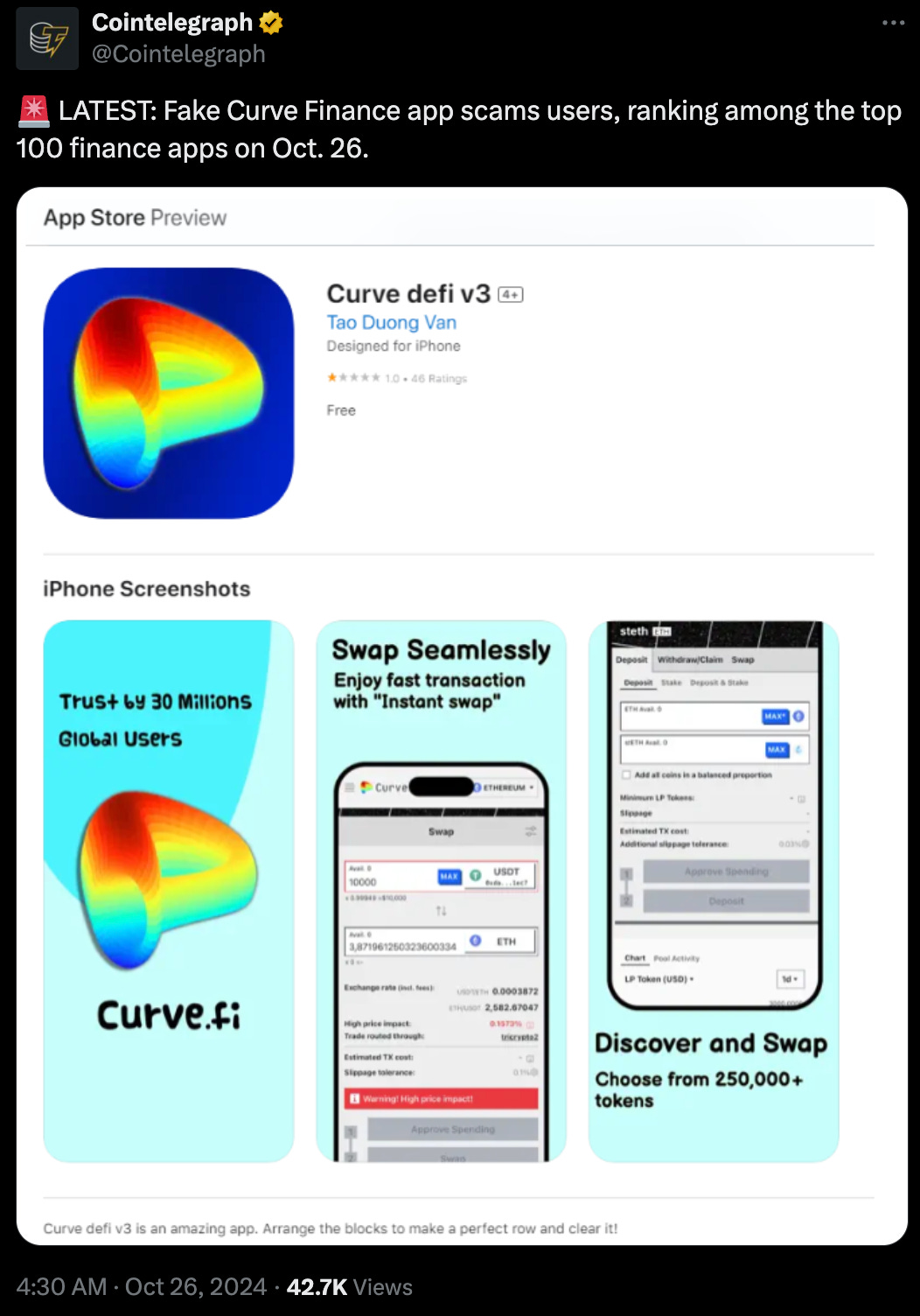

Be careful of this impostor app!

But then again… look how easy it is to get an app in the top 100 finance apps!

Before we get the next cycle, we need mass capitulation. Is the fact that a scam app can easily hit the top 100 one of the telltale signs of mass capitulation? Bullish…

tBTC

Last week we explored the phenomenon of yield-bearing stablecoins seeing all the trading volumes.

October 24, 2024: Yield of Dreams ⚾🏟️

Curve and Reserve Protocol’s USD3 agree… the next big narrative might well be yield-bearing stablecoins!

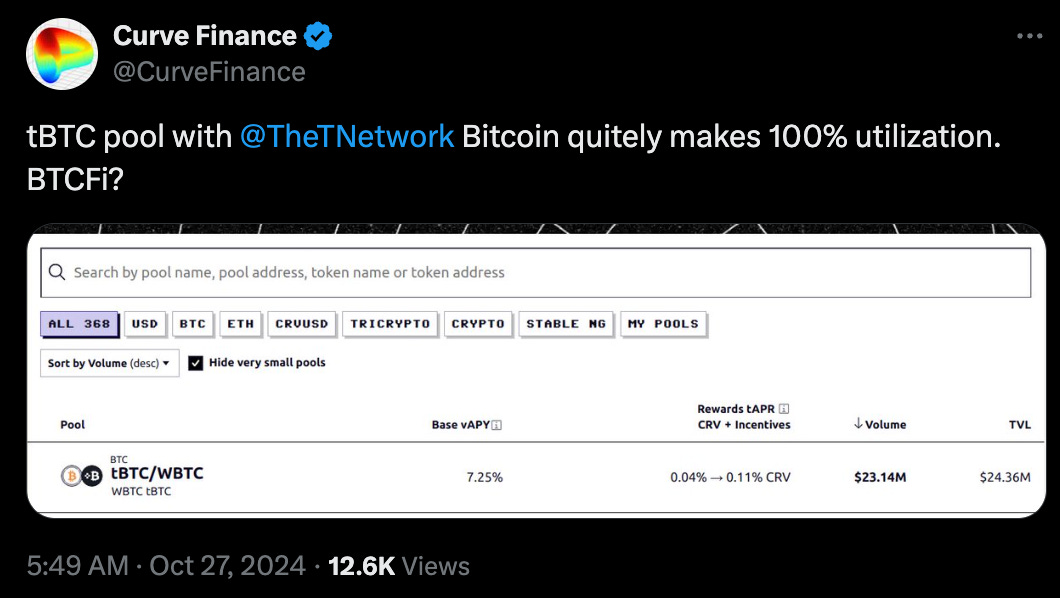

What if it’s not just yield-bearing stablecoins though? Threshold Network’s tBTC is not by itself yield-bearing… but it’s getting 100% utilization?

And there was much rejoicing…

Maybe the story behind this excess trading volume is as simple as… everybody is fleeing WBTC?

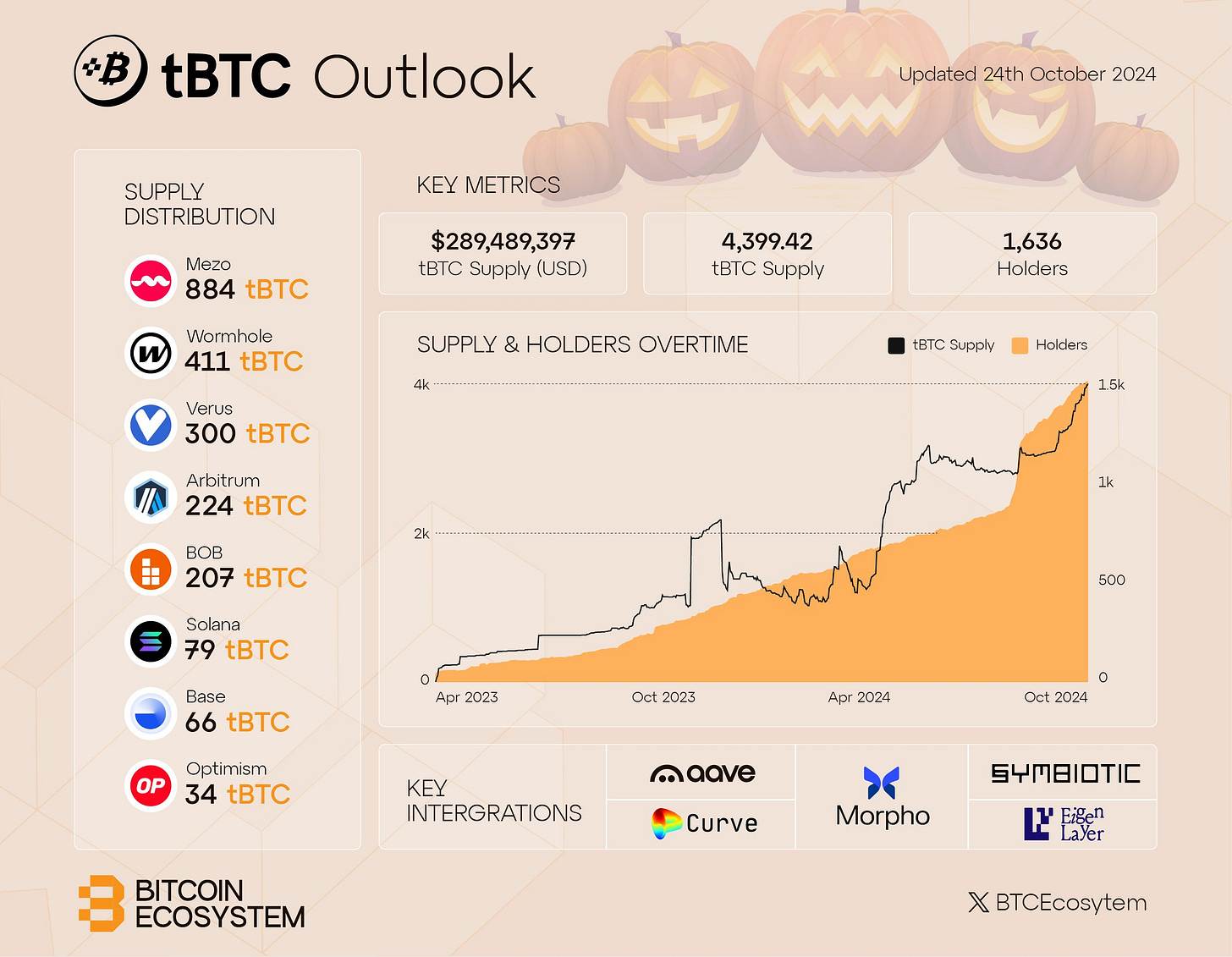

We’ve written a lot about $tBTC lately. It feels as if hundreds of BTC wrappers flooded the zone in the wake of the $WBTC drama...

Sept. 13, 2024: Wrapped BTC Wars 🪖💥

Is it too soon to dub this the wrapped BTC Wars? Coinbase has launched $cbBTC

But certainly none have better capitalized on $WBTC’s fumble than $tBTC…

August 12, 2024: $WBTC Takes an L

Thought you could touch grass on a late summer weekend? Not when there’s new FUD dropping!

Indeed, it seems Threshold really has picked up the “W”… they’ve moved aggressively in the past few months. This one pager shows off the furious activity around tBTC.

As even your grandparents who don’t follow crypto super-closely probably already know, $tBTC got picked up by Aave earlier this year. The undisputed heavyweight champs of DeFi can’t raise the ceilings fast enough to catch all the $tBTC flooding in…

Most of the civilized world might just use Aave, but for everybody else there’s plenty of places to play with $tBTC in DeFi.

They recently got picked up by Synthetix, which means they can be onboarded as collateral for dozens of markets.

They’re also now listed on Compound…

And of course, tBTC has found a natural home in Llama Lend, where Curve BD champ Martin has been continuing his experiment-in-public in bootstrapping the market on Arbitrum.

It has to do so despite so many markets on Arbitrum offering good yields…

For more context, here is our full writeup on Martin’s experiment…

October 10, 2024: Natural Rate📈 🌱

Curve’s Martin Krung shared some beautiful charts, which we felt deserved to be repackaged as a case study in bootstrapping the Curve Llama Lend markets.